Region:Global

Author(s):Shubham

Product Code:KRAA0857

Pages:95

Published On:August 2025

By Type:The hazardous waste management market in New Zealand is segmented by waste type, including Chemical Waste, Medical Waste, Electronic Waste (E-waste), Industrial Hazardous Waste, Construction and Demolition Hazardous Waste, Contaminated Soil, Asbestos Waste, and Others. Chemical Waste is the largest segment, driven by significant industrial output, while Medical Waste is also substantial due to the expanding healthcare sector and stringent medical waste disposal regulations .

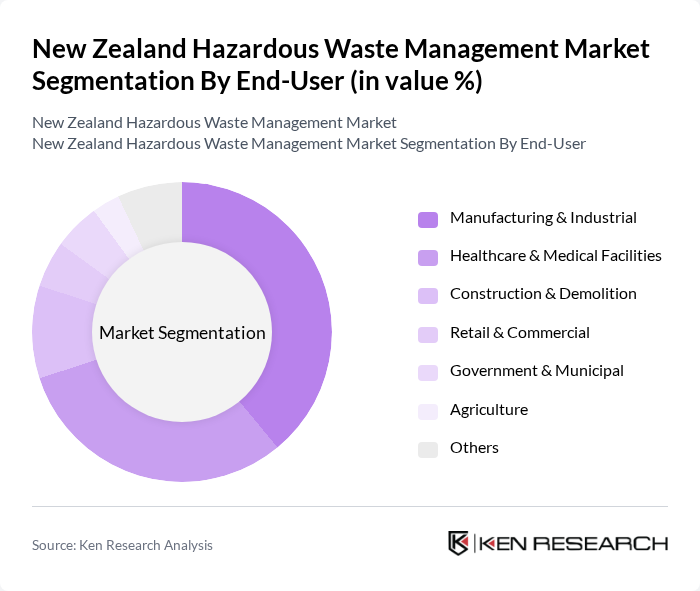

By End-User:End-user segmentation comprises Manufacturing & Industrial, Healthcare & Medical Facilities, Construction & Demolition, Retail & Commercial, Government & Municipal, Agriculture, and Others. The Manufacturing & Industrial segment leads due to the high volume of hazardous waste from production processes, while Healthcare & Medical Facilities are significant contributors, reflecting the sector's growth and regulatory focus on safe medical waste handling .

The New Zealand Hazardous Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Waste Management NZ Limited, EnviroWaste Services Limited, ChemWaste, Interwaste (NZ) Limited, Cleanaway New Zealand, Veolia Environmental Services (NZ) Limited, Green Gorilla, MedCollect, Reclaim Limited, Waste Solutions, Transpacific Technical Services (NZ) Limited, EnviroNZ, Waste Watchers, Hazardous Waste Management Limited, Waste Management Association of New Zealand (Industry Body) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hazardous waste management market in New Zealand appears promising, driven by increasing environmental awareness and regulatory pressures. As industries adapt to stringent regulations, the demand for innovative waste management solutions is expected to rise. Furthermore, the integration of digital technologies and AI in waste management processes will enhance operational efficiency. The focus on sustainable practices will likely lead to the development of new treatment technologies, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Waste Medical Waste Electronic Waste (E-waste) Industrial Hazardous Waste Construction and Demolition Hazardous Waste Contaminated Soil Asbestos Waste Others |

| By End-User | Manufacturing & Industrial Healthcare & Medical Facilities Construction & Demolition Retail & Commercial Government & Municipal Agriculture Others |

| By Disposal Method | Landfilling Incineration Recycling & Resource Recovery Chemical Treatment & Neutralization Secure Storage Others |

| By Collection Method | Scheduled Collection On-Demand Collection Drop-off Centers Mobile Collection Units Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| By Geographic Coverage | North Island South Island Remote & Offshore Islands Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Waste Management Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Hazardous Waste Management | 100 | Facility Managers, Environmental Compliance Officers |

| Medical Waste Disposal Services | 80 | Healthcare Waste Managers, Hospital Administrators |

| Electronic Waste Recycling | 70 | Recycling Plant Operators, Sustainability Coordinators |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Inspectors |

| Consulting Firms in Waste Management | 40 | Environmental Consultants, Waste Management Analysts |

The New Zealand Hazardous Waste Management Market is valued at approximately USD 1.1 billion, reflecting growth driven by industrialization, stricter environmental regulations, and increased awareness of sustainable waste management practices.