Region:Asia

Author(s):Rebecca

Product Code:KRAB0839

Pages:93

Published On:December 2025

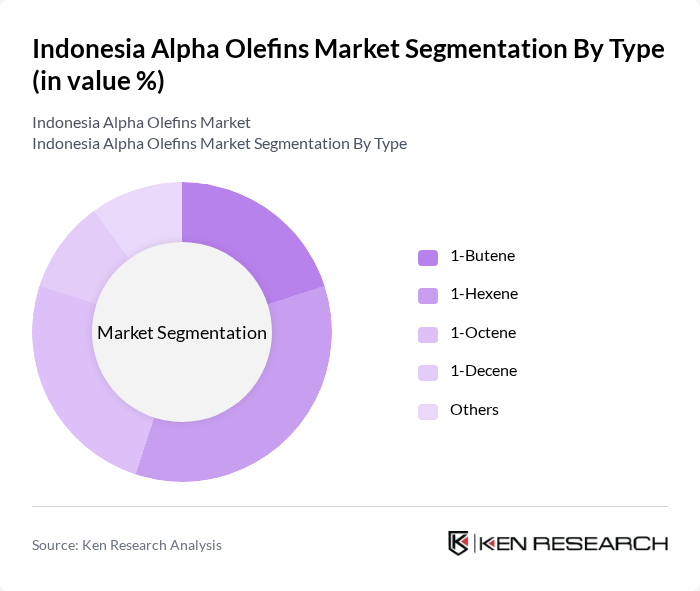

By Type:The alpha olefins market is segmented into various types, including 1-Butene, 1-Hexene, 1-Octene, 1-Decene, and Others. Among these, 1-Hexene is gaining traction due to its extensive use in producing high-performance polyethylene, which is increasingly demanded in packaging applications. The versatility of 1-Hexene in enhancing polymer properties makes it a preferred choice among manufacturers, driving its market share significantly.

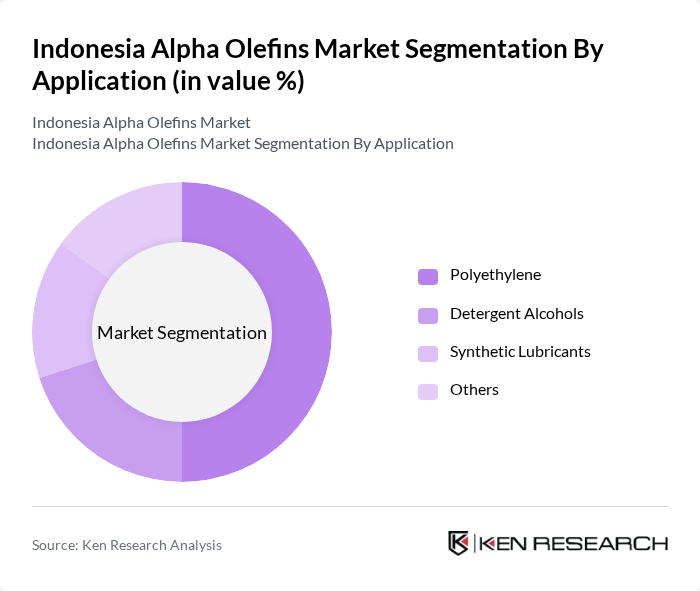

By Application:The alpha olefins market is utilized in various applications, including Polyethylene, Detergent Alcohols, Synthetic Lubricants, and Others. Polyethylene is the dominant application, driven by its extensive use in packaging materials, which are essential for consumer goods. The increasing demand for lightweight and durable packaging solutions is propelling the growth of polyethylene, making it a key driver in the alpha olefins market.

The Indonesia Alpha Olefins Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Chandra Asri Petrochemical Tbk, PT Lotte Chemical Titan Tbk, PT Pupuk Kaltim, PT Pertamina (Persero), PT Indorama Synthetics Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Indonesia alpha olefins market appears promising, driven by ongoing digital transformation and sustainability initiatives. The World Bank's advocacy for digital foundations is expected to enhance supply chain efficiency and operational productivity in the chemical sector. Additionally, the focus on clean energy investments, supported by blended finance packages, will likely incentivize eco-friendly production practices, fostering a more sustainable alpha olefins market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Butene Hexene Octene Decene Others |

| By Application | Polyethylene Detergent Alcohols Synthetic Lubricants Others |

| By End-Use Industry | Plastics Detergents Lubricants Others |

| By Region | Java Sumatra Kalimantan Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polyethylene Production | 60 | Production Managers, Plant Engineers |

| Surfactants Application | 50 | Product Development Managers, R&D Scientists |

| Detergent Manufacturing | 40 | Procurement Managers, Quality Control Analysts |

| Textile Industry Usage | 40 | Textile Engineers, Supply Chain Coordinators |

| Market Research Stakeholders | 50 | Market Analysts, Business Development Managers |

The Indonesia Alpha Olefins Market is currently valued at approximately USD 15 billion. This valuation reflects the market's integration within the broader olefins and aromatics sector, driven by increasing demand in various industries such as packaging and construction.