Region:Middle East

Author(s):Shubham

Product Code:KRAA1143

Pages:99

Published On:August 2025

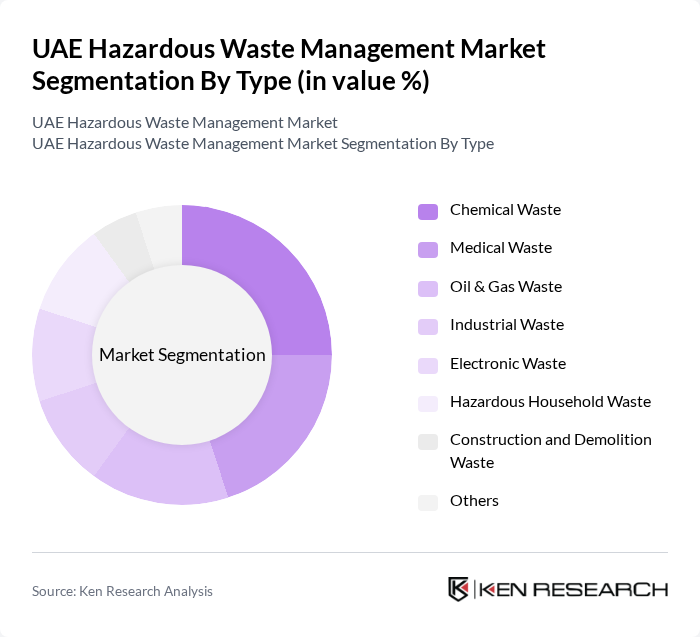

By Type:The hazardous waste management market can be segmented into chemical waste, medical waste, oil & gas waste, industrial waste, electronic waste, hazardous household waste, construction and demolition waste, and others. Each type presents unique challenges and requires specialized handling and disposal methods .

The chemical waste segment is currently the dominant sub-segment in the hazardous waste management market, driven by the extensive use of chemicals in industries such as manufacturing and oil & gas. Increasing regulatory pressure to manage chemical waste responsibly has led to the development of specialized treatment and disposal facilities. The rise in chemical production and usage in the UAE continues to fuel demand for effective hazardous waste management solutions .

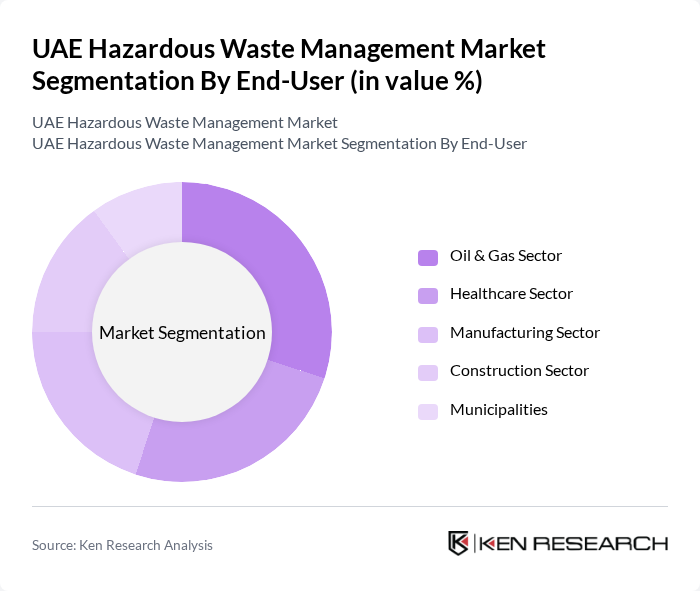

By End-User:The market can also be segmented by end-user, including the oil & gas sector, healthcare sector, manufacturing sector, construction sector, and municipalities. Each end-user has specific waste management needs and regulatory requirements .

The oil & gas sector is the leading end-user in the hazardous waste management market, primarily due to the significant volume of hazardous waste generated during exploration, extraction, and refining processes. Stringent environmental regulations imposed on this sector necessitate comprehensive waste management strategies to mitigate environmental impacts. The healthcare sector follows closely, driven by the increasing volume of medical waste generated from hospitals and clinics, which requires specialized handling and disposal methods .

The UAE Hazardous Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bee'ah (Sharjah Environment Company), Dulsco LLC, Enviroserve, Veolia Environmental Services Emirates, SUEZ Middle East Recycling LLC, Ramky Enviro Engineers Middle East, Al Dhafra Recycling Industries, Abu Dhabi Waste Management Company (Tadweer), Emirates Environmental Technology Co. LLC, Green Planet Environmental Services, Tandeef (a Bee'ah division), CleanCo Waste Treatment LLC, Imdaad LLC, Sharjah National Oil Corporation (Hazardous Waste Division), Sharjah Environment Company (Bee'ah) – Medical Waste Division contribute to innovation, geographic expansion, and service delivery in this space .

The UAE hazardous waste management market is expected to evolve significantly, driven by technological advancements and a shift towards sustainable practices. The adoption of smart waste management systems is anticipated to enhance efficiency and reduce costs. Additionally, the focus on circular economy principles will encourage recycling and resource recovery, aligning with global sustainability goals. As public-private partnerships grow, innovative solutions will emerge, further transforming the waste management landscape in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Waste Medical Waste Oil & Gas Waste Industrial Waste Electronic Waste Hazardous Household Waste Construction and Demolition Waste Others |

| By End-User | Oil & Gas Sector Healthcare Sector Manufacturing Sector Construction Sector Municipalities |

| By Application | Waste Collection Waste Treatment Waste Disposal Recycling |

| By Regulatory Compliance | Local Regulations International Standards Environmental Impact Assessments |

| By Service Type | Collection Services Treatment Services Disposal Services Recycling Services Consulting Services |

| By Technology | Incineration Landfilling Chemical Treatment Biological Treatment Waste-to-Energy |

| By Investment Source | Government Funding Private Investments International Aid Public-Private Partnerships |

| By Region | Dubai Abu Dhabi Sharjah Other Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Waste Management | 100 | Environmental Managers, Compliance Officers |

| Healthcare Hazardous Waste Disposal | 60 | Hospital Waste Managers, Safety Officers |

| Construction and Demolition Waste | 50 | Project Managers, Site Safety Supervisors |

| Chemical Manufacturing Waste | 55 | Production Managers, Environmental Compliance Specialists |

| Oil and Gas Sector Waste Management | 45 | Operations Managers, Environmental Engineers |

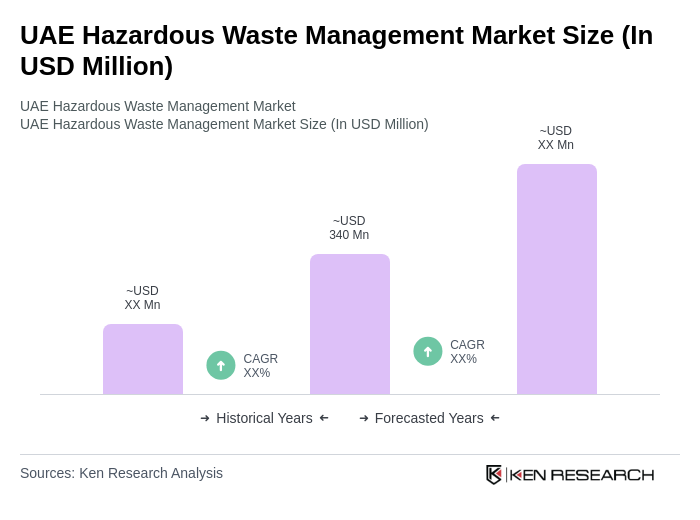

The UAE Hazardous Waste Management Market is valued at approximately USD 340 million, driven by increasing industrial activities, stringent environmental regulations, and a growing awareness of sustainable waste management practices across various sectors.