Region:Asia

Author(s):Rebecca

Product Code:KRAD3980

Pages:90

Published On:January 2026

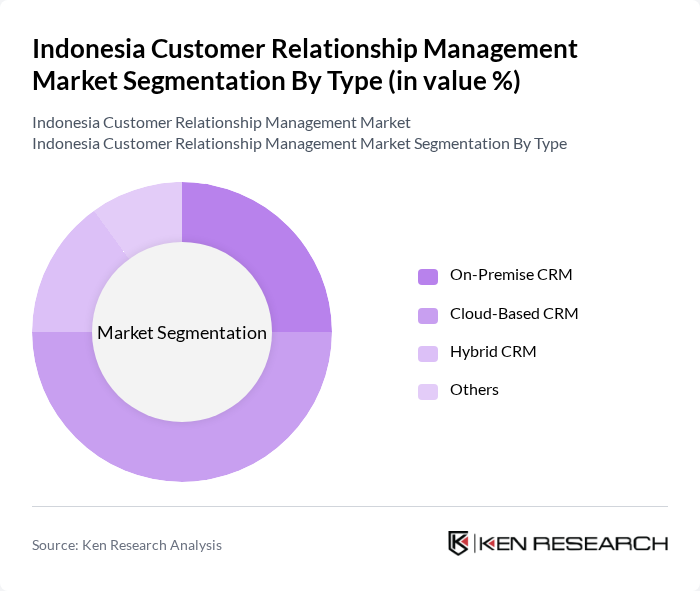

By Type:The market is segmented into On-Premise CRM, Cloud-Based CRM, Hybrid CRM, and Others. Among these, Cloud-Based CRM is gaining significant traction due to its flexibility, scalability, and cost-effectiveness, with adoption rising to 77% among SMEs. Businesses are increasingly opting for cloud solutions to enhance collaboration and access customer data from anywhere, driving the demand for this segment.

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, and Others. SMEs are the leading segment as they increasingly recognize the importance of CRM systems in managing customer relationships and driving sales growth, accounting for over 60% of CRM users. The affordability and scalability of CRM solutions make them particularly appealing to this segment.

The Indonesia Customer Relationship Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, Microsoft Dynamics 365, SAP CRM, Oracle CRM, HubSpot, Zoho CRM, Freshworks, Pipedrive, SugarCRM, Insightly, Nimble, Bitrix24, Keap, Agile CRM, Odoo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia CRM market appears promising, driven by technological advancements and changing consumer behaviors. As businesses increasingly recognize the importance of customer-centric strategies, investments in CRM solutions are expected to rise. The integration of artificial intelligence and machine learning will further enhance CRM capabilities, enabling businesses to deliver personalized experiences. Additionally, the growing trend of omnichannel engagement will compel companies to adopt comprehensive CRM systems that can seamlessly connect various customer touchpoints, ensuring a cohesive customer journey.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise CRM Cloud-Based CRM Hybrid CRM Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Others |

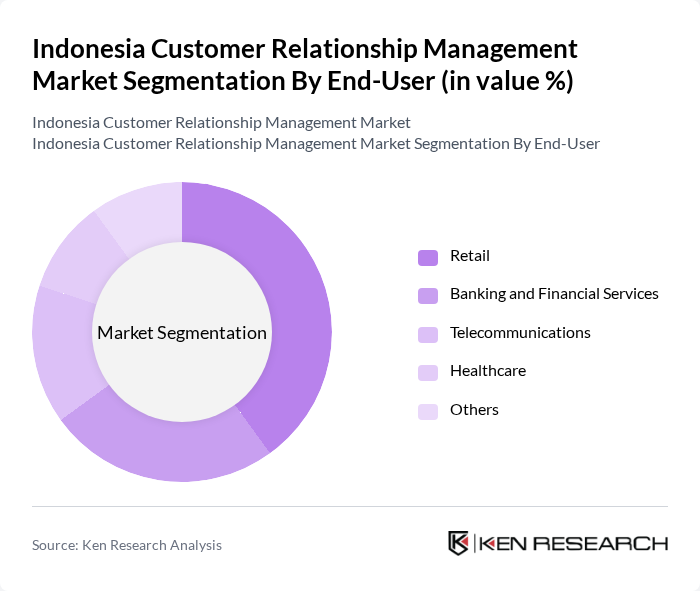

| By Industry Vertical | Retail Banking and Financial Services Telecommunications Healthcare Others |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud Others |

| By Functionality | Sales Automation Marketing Automation Customer Service Others |

| By Customer Type | B2B B2C C2C Others |

| By Region | Java Sumatra Bali Kalimantan Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail CRM Solutions | 100 | Marketing Managers, Customer Experience Directors |

| Banking Sector CRM Implementation | 80 | IT Managers, Customer Relationship Officers |

| Telecommunications Customer Engagement | 70 | Product Managers, Service Delivery Managers |

| Healthcare CRM Adoption | 60 | Healthcare Administrators, Patient Experience Coordinators |

| SME CRM Usage Trends | 90 | Small Business Owners, Operations Managers |

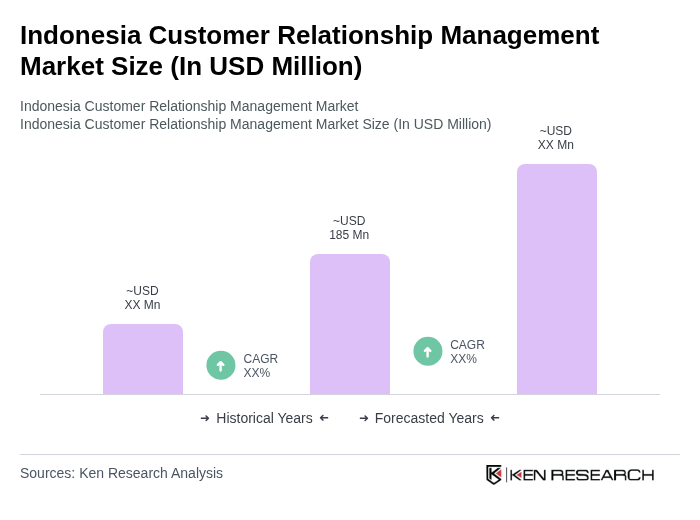

The Indonesia Customer Relationship Management market is valued at approximately USD 185 million, reflecting significant growth driven by digital technology adoption, e-commerce expansion, and enhanced customer engagement strategies among businesses.