Region:Central and South America

Author(s):Rebecca

Product Code:KRAB1823

Pages:96

Published On:October 2025

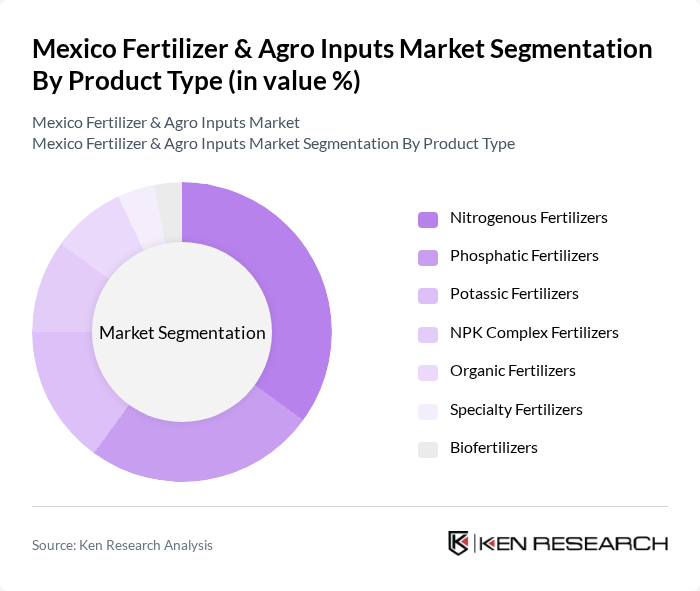

By Product Type:The product type segmentation includes various categories of fertilizers that cater to different agricultural needs. Nitrogenous fertilizers are widely used due to their essential role in plant growth, while phosphatic and potassic fertilizers are crucial for enhancing soil fertility. Organic fertilizers are gaining traction as farmers seek sustainable alternatives, and specialty fertilizers are increasingly popular for targeted applications with controlled-release mechanisms and polymer coatings. Biofertilizers are experiencing robust growth due to rising organic farming practices and government support for sustainable agriculture. Each sub-segment plays a vital role in meeting the diverse requirements of the agricultural sector.

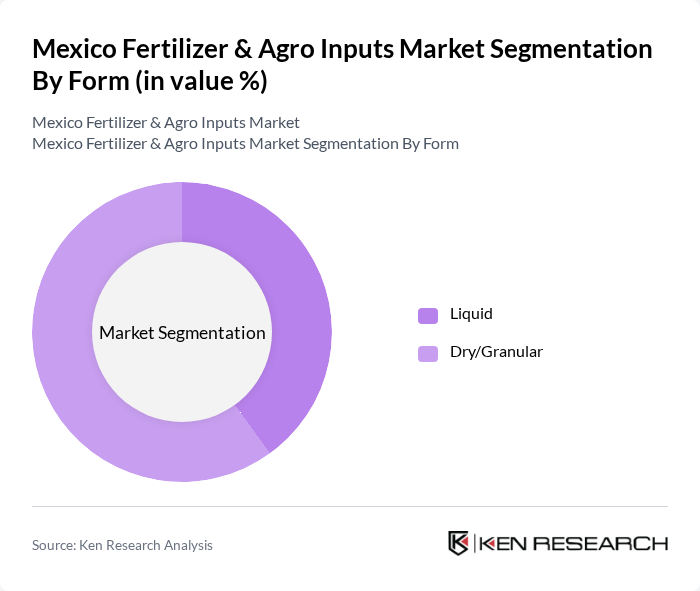

By Form:The form segmentation categorizes fertilizers based on their physical state, which influences their application methods and effectiveness. Liquid fertilizers are favored for their ease of application and quick absorption by plants, representing the largest revenue-generating segment. Dry/granular fertilizers are preferred for their long-lasting effects and ease of storage, and are experiencing the fastest growth during the current period. The choice between these forms often depends on the specific crop requirements and farming practices.

The Mexico Fertilizer & Agro Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, Nutrien Ltd., The Mosaic Company, CF Industries Holdings, Inc., FERTIZONA, Haifa Group, ICL Group, Aditya Birla Group, SKW Stickstoffwerke Piesteritz, Petroleo Brasileiro SA (Petrobras), BASF SE, Syngenta AG, Corteva Agriscience, FMC Corporation, UPL Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico Fertilizer & Agro Inputs Market is poised for significant transformation as sustainability becomes a central focus. With the government promoting eco-friendly practices, the demand for organic and bio-based fertilizers is expected to rise. Additionally, advancements in digital farming technologies will enhance efficiency and productivity. As farmers increasingly adopt these innovations, the market will likely see a shift towards integrated solutions that combine fertilizers with precision agriculture tools, fostering a more sustainable agricultural landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Nitrogenous Fertilizers Phosphatic Fertilizers Potassic Fertilizers NPK Complex Fertilizers Organic Fertilizers Specialty Fertilizers Biofertilizers |

| By Form | Liquid Dry/Granular |

| By Crop Application | Grains and Cereals Pulses and Oilseeds Fruits and Vegetables Turf and Ornamental |

| By Distribution Channel | Direct Sales Retail Outlets Agricultural Cooperatives Online Sales |

| By Region | Central Mexico Northern Mexico The Bajío Pacific Coast Yucatan Peninsula Baja California |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 80 | Retail Managers, Store Owners |

| Agro Inputs Distribution | 60 | Distributors, Supply Chain Managers |

| Crop-Specific Fertilizer Usage | 70 | Agronomists, Crop Consultants |

| Organic Fertilizer Adoption | 40 | Farmers, Organic Product Specialists |

| Government Policy Impact | 40 | Policy Makers, Agricultural Economists |

The Mexico Fertilizer & Agro Inputs Market is valued at approximately USD 5.5 billion, driven by increasing food production demands, advancements in agricultural technologies, and government initiatives focused on enhancing agricultural productivity and sustainability.