Region:North America

Author(s):Geetanshi

Product Code:KRAA1983

Pages:86

Published On:August 2025

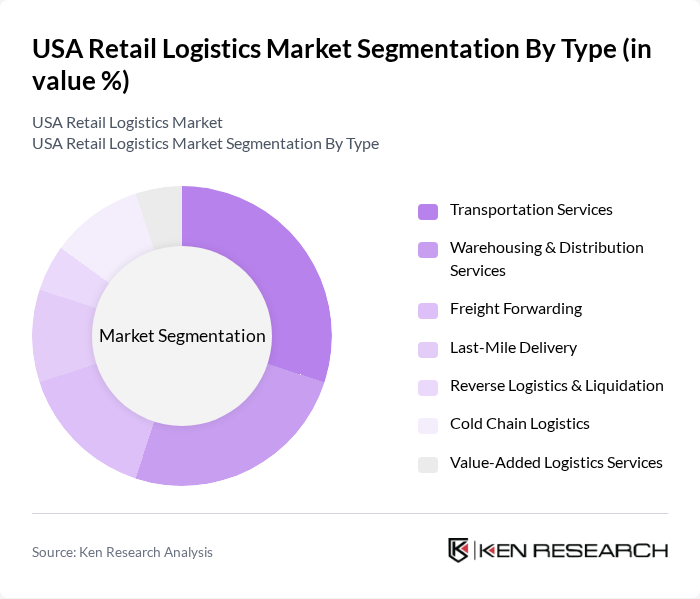

By Type:The retail logistics market is segmented into transportation services, warehousing & distribution services, freight forwarding, last-mile delivery, reverse logistics & liquidation, cold chain logistics, and value-added logistics services. Each segment plays a crucial role in the logistics ecosystem, supporting supply chain management through specialized solutions such as automated warehousing, temperature-controlled distribution, and technology-enabled last-mile delivery.

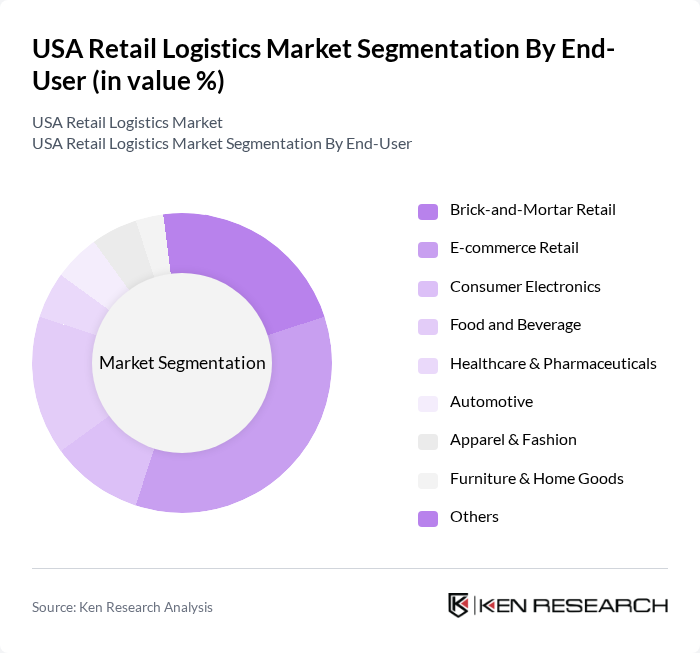

By End-User:The end-user segmentation of the retail logistics market includes brick-and-mortar retail, e-commerce retail, consumer electronics, food and beverage, healthcare & pharmaceuticals, automotive, apparel & fashion, furniture & home goods, and others. This segmentation reflects the diverse applications of logistics services, with e-commerce and food & beverage sectors experiencing rapid growth due to rising online shopping and demand for temperature-controlled logistics.

The USA Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as FedEx Corporation, United Parcel Service, Inc. (UPS), XPO Logistics, Inc., DHL Supply Chain (Deutsche Post DHL Group), C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc., Ryder System, Inc., Schneider National, Inc., Kuehne + Nagel International AG, DB Schenker, GEODIS, CEVA Logistics, Penske Logistics, Total Quality Logistics (TQL), Expeditors International of Washington, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The USA retail logistics market is poised for transformative growth driven by technological advancements and evolving consumer preferences. As companies increasingly adopt automation and AI, operational efficiencies will improve, allowing for faster delivery times. Additionally, the focus on sustainability will shape logistics strategies, with businesses seeking eco-friendly solutions. The expansion of e-commerce will continue to drive demand, necessitating innovative logistics approaches to meet consumer expectations for speed and reliability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing & Distribution Services Freight Forwarding Last-Mile Delivery Reverse Logistics & Liquidation Cold Chain Logistics Value-Added Logistics Services |

| By End-User | Brick-and-Mortar Retail E-commerce Retail Consumer Electronics Food and Beverage Healthcare & Pharmaceuticals Automotive Apparel & Fashion Furniture & Home Goods Others |

| By Distribution Mode | Road Rail Air Sea Intermodal Others |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Partnerships Others |

| By Service Type | Standard Services Premium/Expedited Services Customized Solutions Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Dynamic Pricing Others |

| By Technology Integration | IoT & Real-Time Tracking Solutions AI and Machine Learning Automation & Robotics Blockchain Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Coordinators, Supply Chain Managers |

| E-commerce Fulfillment Strategies | 80 | E-commerce Managers, Operations Analysts |

| Warehouse Management Practices | 60 | Warehouse Supervisors, Inventory Managers |

| Last-Mile Delivery Solutions | 50 | Delivery Managers, Logistics Consultants |

| Returns Management Processes | 40 | Customer Service Managers, Returns Analysts |

The USA Retail Logistics Market is valued at approximately USD 140 billion, driven by the growth of e-commerce, consumer demand for faster delivery, and advancements in logistics technology such as automation and warehouse robotics.