Region:Asia

Author(s):Dev

Product Code:KRAA6408

Pages:90

Published On:September 2025

By Type:The market is segmented into various types of products, including fitness equipment, sports apparel, footwear, accessories, nutrition supplements, team sports equipment, and others. Among these, fitness equipment and sports apparel are the most significant segments, driven by the increasing trend of home workouts and the growing popularity of athleisure wear. The demand for nutrition supplements is also on the rise as consumers become more health-conscious.

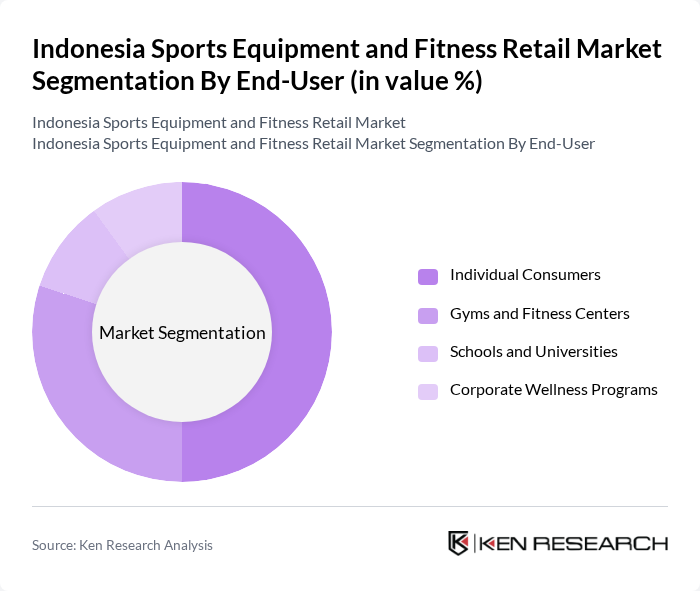

By End-User:The end-user segmentation includes individual consumers, gyms and fitness centers, schools and universities, and corporate wellness programs. Individual consumers represent the largest segment, driven by the increasing trend of personal fitness and home workouts. Gyms and fitness centers are also significant contributors, as they invest in a wide range of equipment to attract members.

The Indonesia Sports Equipment and Fitness Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Adidas Indonesia, PT. Nike Indonesia, PT. Decathlon Indonesia, PT. Sport Station, PT. Mitra Adiperkasa Tbk, PT. Surya Citra Media Tbk, PT. Proline Sports, PT. Sinar Mas Group, PT. Jaya Abadi, PT. Global Sport, PT. Sportindo, PT. Bhinneka Mentari Dimensi, PT. Tiga Pilar Sejahtera Food Tbk, PT. Citra Niaga, PT. Karya Mandiri contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian sports equipment and fitness retail market appears promising, driven by increasing health consciousness and a growing fitness culture. As more consumers prioritize wellness, the demand for innovative fitness solutions is expected to rise. Additionally, the expansion of e-commerce will continue to facilitate access to a wider range of products. Companies that adapt to these trends and invest in technology will likely capture significant market share, positioning themselves for long-term success in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Footwear Accessories Nutrition Supplements Team Sports Equipment Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Universities Corporate Wellness Programs |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 150 | Store Managers, Retail Buyers |

| Fitness Equipment Manufacturers | 100 | Product Development Managers, Sales Directors |

| Consumer Fitness Trends | 200 | Fitness Enthusiasts, Gym Members |

| Online Fitness Retailers | 80 | E-commerce Managers, Digital Marketing Specialists |

| Health and Wellness Influencers | 50 | Fitness Coaches, Social Media Influencers |

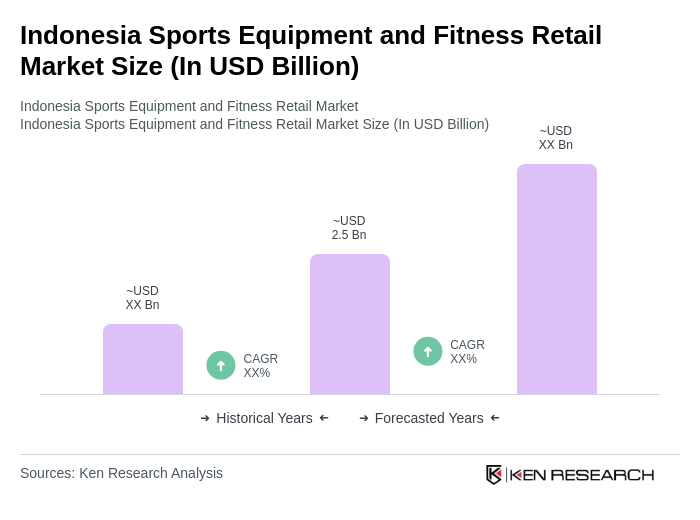

The Indonesia Sports Equipment and Fitness Retail Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increased health consciousness, rising disposable incomes, and the popularity of fitness activities among the population.