Region:Europe

Author(s):Dev

Product Code:KRAB6531

Pages:82

Published On:October 2025

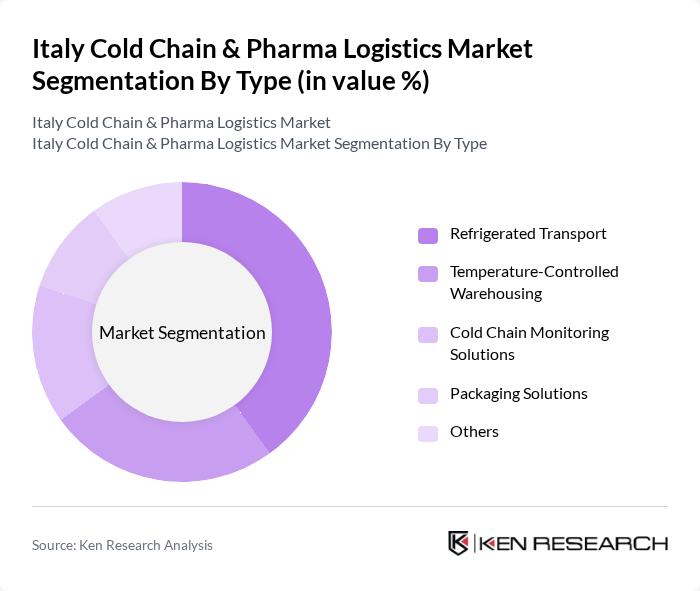

By Type:The market is segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Solutions, Packaging Solutions, and Others. Among these, Refrigerated Transport is the leading sub-segment due to the rising demand for efficient transportation of temperature-sensitive goods. The increasing number of pharmaceutical products requiring cold chain logistics has driven investments in refrigerated transport solutions, ensuring timely and safe delivery.

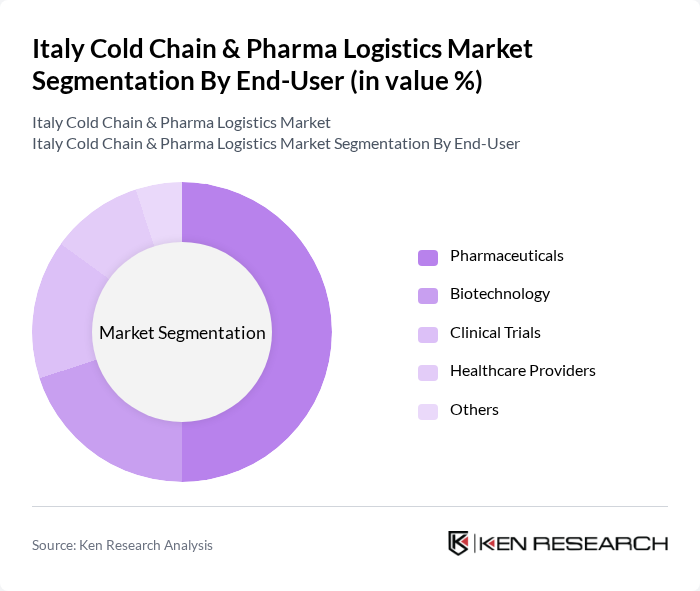

By End-User:The end-user segmentation includes Pharmaceuticals, Biotechnology, Clinical Trials, Healthcare Providers, and Others. The Pharmaceuticals sub-segment is the most significant contributor to the market, driven by the increasing production of biologics and vaccines that require stringent temperature controls during transportation and storage. The growing focus on patient safety and product efficacy has led to heightened demand for specialized logistics services in this sector.

The Italy Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, UPS Healthcare, FedEx, Geodis, Agility Logistics, Panalpina, CEVA Logistics, Lineage Logistics, Americold, Cardinal Health, Thermo Fisher Scientific, and Maersk contribute to innovation, geographic expansion, and service delivery in this space.

The future of Italy's cold chain and pharma logistics market appears promising, driven by technological advancements and increasing demand for biopharmaceuticals. As companies invest in smart logistics solutions, the integration of IoT and automation will enhance operational efficiency. Additionally, the focus on sustainability will likely lead to the adoption of green logistics practices, aligning with EU regulations. These trends will create a more resilient and responsive supply chain, capable of meeting the evolving needs of the pharmaceutical sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Solutions Packaging Solutions Others |

| By End-User | Pharmaceuticals Biotechnology Clinical Trials Healthcare Providers Others |

| By Distribution Mode | Road Transport Air Freight Rail Transport Sea Freight Others |

| By Packaging Type | Insulated Containers Refrigerated Pallets Temperature-Controlled Boxes Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) In-House Logistics Others |

| By Compliance Type | GDP Compliance GMP Compliance ISO Standards Others |

| By Market Segment | Retail Wholesale Direct-to-Consumer Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 150 | Logistics Directors, Supply Chain Managers |

| Cold Chain Technology Providers | 100 | Product Managers, Technical Directors |

| Regulatory Compliance in Pharma Logistics | 80 | Compliance Officers, Quality Assurance Managers |

| Temperature-Controlled Storage Solutions | 70 | Warehouse Managers, Operations Supervisors |

| Pharmaceutical Retail Logistics | 90 | Retail Operations Managers, Inventory Control Specialists |

The Italy Cold Chain & Pharma Logistics Market is valued at approximately USD 8.5 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals and the expansion of the healthcare sector, which requires efficient logistics solutions to maintain product integrity.