Region:Africa

Author(s):Geetanshi

Product Code:KRAB2828

Pages:80

Published On:October 2025

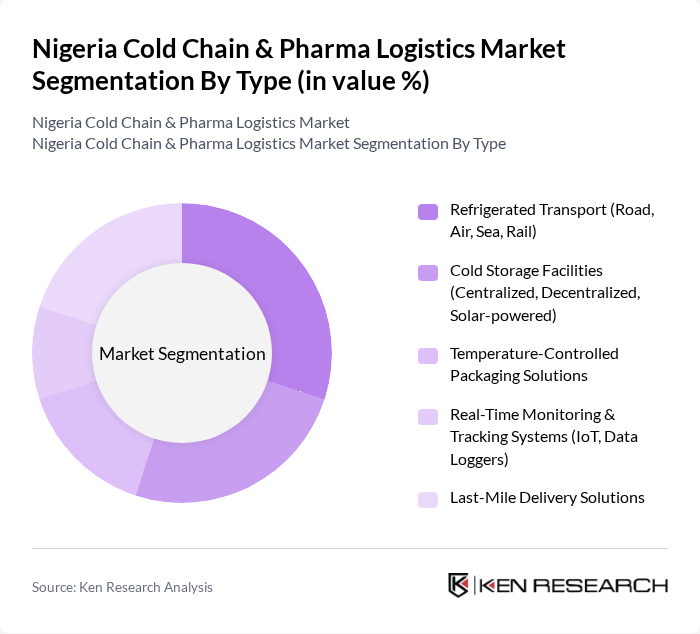

By Type:The market is segmented into Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging Solutions, Real-Time Monitoring & Tracking Systems, and Last-Mile Delivery Solutions. Each of these segments is essential for maintaining the quality and safety of temperature-sensitive products throughout the supply chain. The adoption of solar-powered cold storage and IoT-enabled monitoring is increasing, especially in rural and peri-urban areas, supporting food security and pharmaceutical distribution .

The Refrigerated Transport segment leads the market, driven by the increasing need for efficient movement of temperature-sensitive goods in the pharmaceutical and food sectors. The expansion of e-commerce and demand for fresh produce are accelerating investments in advanced refrigerated vehicles and logistics solutions, with companies focusing on fleet expansion and technology upgrades to meet consumer expectations for quality and safety .

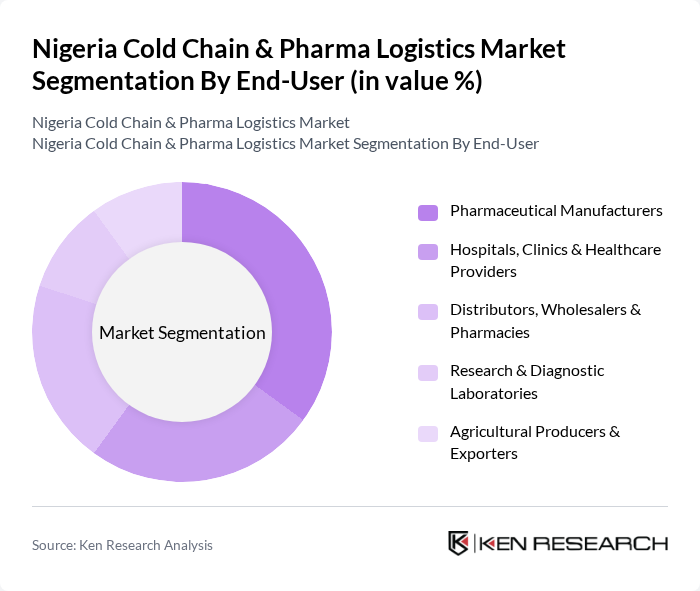

By End-User:The market is segmented by end-users, including Pharmaceutical Manufacturers, Hospitals, Clinics & Healthcare Providers, Distributors, Wholesalers & Pharmacies, Research & Diagnostic Laboratories, and Agricultural Producers & Exporters. Each end-user group has distinct requirements, with pharmaceutical manufacturers and healthcare providers demanding stringent temperature controls, and agricultural exporters focusing on reducing post-harvest losses .

Pharmaceutical Manufacturers are the leading end-user segment, reflecting the stringent requirements for the storage and transportation of vaccines and other temperature-sensitive medications. The growing prevalence of chronic diseases, expansion of immunization programs, and rising healthcare investments are driving demand for reliable cold chain logistics solutions to ensure product efficacy and safety .

The Nigeria Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Nigeria, Kuehne + Nagel Nigeria, Maersk Nigeria, ColdHubs Limited, Red Star Express Plc, Jumia Logistics, GIG Logistics, Transcorp Logistics, APM Terminals Nigeria, Nigerian Ports Authority, Medlog Nigeria, Koolboks Nigeria, Zenith Carex International, Ifrige Logistics, ABC Transport Plc contribute to innovation, geographic expansion, and service delivery in this space .

The future of Nigeria's cold chain and pharma logistics market appears promising, driven by technological advancements and increased investment in infrastructure. The adoption of IoT solutions is expected to enhance tracking and monitoring of temperature-sensitive products, improving efficiency. Additionally, the government's commitment to healthcare reforms and partnerships with international logistics firms will likely foster a more robust logistics ecosystem, ensuring better access to pharmaceuticals across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport (Road, Air, Sea, Rail) Cold Storage Facilities (Centralized, Decentralized, Solar-powered) Temperature-Controlled Packaging Solutions Real-Time Monitoring & Tracking Systems (IoT, Data Loggers) Last-Mile Delivery Solutions |

| By End-User | Pharmaceutical Manufacturers Hospitals, Clinics & Healthcare Providers Distributors, Wholesalers & Pharmacies Research & Diagnostic Laboratories Agricultural Producers & Exporters |

| By Distribution Mode | Direct Distribution (Manufacturer to End-User) Third-Party Logistics (3PL, 4PL) E-commerce & Digital Health Platforms NGO & Government Distribution Channels |

| By Application | Vaccines & Immunization Products Biologics & Biosimilars Blood & Blood Products Insulin & Hormones Perishable Food & Agricultural Products |

| By Sales Channel | Online Pharmacies & B2B Platforms Offline Retail (Pharmacies, Hospitals, Clinics) Direct Institutional Sales Government & NGO Procurement |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support International Aid & Development Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 120 | Logistics Managers, Supply Chain Analysts |

| Cold Chain Equipment Providers | 60 | Sales Directors, Product Managers |

| Healthcare Facility Operations | 50 | Pharmacy Managers, Hospital Administrators |

| Regulatory Compliance in Pharma Logistics | 40 | Compliance Officers, Quality Assurance Managers |

| Temperature-Sensitive Product Manufacturers | 70 | Production Managers, R&D Directors |

The Nigeria Cold Chain & Pharma Logistics Market is valued at approximately USD 1.1 billion, driven by the increasing demand for temperature-sensitive products in the pharmaceutical and food sectors, along with the expansion of healthcare infrastructure and consumer awareness regarding product quality.