Region:Europe

Author(s):Shubham

Product Code:KRAA1111

Pages:96

Published On:August 2025

By Type:The hazardous waste management market is segmented into Chemical Waste, Medical Waste, Electronic Waste (WEEE), Industrial Hazardous Waste, Construction and Demolition Hazardous Waste, Hazardous Household Waste, Asbestos Waste, and Others. Each segment is shaped by sector-specific regulatory requirements and waste generation patterns. Chemical and industrial hazardous waste represent the largest segments, driven by manufacturing and processing industries, while medical and electronic waste are influenced by healthcare and technology sector growth .

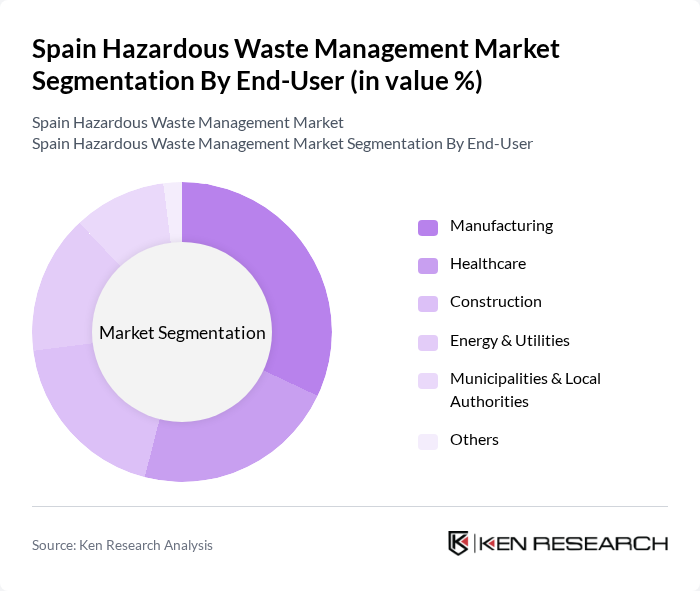

By End-User:The end-user segmentation includes Manufacturing, Healthcare, Construction, Energy & Utilities, Municipalities & Local Authorities, and Others. Manufacturing and healthcare sectors are the primary generators of hazardous waste, requiring specialized collection and treatment solutions. Construction and energy sectors also contribute significantly, while municipalities focus on the safe management of household hazardous waste .

The Spain Hazardous Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as SUEZ España, Veolia España, Urbaser, FCC Medio Ambiente, Ferrovial Servicios, Remondis Iberia, Serveis Medi Ambient SA, Acciona, Tradebe, Ecoembes, Recyclia, Bioterra, Cespa Gestión de Residuos, Grupo Layna, and Ecolumber contribute to innovation, geographic expansion, and service delivery in this space .

The future of the hazardous waste management market in Spain appears promising, driven by increasing industrial activity and a strong regulatory framework. As industries adapt to stringent environmental regulations, investments in advanced waste treatment technologies are expected to rise. Additionally, the shift towards a circular economy will encourage businesses to minimize waste generation and enhance recycling efforts. Overall, the market is poised for growth as stakeholders prioritize sustainable practices and compliance with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Waste Medical Waste Electronic Waste (WEEE) Industrial Hazardous Waste Construction and Demolition Hazardous Waste Hazardous Household Waste Asbestos Waste Others |

| By End-User | Manufacturing Healthcare Construction Energy & Utilities Municipalities & Local Authorities Others |

| By Disposal Method | Landfilling Incineration (with/without energy recovery) Recycling & Resource Recovery Physico-chemical Treatment Biological Treatment Others |

| By Collection Method | Curbside Collection Drop-off Centers Scheduled Collection On-demand Collection Specialized Hazardous Waste Collection Others |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain Central Spain Canary & Balearic Islands Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Hazardous Waste Management | 100 | City Waste Managers, Environmental Officers |

| Industrial Waste Treatment Facilities | 70 | Facility Managers, Compliance Officers |

| Hazardous Waste Recycling Initiatives | 60 | Recycling Plant Operators, Sustainability Managers |

| Regulatory Compliance and Policy | 50 | Policy Makers, Environmental Consultants |

| Hazardous Waste Disposal Services | 80 | Service Providers, Operations Managers |

The Spain Hazardous Waste Management Market is valued at approximately EUR 560 million, driven by stringent environmental regulations, increasing industrial activities, and the adoption of advanced waste treatment technologies.