Region:Asia

Author(s):Geetanshi

Product Code:KRAB2837

Pages:89

Published On:October 2025

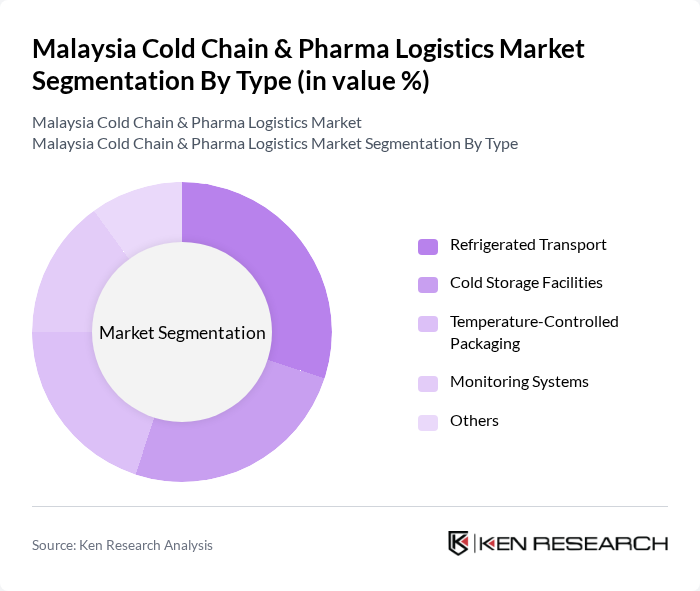

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, and Others. Each of these segments plays a crucial role in ensuring the safe and efficient transportation and storage of temperature-sensitive products. Refrigerated transport and cold storage facilities remain the largest segments due to their essential roles in food and pharmaceutical distribution, while monitoring systems and temperature-controlled packaging are gaining traction with increased regulatory scrutiny and technological advancements .

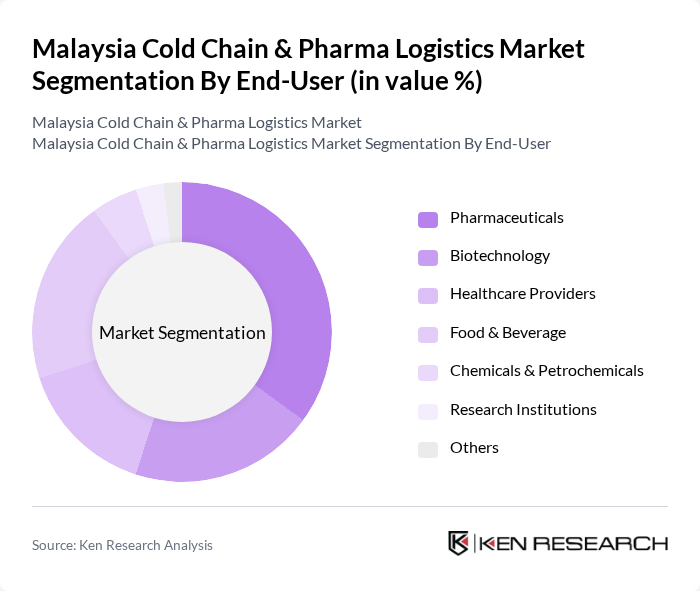

By End-User:The end-user segmentation includes Pharmaceuticals, Biotechnology, Healthcare Providers, Food & Beverage, Chemicals & Petrochemicals, Research Institutions, and Others. Each segment has unique requirements and contributes to the overall demand for cold chain logistics services. The food and beverage sector accounts for the largest share, driven by the need for safe and fresh perishable food distribution, while pharmaceuticals and biotechnology segments are expanding rapidly due to stricter regulatory requirements and increased vaccine and biologics distribution .

The Malaysia Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as TASCO Berhad, Tiong Nam Logistics Holdings Berhad, Cold Chain Network Sdn Bhd (CCN), MASKargo (Malaysia Airlines Cargo), FRIO Logistics Sdn Bhd, Iglo Malaysia Sdn Bhd, GDEX Berhad, DHL Supply Chain Malaysia, Kuehne + Nagel Malaysia, DB Schenker Malaysia, Yusen Logistics Malaysia, CEVA Logistics Malaysia, Agility Logistics Malaysia, Kerry Logistics Malaysia, Ninja Van Malaysia contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Malaysia cold chain and pharma logistics market appears promising, driven by technological advancements and increasing healthcare demands. Investments in IoT and automation are expected to enhance operational efficiency, while the growth of biopharmaceuticals will further necessitate robust cold chain solutions. As the government continues to support infrastructure development, the market is likely to witness improved logistics capabilities, ensuring better access to temperature-sensitive products across diverse regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Others |

| By End-User | Pharmaceuticals Biotechnology Healthcare Providers Food & Beverage Chemicals & Petrochemicals Research Institutions Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Application | Vaccines Blood Products Biologics Perishable Food Products Others |

| By Service Type | Transportation Services Warehousing Services Packaging Services Value-Added Services Others |

| By Temperature Range | Ambient (Above 8°C) Chilled (0–8°C) Frozen (Below -18°C) Deep Frozen (Below -30°C) Others |

| By Regulatory Compliance | Good Distribution Practice (GDP) Good Manufacturing Practice (GMP) Halal Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 60 | Logistics Managers, Supply Chain Executives |

| Cold Chain Storage Facilities | 50 | Facility Managers, Operations Directors |

| Healthcare Supply Chain Management | 40 | Procurement Officers, Inventory Managers |

| Biotechnology Product Distribution | 40 | Research and Development Managers, Quality Assurance Leads |

| Regulatory Compliance in Pharma Logistics | 40 | Compliance Officers, Regulatory Affairs Managers |

The Malaysia Cold Chain & Pharma Logistics Market is valued at approximately USD 530 million, reflecting a significant growth driven by the increasing demand for temperature-sensitive products in the pharmaceutical and food sectors.