Region:Asia

Author(s):Shubham

Product Code:KRAB4375

Pages:98

Published On:October 2025

By Type:The market is segmented into various types, including Pet Food, Pet Accessories, Veterinary Services, Pet Grooming Services, Pet Insurance, Pet Training Services, and Others. Among these, Pet Food is the leading sub-segment, driven by the increasing trend of pet humanization and the growing demand for premium and specialized diets. Consumers are increasingly willing to invest in high-quality food options for their pets, which has significantly boosted this segment.

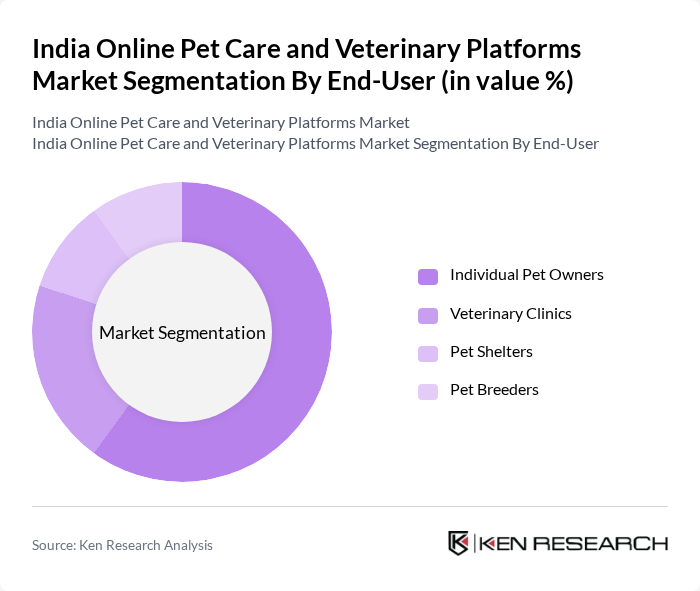

By End-User:The end-user segmentation includes Individual Pet Owners, Veterinary Clinics, Pet Shelters, and Pet Breeders. Individual Pet Owners dominate the market, as they represent the largest consumer base for pet care products and services. The increasing trend of pet adoption and the growing emotional bond between pets and their owners have led to a surge in spending on pet-related services and products.

The India Online Pet Care and Veterinary Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as PetSmart, Chewy, Petco, Heads Up For Tails, Wiggles, DogSpot, PetCare, Vetstreet, PetPals, Furrytail, PetSutra, PetMeds, PetSnap, Woof & Wag, Pawfect contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online pet care and veterinary platforms market in India appears promising, driven by technological advancements and evolving consumer preferences. The integration of telemedicine and AI in pet care services is expected to enhance accessibility and efficiency. Additionally, the growing trend of subscription-based services will likely cater to the increasing demand for convenience among pet owners, fostering a more robust market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Pet Food Pet Accessories Veterinary Services Pet Grooming Services Pet Insurance Pet Training Services Others |

| By End-User | Individual Pet Owners Veterinary Clinics Pet Shelters Pet Breeders |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Distribution Mode | Home Delivery In-Store Pickup Third-Party Logistics |

| By Price Range | Budget Mid-Range Premium |

| By Product Origin | Domestic Products Imported Products |

| By Customer Segment | First-Time Pet Owners Experienced Pet Owners Pet Enthusiasts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Veterinary Consultations | 150 | Veterinarians, Telehealth Coordinators |

| Pet Supply E-commerce | 120 | Pet Owners, E-commerce Managers |

| Pet Care Service Platforms | 100 | Service Providers, Platform Developers |

| Pet Insurance Market | 80 | Insurance Agents, Pet Owners |

| Pet Health and Wellness Trends | 90 | Veterinary Technicians, Pet Nutritionists |

The India Online Pet Care and Veterinary Platforms Market is valued at approximately INR 50 billion, reflecting significant growth driven by increasing pet ownership, rising disposable incomes, and heightened awareness of pet health and wellness among consumers.