Region:Europe

Author(s):Shubham

Product Code:KRAB6619

Pages:90

Published On:October 2025

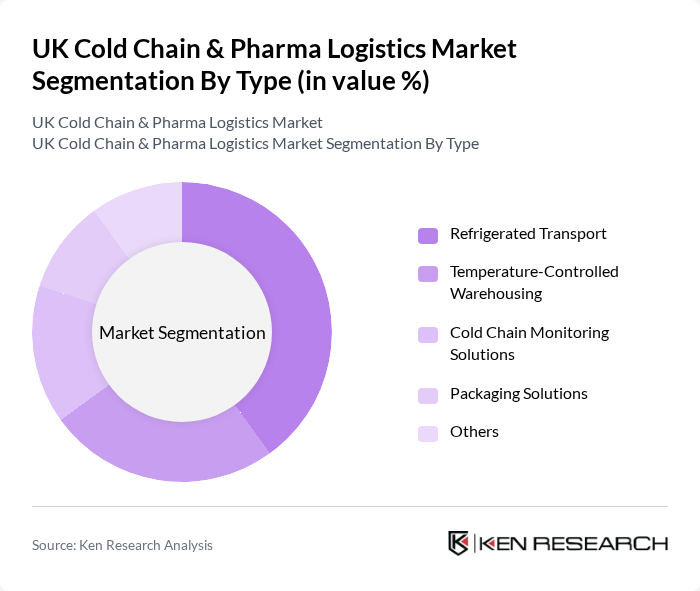

By Type:The market is segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Solutions, Packaging Solutions, and Others. Among these, Refrigerated Transport is the leading segment due to the increasing demand for efficient transportation of temperature-sensitive goods. The rise in e-commerce and the need for timely delivery of pharmaceuticals have further propelled this segment's growth.

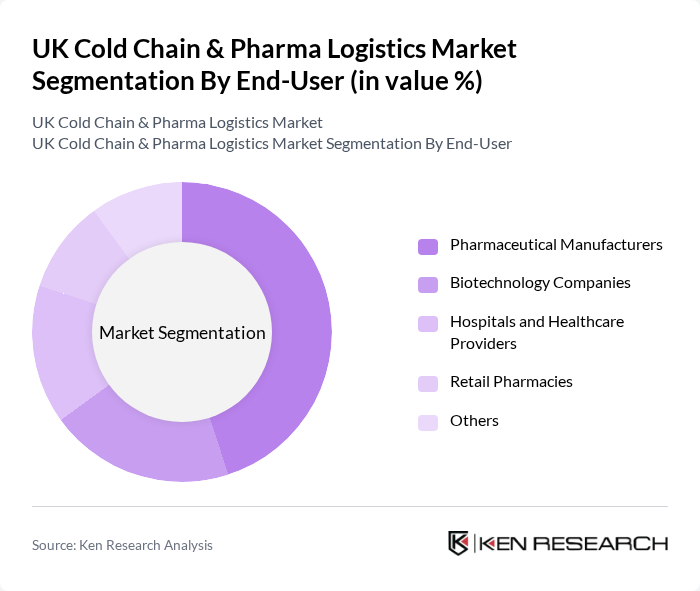

By End-User:The end-user segmentation includes Pharmaceutical Manufacturers, Biotechnology Companies, Hospitals and Healthcare Providers, Retail Pharmacies, and Others. Pharmaceutical Manufacturers dominate this segment, driven by the need for reliable logistics solutions to transport sensitive products. The increasing focus on biologics and personalized medicine has further intensified the demand for specialized cold chain logistics.

The UK Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, XPO Logistics, DB Schenker, UPS Healthcare, FedEx Supply Chain, Cardinal Health, AmerisourceBergen, Geodis, Agility Logistics, Lineage Logistics, Cold Chain Technologies, Pelican BioThermal, Thermo Fisher Scientific, BioLife Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The UK cold chain and pharma logistics market is poised for significant transformation, driven by technological innovations and evolving consumer expectations. As the demand for temperature-sensitive pharmaceuticals continues to rise, logistics providers will increasingly adopt smart technologies to enhance operational efficiency and ensure compliance. Additionally, the focus on sustainability will shape logistics strategies, prompting investments in eco-friendly practices and infrastructure. This dynamic environment presents both challenges and opportunities for stakeholders aiming to navigate the complexities of the market effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Solutions Packaging Solutions Others |

| By End-User | Pharmaceutical Manufacturers Biotechnology Companies Hospitals and Healthcare Providers Retail Pharmacies Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Packaging Type | Insulated Containers Refrigerated Trucks Temperature-Controlled Pallets Others |

| By Service Type | Transportation Services Warehousing Services Monitoring Services Others |

| By Product Type | Vaccines Biologics Clinical Trial Materials Others |

| By Compliance Type | GDP Compliance ISO Standards Other Regulatory Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Operations | 150 | Logistics Managers, Supply Chain Analysts |

| Temperature-Controlled Storage Solutions | 100 | Warehouse Managers, Facility Operations Heads |

| Regulatory Compliance in Pharma Logistics | 80 | Compliance Officers, Quality Assurance Managers |

| Last-Mile Delivery in Pharma | 70 | Delivery Managers, Operations Supervisors |

| Pharmaceutical Supply Chain Innovations | 90 | R&D Managers, Technology Officers |

The UK Cold Chain & Pharma Logistics Market is valued at approximately USD 15 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals, the rise in e-commerce, and the need for efficient supply chain solutions.