Region:Africa

Author(s):Rebecca

Product Code:KRAB2879

Pages:81

Published On:October 2025

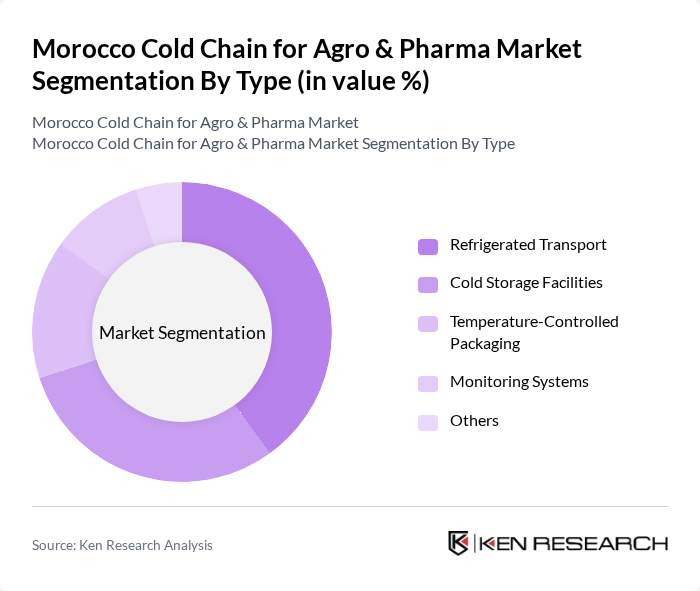

By Type:The cold chain market is segmented into various types, includingRefrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, and Others. Each of these segments plays a crucial role in maintaining the required temperature for perishable goods throughout the supply chain. Refrigerated transport leads the segment due to the need for efficient first-mile and last-mile connectivity, especially for perishable agricultural exports. Cold warehousing is rapidly expanding in urban centers, driven by demand from pharmaceuticals, modern trade retailers, and seafood exporters. Multi-temperature warehousing and digital monitoring solutions are emerging as key differentiators.

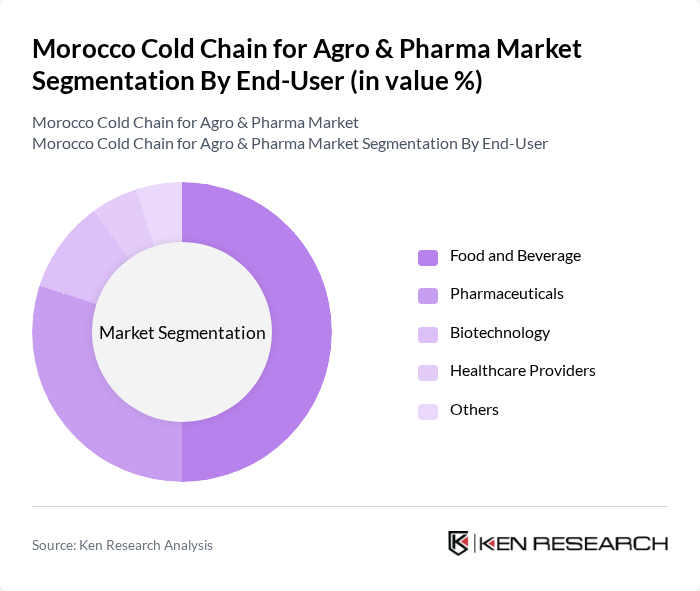

By End-User:The market is further segmented by end-users, which includeFood and Beverage, Pharmaceuticals, Biotechnology, Healthcare Providers, and Others. Each end-user category has distinct requirements for cold chain logistics, influencing the overall market dynamics. Food and beverage remains the largest segment, driven by Morocco’s agro-export sector and rising domestic demand for fresh and processed foods. Pharmaceuticals and biotechnology are rapidly growing due to stricter regulatory requirements and increased vaccine distribution.

The Morocco Cold Chain for Agro & Pharma Market is characterized by a dynamic mix of regional and international players. Leading participants such as Frigolog, Saham Logistics, STG Maroc, SJL Group, Timar, and other regional players contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain market in Morocco appears promising, driven by increasing investments in infrastructure and technology. The adoption of IoT solutions is expected to enhance operational efficiency, while the growth of e-commerce will further stimulate demand for reliable cold chain logistics. As consumer awareness of food safety and quality continues to rise, companies will need to adapt to these trends, ensuring compliance with evolving regulations and meeting the expectations of a more discerning customer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Others |

| By End-User | Food and Beverage Pharmaceuticals Biotechnology Healthcare Providers Others |

| By Application | Fresh Produce Dairy Products Vaccines and Biologics Processed Foods Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Retail Chains Others |

| By Sales Channel | Online Sales Offline Sales Wholesale Distributors Direct Sales Others |

| By Price Range | Low Price Mid Price High Price Premium Price Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Cold Storage Facilities | 85 | Facility Managers, Operations Directors |

| Pharmaceutical Distribution Centers | 65 | Supply Chain Managers, Quality Assurance Officers |

| Logistics Providers for Cold Chain | 55 | Business Development Managers, Logistics Coordinators |

| Retailers with Cold Chain Requirements | 45 | Procurement Managers, Store Operations Heads |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

The Morocco Cold Chain for Agro & Pharma Market is valued at approximately USD 420 million, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, along with advancements in logistics infrastructure and compliance with international safety standards.