Region:Middle East

Author(s):Dev

Product Code:KRAB6912

Pages:93

Published On:October 2025

Market.png)

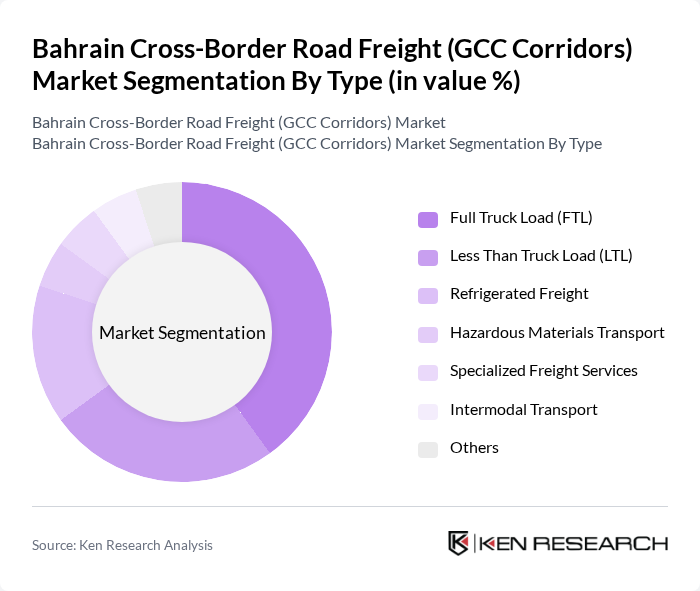

By Type:The market is segmented into various types of freight services, including Full Truck Load (FTL), Less Than Truck Load (LTL), Refrigerated Freight, Hazardous Materials Transport, Specialized Freight Services, Intermodal Transport, and Others. Each of these sub-segments caters to different logistical needs and customer preferences, with FTL and LTL being the most prominent due to their flexibility and cost-effectiveness.

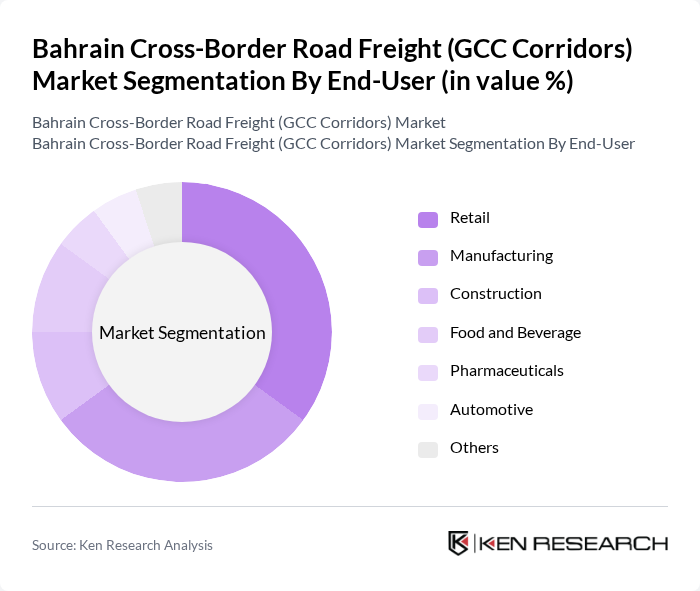

By End-User:The end-user segmentation includes Retail, Manufacturing, Construction, Food and Beverage, Pharmaceuticals, Automotive, and Others. The retail and manufacturing sectors are the largest consumers of cross-border road freight services, driven by the need for timely delivery of goods and raw materials across borders.

The Bahrain Cross-Border Road Freight (GCC Corridors) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Agency Company (GAC), Agility Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain, Aramex, CEVA Logistics, FedEx Logistics, Maersk Logistics, Panalpina, XPO Logistics, Agility Logistics, Al-Futtaim Logistics, Bahri, Emirates Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain cross-border road freight market appears promising, driven by ongoing investments in infrastructure and government initiatives aimed at enhancing trade efficiency. As e-commerce continues to expand, the demand for reliable freight services is expected to grow. Furthermore, the adoption of digital technologies and smart logistics solutions will likely transform operations, improving service delivery and customer satisfaction. Overall, the market is poised for significant evolution, adapting to emerging trends and challenges in the logistics landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Refrigerated Freight Hazardous Materials Transport Specialized Freight Services Intermodal Transport Others |

| By End-User | Retail Manufacturing Construction Food and Beverage Pharmaceuticals Automotive Others |

| By Service Type | Standard Freight Services Expedited Freight Services Contract Logistics Freight Forwarding Customs Brokerage Others |

| By Route Type | Major Highways Secondary Roads Urban Routes Rural Routes Cross-Border Routes Others |

| By Delivery Time | Same-Day Delivery Next-Day Delivery Standard Delivery Scheduled Delivery Others |

| By Pricing Model | Flat Rate Pricing Variable Pricing Subscription-Based Pricing Others |

| By Payment Method | Prepaid Postpaid Credit Terms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-Border Freight Operations | 100 | Logistics Managers, Freight Forwarding Executives |

| Customs Clearance Processes | 80 | Customs Officers, Compliance Managers |

| Transport Infrastructure Assessment | 70 | Transport Planners, Infrastructure Analysts |

| Regional Trade Policy Impact | 60 | Trade Policy Experts, Economic Advisors |

| Logistics Technology Adoption | 90 | IT Managers, Operations Directors |

The Bahrain Cross-Border Road Freight market is valued at approximately USD 1.2 billion, reflecting a robust growth driven by increased demand for logistics solutions, trade agreements within the GCC, and the rise of e-commerce activities.