Region:Middle East

Author(s):Geetanshi

Product Code:KRAB0001

Pages:96

Published On:August 2025

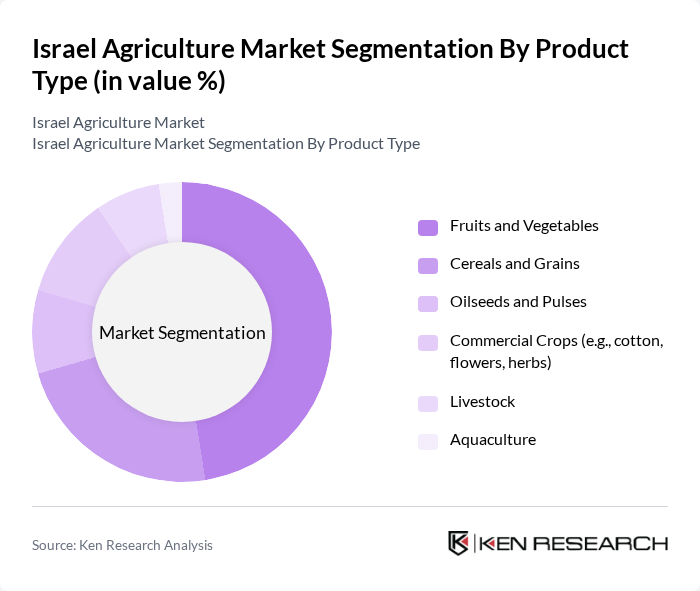

By Product Type:The product type segmentation includes various categories such as fruits and vegetables, cereals and grains, oilseeds and pulses, commercial crops, livestock, and aquaculture. Among these, fruits and vegetables dominate the market due to the increasing consumer preference for fresh produce and health-conscious eating habits. The demand for organic fruits and vegetables has surged, driven by a growing awareness of health and nutrition .

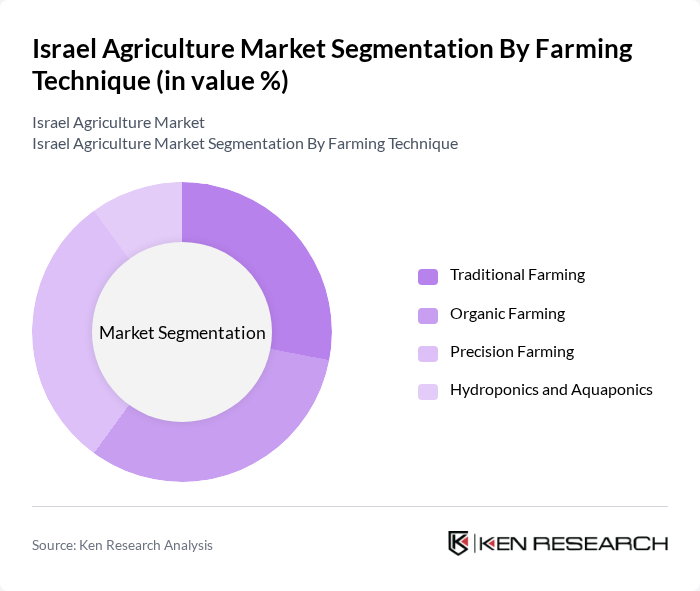

By Farming Technique:The farming technique segmentation encompasses traditional farming, organic farming, precision farming, and hydroponics and aquaponics. Precision farming and organic farming are leading sub-segments, driven by consumer demand for chemical-free produce, sustainable practices, and the adoption of smart farming technologies. The trend towards resource-efficient and data-driven agriculture is supported by government incentives and a growing market for sustainable products, making these segments significant contributors to the overall agricultural landscape .

The Israel Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netafim, Haifa Group, BioBee Sde Eliyahu Ltd., Evogene Ltd., CropX Technologies, Gadot Agro, Rivulis Irrigation, GreenOnyx, Phytech, Adama Agricultural Solutions Ltd., Taranis, Manna Irrigation Intelligence, Saturas, AgriTask, and Hargol FoodTech contribute to innovation, geographic expansion, and service delivery in this space.

The future of Israel's agriculture market appears promising, driven by ongoing technological advancements and a strong focus on sustainability. As the demand for organic and locally sourced products continues to rise, farmers are likely to adopt innovative practices that enhance productivity while conserving resources. Additionally, government initiatives aimed at supporting agri-tech development will further bolster the sector. The integration of smart technologies and sustainable practices will be crucial in addressing challenges such as water scarcity and operational costs, ensuring long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fruits and Vegetables Cereals and Grains Oilseeds and Pulses Commercial Crops (e.g., cotton, flowers, herbs) Livestock Aquaculture |

| By Farming Technique | Traditional Farming Organic Farming Precision Farming Hydroponics and Aquaponics |

| By Irrigation Method | Drip Irrigation Sprinkler Irrigation Surface Irrigation Others |

| By Agricultural Input | Seeds Fertilizers Crop Protection Chemicals Equipment & Machinery |

| By End-User | Farmers Food Processors Retailers Exporters |

| By Distribution Channel | Direct Sales Wholesale Online Sales |

| By Technology Adoption | Traditional Techniques Smart Farming Technologies Sustainable Practices |

| By Geography | Northern Israel Central Israel Southern Israel |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 50 | Farm Owners, Agronomists |

| Fruit and Vegetable Growers | 40 | Farm Managers, Supply Chain Coordinators |

| Dairy and Livestock Farmers | 40 | Livestock Managers, Veterinary Experts |

| Aquaculture Operators | 40 | Aquaculture Managers, Environmental Scientists |

| Agricultural Technology Providers | 40 | Product Development Managers, Sales Directors |

The Israel Agriculture Market is valued at approximately USD 13.1 billion, reflecting significant growth driven by advancements in agricultural technology, increased demand for organic produce, and government support for sustainable farming practices.