Region:Africa

Author(s):Dev

Product Code:KRAA0477

Pages:100

Published On:August 2025

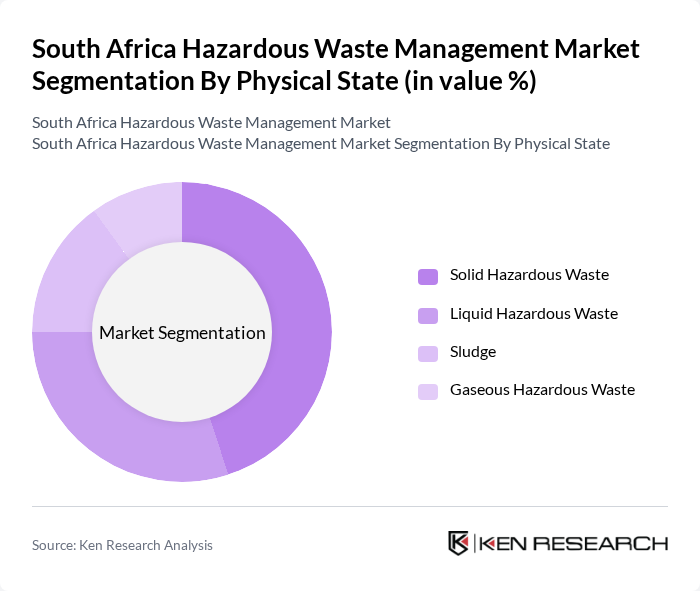

By Physical State:The physical state of hazardous waste is categorized into solid, liquid, sludge, and gaseous forms. Solid hazardous waste includes materials such as contaminated soil, industrial by-products, and discarded equipment. Liquid hazardous waste encompasses chemicals, solvents, and effluents from manufacturing and healthcare facilities. Sludge refers to semi-solid waste generated from wastewater treatment and industrial processes, while gaseous hazardous waste includes emissions and volatile compounds from industrial operations. Solid hazardous waste remains the most prevalent due to its volume and diversity .

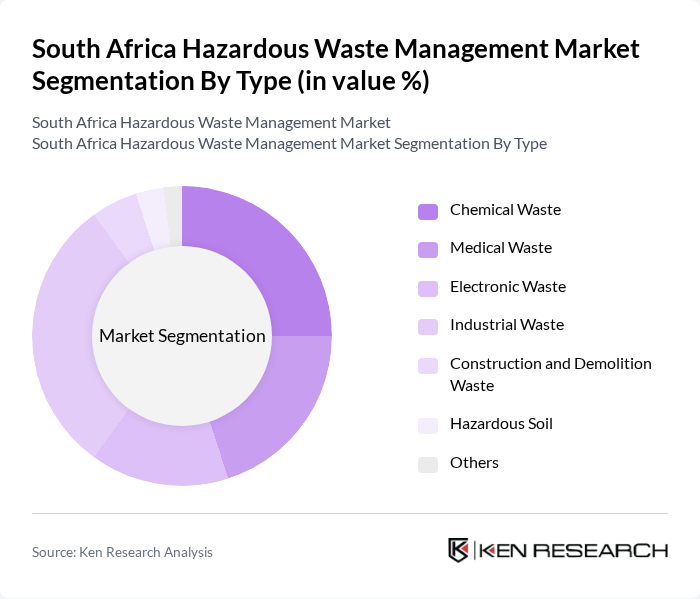

By Type:The hazardous waste market is segmented by type into chemical waste, medical waste, electronic waste, industrial waste, construction and demolition waste, hazardous soil, and others. Chemical waste includes toxic substances and residues from industrial and laboratory processes. Medical waste consists of discarded materials from healthcare facilities, such as sharps, pharmaceuticals, and infectious materials. Electronic waste covers obsolete electronic devices and components. Industrial waste includes hazardous by-products from manufacturing, mining, and energy sectors. Construction and demolition waste arises from building and infrastructure projects, often containing hazardous materials like asbestos or lead. Hazardous soil refers to contaminated land requiring remediation, while 'others' includes miscellaneous hazardous substances not classified elsewhere. Industrial waste is the leading subsegment due to the scale of industrial operations in South Africa .

The South Africa Hazardous Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as EnviroServ Waste Management, Interwaste Holdings, WastePlan, The Waste Group, Averda South Africa, Veolia Services Southern Africa, SUEZ South Africa, Remade Recycling (a division of Mpact), Barloworld Logistics, GreenCape, Biowaste Technologies, WasteTech, EcoWaste, Cleanaway South Africa, and Ecolab South Africa contribute to innovation, geographic expansion, and service delivery in this space .

The South African hazardous waste management market is poised for significant transformation, driven by increasing industrialization and stringent regulations. As businesses adapt to evolving environmental standards, the adoption of innovative waste management technologies will become crucial. The focus on sustainability will likely lead to enhanced recycling initiatives and waste-to-energy projects, fostering collaboration between public and private sectors. This shift towards a circular economy will not only mitigate environmental impacts but also create new economic opportunities within the hazardous waste management landscape.

| Segment | Sub-Segments |

|---|---|

| By Physical State | Solid Hazardous Waste Liquid Hazardous Waste Sludge Gaseous Hazardous Waste |

| By Type | Chemical Waste Medical Waste Electronic Waste Industrial Waste Construction and Demolition Waste Hazardous Soil Others |

| By End-User | Healthcare Manufacturing Construction Mining Energy & Utilities Government Others |

| By Treatment Method | Incineration Landfilling Recycling Chemical Treatment Biological Treatment Physical Treatment Others |

| By Source of Waste | Industrial Sources Commercial Sources Residential Sources Agricultural Sources Others |

| By Disposal Method | On-site Disposal Off-site Disposal Treatment and Disposal Others |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Free State Limpopo Mpumalanga Northern Cape |

| By Policy Support | Government Subsidies Tax Incentives Grants for Waste Management Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Waste Management | 100 | Environmental Managers, Compliance Officers |

| Healthcare Waste Disposal | 80 | Hospital Administrators, Waste Management Coordinators |

| Construction and Demolition Waste | 70 | Project Managers, Site Supervisors |

| Electronic Waste Recycling | 50 | IT Managers, Sustainability Officers |

| Hazardous Waste Treatment Facilities | 90 | Facility Managers, Operations Directors |

The South Africa Hazardous Waste Management Market is valued at approximately USD 17 million, reflecting a five-year historical analysis. This growth is driven by increasing industrial activities, stricter environmental regulations, and a heightened awareness of sustainable waste management practices.