Region:Asia

Author(s):Geetanshi

Product Code:KRAA0190

Pages:80

Published On:August 2025

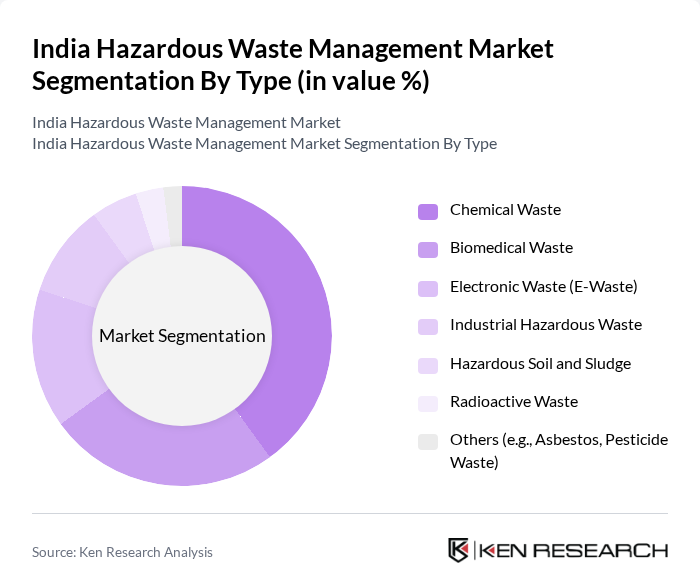

By Type:The hazardous waste management market in India is segmented into Chemical Waste, Biomedical Waste, Electronic Waste (E-Waste), Industrial Hazardous Waste, Hazardous Soil and Sludge, Radioactive Waste, and Others (such as Asbestos and Pesticide Waste). Chemical Waste remains the largest segment, primarily due to the extensive use of chemicals in manufacturing and pharmaceutical industries. Biomedical Waste is also a significant contributor, driven by the expansion of healthcare infrastructure and the necessity for proper disposal to reduce health and environmental risks .

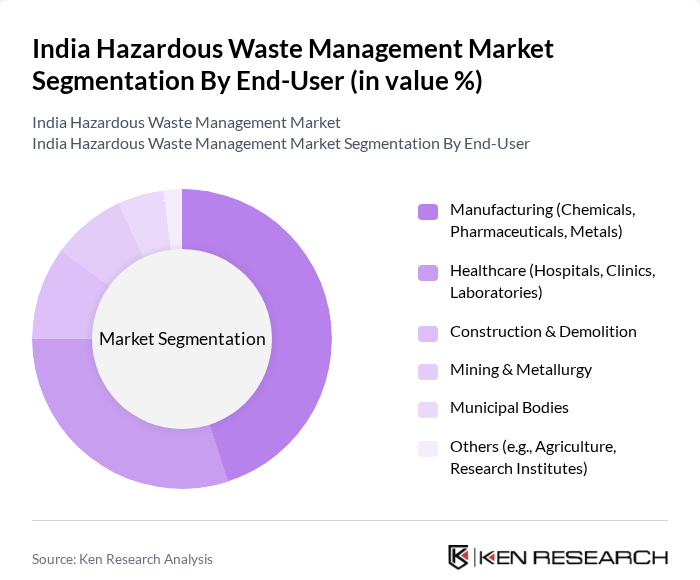

By End-User:End-user segmentation includes Manufacturing (Chemicals, Pharmaceuticals, Metals), Healthcare (Hospitals, Clinics, Laboratories), Construction & Demolition, Mining & Metallurgy, Municipal Bodies, and Others (such as Agriculture and Research Institutes). The Manufacturing sector is the largest end-user, generating substantial hazardous waste through various production processes. The Healthcare sector also contributes significantly, particularly due to the proliferation of healthcare facilities and the associated biomedical waste .

The India Hazardous Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ramky Enviro Engineers Ltd., SMS Envoclean Pvt. Ltd., GEPIL (Gujarat Enviro Protection & Infrastructure Ltd.), Attero Recycling Pvt. Ltd., EcoWise Waste Management Pvt. Ltd., IL&FS Environmental Infrastructure & Services Ltd., Tamil Nadu Waste Management Ltd. (TNWML), Sembcorp Green Infra Ltd., Bharat Aluminium Company Ltd. (BALCO), Hindustan Zinc Ltd., A2Z Group, Clean Harbors India Pvt. Ltd., Veolia India Pvt. Ltd., SUEZ India Pvt. Ltd., and Jindal Steel & Power Ltd. contribute to innovation, geographic expansion, and service delivery in this sector.

The future of the hazardous waste management market in India appears promising, driven by increasing industrial activities and a growing emphasis on environmental sustainability. As regulations become more stringent, industries will likely invest in advanced waste management technologies. Additionally, the integration of digital solutions, such as IoT for monitoring waste disposal, is expected to enhance operational efficiency. The market is poised for growth as stakeholders recognize the importance of sustainable practices in mitigating environmental impacts and complying with regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Waste Biomedical Waste Electronic Waste (E-Waste) Industrial Hazardous Waste Hazardous Soil and Sludge Radioactive Waste Others (e.g., Asbestos, Pesticide Waste) |

| By End-User | Manufacturing (Chemicals, Pharmaceuticals, Metals) Healthcare (Hospitals, Clinics, Laboratories) Construction & Demolition Mining & Metallurgy Municipal Bodies Others (e.g., Agriculture, Research Institutes) |

| By Region | North India South India East India West India |

| By Technology | Incineration Landfilling Recycling & Resource Recovery Plasma Gasification Chemical/Physico-Chemical Treatment Biological Treatment Others |

| By Application | Waste Collection & Transportation Waste Treatment Waste Disposal Waste Recycling Waste-to-Energy Others |

| By Investment Source | Private Investment Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Grants and Loans Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Waste Management | 100 | Environmental Managers, Compliance Officers |

| Biomedical Waste Disposal | 60 | Hospital Administrators, Waste Management Coordinators |

| Electronic Waste Recycling | 50 | IT Managers, Sustainability Officers |

| Hazardous Waste Treatment Technologies | 40 | Technical Directors, R&D Managers |

| Policy and Regulation Impact | 40 | Regulatory Affairs Specialists, Policy Analysts |

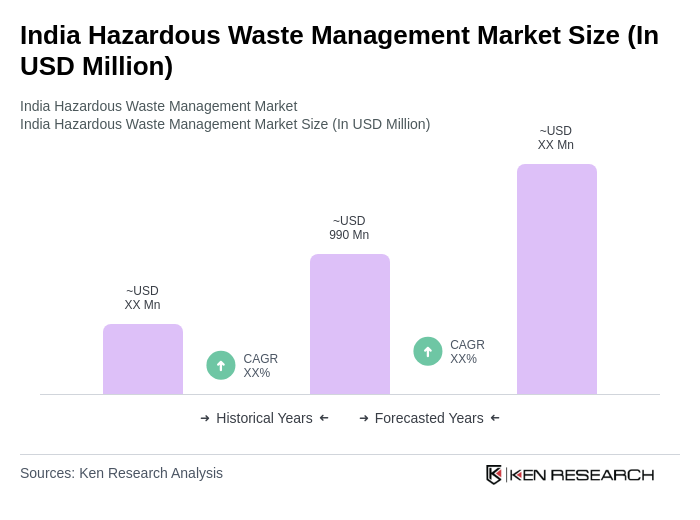

The India Hazardous Waste Management Market is valued at approximately USD 990 million, driven by increasing industrial activities, stricter environmental regulations, and growing awareness of sustainable waste management practices.