Region:Asia

Author(s):Shubham

Product Code:KRAB6604

Pages:95

Published On:October 2025

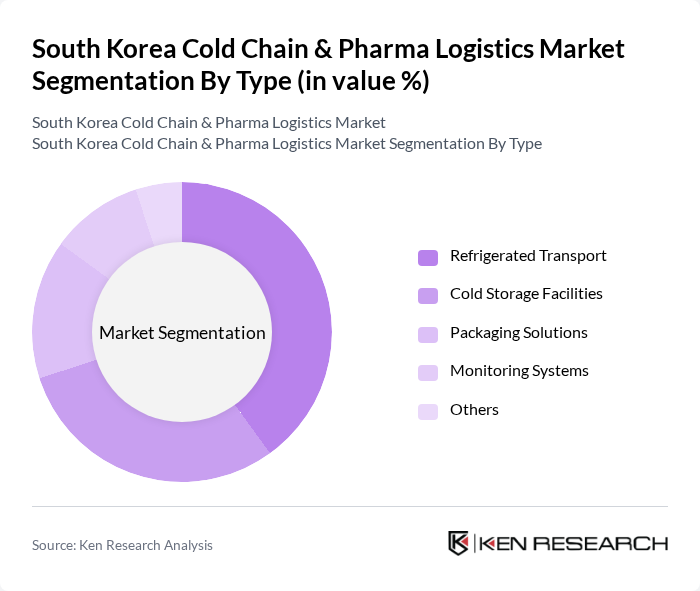

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Packaging Solutions, Monitoring Systems, and Others. Each of these segments plays a crucial role in ensuring the integrity of temperature-sensitive products throughout the supply chain.

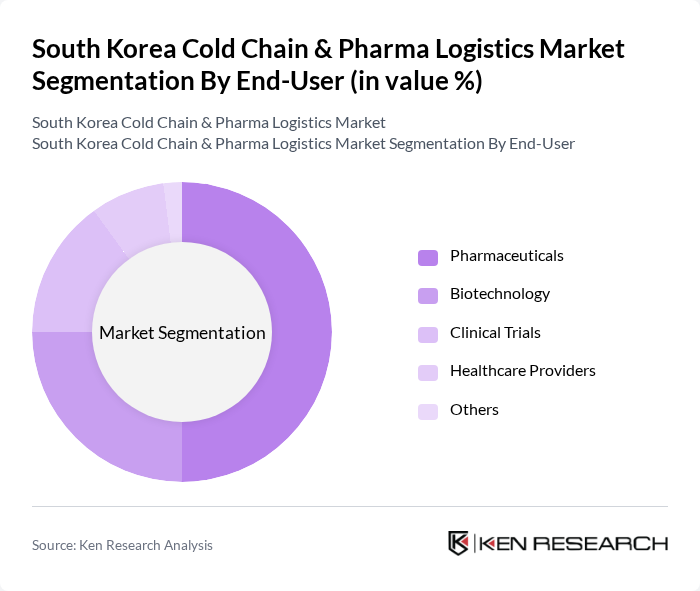

By End-User:The end-user segmentation includes Pharmaceuticals, Biotechnology, Clinical Trials, Healthcare Providers, and Others. Each segment reflects the diverse applications of cold chain logistics in maintaining the quality and safety of temperature-sensitive products.

The South Korea Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics, Hanjin Transportation, Lotte Global Logistics, SK Networks, Hyundai Glovis, DB Schenker, Kuehne + Nagel, DSV Panalpina, XPO Logistics, Nippon Express, Agility Logistics, Panalpina, Geodis, Expeditors International, Sinotrans Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South Korean cold chain and pharma logistics market appears promising, driven by technological advancements and increasing consumer expectations for drug safety. The integration of IoT and AI technologies is expected to enhance tracking and monitoring capabilities, improving operational efficiency. Additionally, the focus on sustainability will likely lead to the adoption of eco-friendly practices, further shaping the logistics landscape. These trends indicate a dynamic evolution in the market, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Packaging Solutions Monitoring Systems Others |

| By End-User | Pharmaceuticals Biotechnology Clinical Trials Healthcare Providers Others |

| By Distribution Mode | Road Transport Air Transport Sea Transport Rail Transport Others |

| By Application | Vaccines Blood Products Biologics Medical Devices Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Logistics | 150 | Logistics Managers, Supply Chain Analysts |

| Temperature-Controlled Transport Services | 100 | Operations Directors, Fleet Managers |

| Pharma Warehousing Solutions | 80 | Warehouse Managers, Compliance Officers |

| Regulatory Compliance in Pharma Logistics | 70 | Regulatory Affairs Specialists, Quality Assurance Managers |

| Cold Chain Technology Providers | 90 | Product Development Managers, Technology Officers |

The South Korea Cold Chain & Pharma Logistics Market is valued at approximately USD 5 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals and the expansion of the healthcare sector, which requires efficient logistics solutions to maintain product integrity.