Region:Europe

Author(s):Rebecca

Product Code:KRAA4818

Pages:96

Published On:September 2025

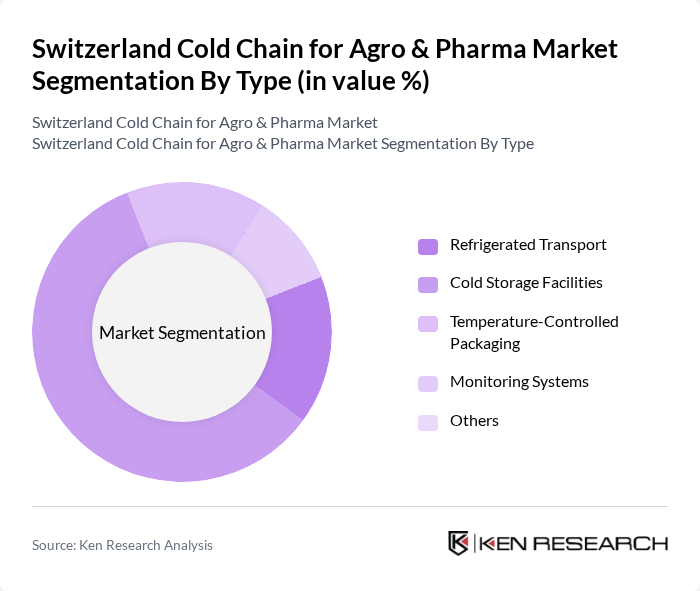

By Type:The cold chain market is segmented intoRefrigerated Transport,Cold Storage Facilities,Temperature-Controlled Packaging,Monitoring Systems, andOthers. Each segment is critical for maintaining the safety and efficacy of temperature-sensitive products.Cold Storage Facilitiesrepresent the largest segment by revenue, reflecting the need for robust infrastructure to support the storage of pharmaceuticals and high-value food products.Refrigerated Transportis rapidly growing, driven by the expansion of last-mile delivery and cross-border logistics for biologics and specialty foods .

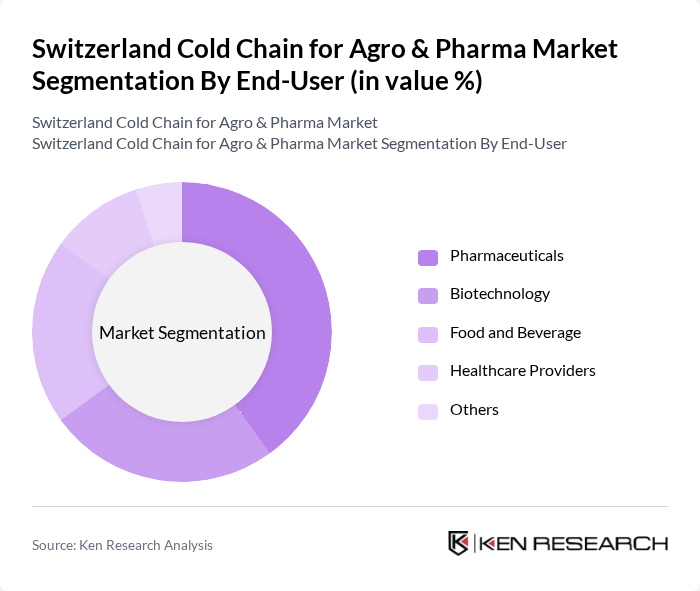

By End-User:The end-user segmentation includesPharmaceuticals,Biotechnology,Food and Beverage,Healthcare Providers, andOthers. ThePharmaceuticalsandBiotechnologysegments account for the largest share, reflecting Switzerland’s strong position as a global pharmaceutical and biotech hub. TheFood and Beveragesegment is also significant, driven by the demand for premium and perishable foods that require strict temperature control .

The Switzerland Cold Chain for Agro & Pharma Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kühne + Nagel International AG, Swisslog Holding AG, DB Schenker, DSV A/S, DHL Supply Chain (Deutsche Post DHL Group), Agility Logistics, CEVA Logistics, Planzer Transport AG, Galliker Transport AG, Rhenus Logistics, Frigo-Trans AG, Havi Logistics (HAVI Group), Americold Realty Trust, Lineage Logistics, Nagel-Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain market in Switzerland appears promising, driven by technological advancements and increasing demand for temperature-sensitive products. As the pharmaceutical sector continues to expand, companies are likely to invest in automation and IoT solutions to enhance efficiency. Additionally, sustainability initiatives will play a crucial role, with a focus on reducing carbon footprints and energy consumption. These trends will shape the market landscape, fostering innovation and improving service delivery in the cold chain sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Others |

| By End-User | Pharmaceuticals Biotechnology Food and Beverage Healthcare Providers Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Application | Vaccine Distribution Perishable Food Transport Clinical Trials Logistics Blood & Biologics Logistics Others |

| By Packaging Type | Insulated Containers Refrigerated Trucks Cryogenic Packaging Pallet Shippers Others |

| By Service Type | Transportation Services Warehousing Services Monitoring & Validation Services Packaging Solutions Others |

| By Temperature Range | Chilled (2°C to 8°C) Frozen (-18°C and below) Controlled Room Temperature (15°C to 25°C) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Logistics | 60 | Logistics Managers, Quality Assurance Officers |

| Agricultural Cold Storage Solutions | 50 | Supply Chain Directors, Farm Operations Managers |

| Temperature-Controlled Transportation | 40 | Fleet Managers, Distribution Coordinators |

| Cold Chain Technology Providers | 40 | Product Development Managers, Technical Sales Representatives |

| Regulatory Compliance in Cold Chain | 40 | Compliance Officers, Regulatory Affairs Managers |

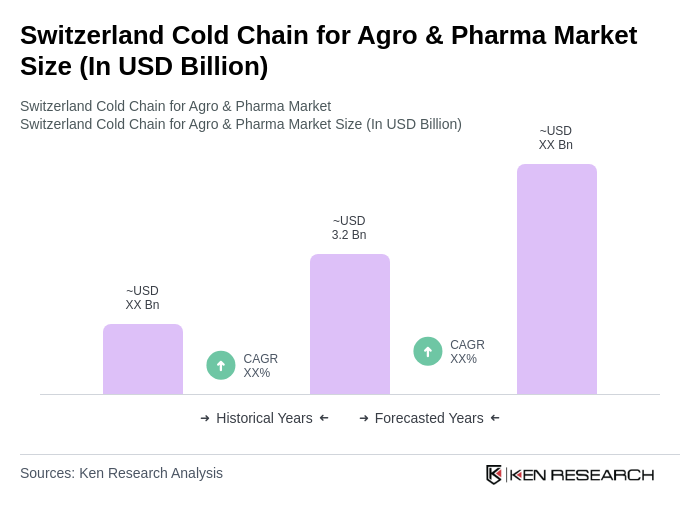

The Switzerland Cold Chain for Agro & Pharma Market is valued at approximately USD 3.2 billion. This valuation reflects the increasing demand for temperature-sensitive pharmaceuticals, biologics, and high-value food products, alongside advancements in cold chain logistics and monitoring technologies.