Region:Middle East

Author(s):Rebecca

Product Code:KRAC0191

Pages:95

Published On:August 2025

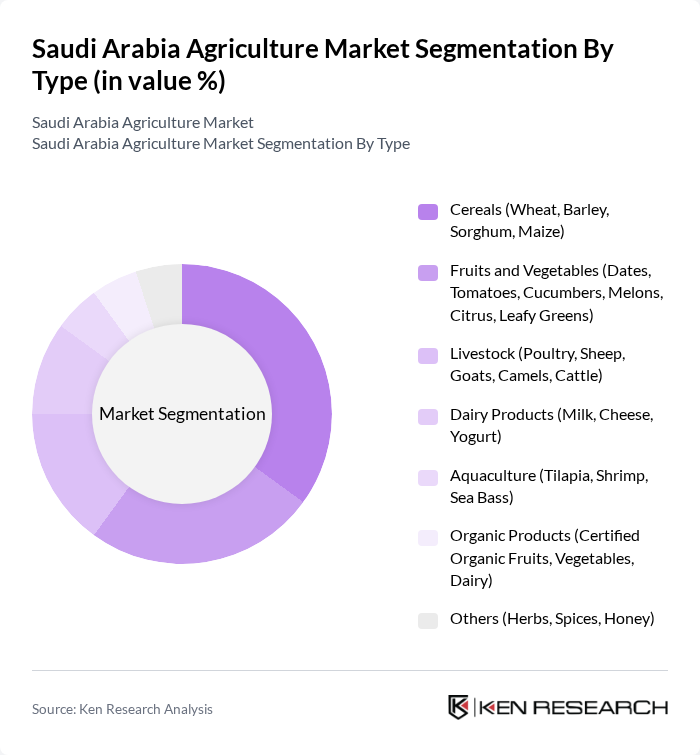

By Type:The agriculture market in Saudi Arabia is segmented into cereals, fruits and vegetables, livestock, dairy products, aquaculture, organic products, and others. Cereals—particularly wheat, barley, sorghum, and maize—continue to dominate due to their essential role in food security and staple diets. The fruits and vegetables segment is expanding rapidly, driven by large-scale greenhouse adoption and the popularity of high-value crops such as dates, tomatoes, cucumbers, and melons. Livestock, dairy, and aquaculture remain significant, with poultry and dairy products being especially prominent. The increasing demand for healthy and organic food options has led to a rise in the production of certified organic products, appealing to health-conscious consumers.

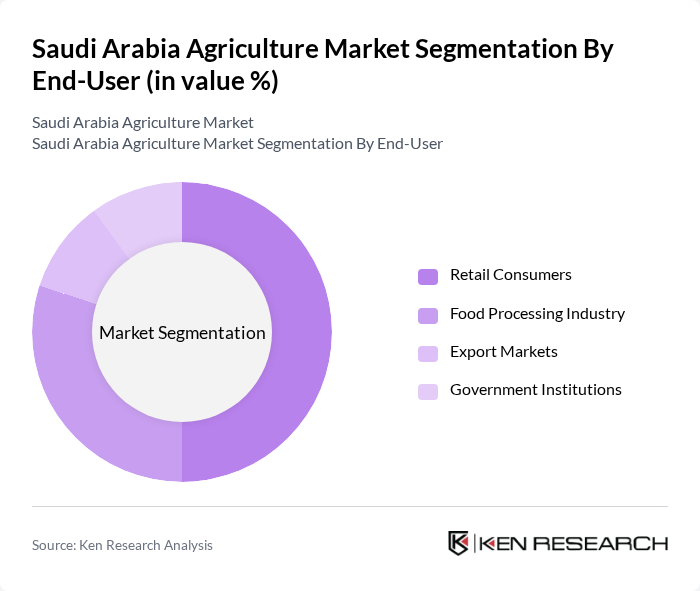

By End-User:The end-user segmentation of the agriculture market includes retail consumers, the food processing industry, export markets, and government institutions. Retail consumers represent the largest segment, driven by population growth and evolving dietary preferences for fresh and locally sourced products. The food processing industry is also significant, requiring a steady supply of raw agricultural products to meet demand for processed foods. Export markets and government institutions play important roles in supporting sector growth and food security initiatives.

The Saudi Arabia Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Savola Group, National Agricultural Development Company (NADEC), Tabuk Agricultural Development Company, Al-Jouf Agricultural Development Company, United Farmers Holding Company, Arabian Agricultural Services Company (ARASCO), Saudi Agricultural and Livestock Investment Company (SALIC), Al-Othaim Holding Company, Al-Jazeera Agricultural Company, Al-Muhaidib Group, Al-Babtain Group, Al-Safi Danone, Al-Rajhi Agricultural Investment Company, and Al-Khodari Sons Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian agriculture market appears promising, driven by technological advancements and a strong governmental focus on sustainability. The adoption of smart farming technologies is expected to revolutionize traditional practices, enhancing productivity and resource management. Additionally, the increasing emphasis on climate-resilient crops will help mitigate the impacts of climate change, ensuring food security. As the market evolves, collaboration between public and private sectors will be crucial in addressing challenges and seizing growth opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Cereals (Wheat, Barley, Sorghum, Maize) Fruits and Vegetables (Dates, Tomatoes, Cucumbers, Melons, Citrus, Leafy Greens) Livestock (Poultry, Sheep, Goats, Camels, Cattle) Dairy Products (Milk, Cheese, Yogurt) Aquaculture (Tilapia, Shrimp, Sea Bass) Organic Products (Certified Organic Fruits, Vegetables, Dairy) Others (Herbs, Spices, Honey) |

| By End-User | Retail Consumers Food Processing Industry Export Markets Government Institutions |

| By Distribution Channel | Direct Sales Wholesale Markets Online Retail Supermarkets and Hypermarkets |

| By Region | Central Region (Riyadh, Qassim) Eastern Region (Dammam, Al-Ahsa) Western Region (Jeddah, Makkah, Madinah) Southern Region (Jizan, Asir, Najran) |

| By Farming Method | Conventional Farming Organic Farming Hydroponics Aquaponics |

| By Crop Type | Grains (Wheat, Barley, Sorghum) Pulses (Lentils, Chickpeas, Beans) Oilseeds (Sunflower, Sesame) Vegetables (Tomatoes, Cucumbers, Leafy Greens) |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 100 | Farm Owners, Agricultural Managers |

| Fruit and Vegetable Growers | 90 | Horticulturists, Cooperative Leaders |

| Agricultural Equipment Suppliers | 50 | Sales Managers, Product Specialists |

| Agrochemical Distributors | 60 | Distribution Managers, Supply Chain Analysts |

| Government Agricultural Policy Makers | 40 | Policy Advisors, Regulatory Officials |

The Saudi Arabia Agriculture Market is valued at approximately USD 18 billion, reflecting a significant growth trend driven by investments in agricultural technology, government initiatives for food security, and increasing demand for locally produced food products.