Region:Middle East

Author(s):Shubham

Product Code:KRAB4480

Pages:87

Published On:October 2025

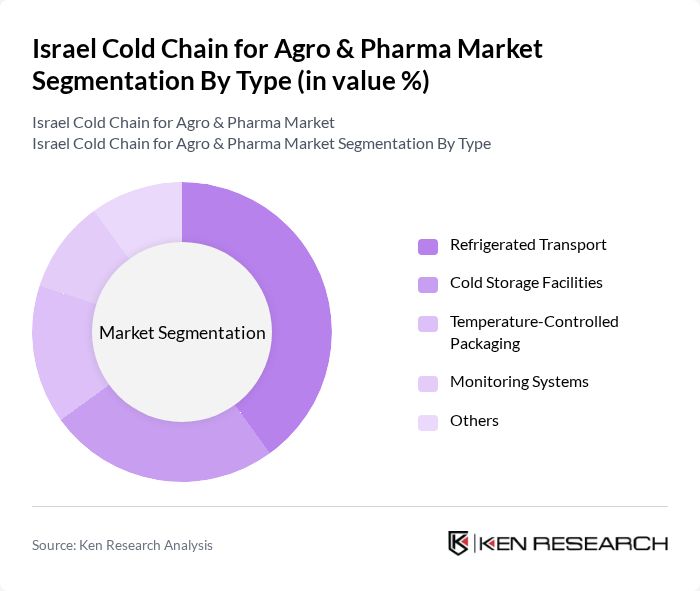

By Type:The cold chain market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, and Others. Among these, Refrigerated Transport is the leading sub-segment, driven by the increasing demand for efficient logistics solutions in the agriculture and pharmaceutical sectors. The need for timely delivery of temperature-sensitive products has led to significant investments in refrigerated transport solutions, making it a critical component of the cold chain ecosystem.

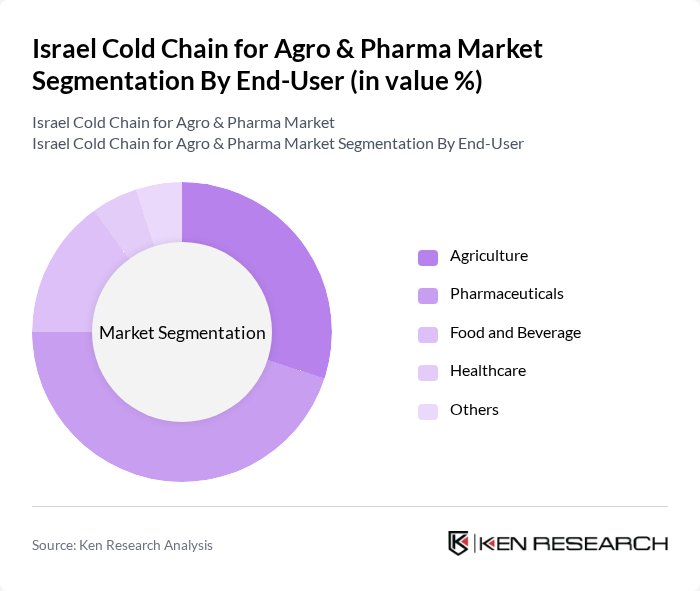

By End-User:The market is segmented by end-users, including Agriculture, Pharmaceuticals, Food and Beverage, Healthcare, and Others. The Pharmaceuticals segment is the dominant sub-segment, driven by the increasing need for effective temperature control in the distribution of vaccines and other sensitive medical products. The rise in healthcare demands, particularly during health crises, has further solidified the importance of this segment in the cold chain market.

The Israel Cold Chain for Agro & Pharma Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tnuva, Strauss Group, Teva Pharmaceutical Industries Ltd., Makhteshim Agan Industries Ltd., Agrexco, Israel Chemicals Ltd., Elbit Systems Ltd., ZIM Integrated Shipping Services Ltd., Fresh Del Monte Produce Inc., Osem Investments Ltd., Netafim, A.B. M. Cold Chain Solutions, Hatzor Logistics, Golan Heights Winery, Superfarm contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain market in Israel appears promising, driven by increasing investments in infrastructure and technology. As the demand for fresh produce and pharmaceuticals continues to rise, companies are likely to adopt more advanced solutions to enhance efficiency and sustainability. The integration of IoT and automation will play a crucial role in optimizing operations, while government incentives for energy-efficient technologies will further support growth. Overall, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Others |

| By End-User | Agriculture Pharmaceuticals Food and Beverage Healthcare Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Fresh Produce Pharmaceuticals Dairy Products Frozen Foods Others |

| By Sales Channel | Online Sales Retail Sales Wholesale Distribution Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Cold Chain Logistics | 100 | Logistics Managers, Supply Chain Analysts |

| Pharmaceutical Distribution Networks | 80 | Operations Directors, Compliance Officers |

| Cold Storage Facility Management | 70 | Facility Managers, Quality Assurance Leads |

| Temperature-Controlled Transport Services | 90 | Transport Managers, Fleet Coordinators |

| Technology Providers for Cold Chain Solutions | 60 | Product Managers, Business Development Executives |

The Israel Cold Chain for Agro & Pharma Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the rising demand for temperature-sensitive products in agriculture and pharmaceuticals, along with advancements in cold chain technologies.