Region:Europe

Author(s):Rebecca

Product Code:KRAA6865

Pages:83

Published On:September 2025

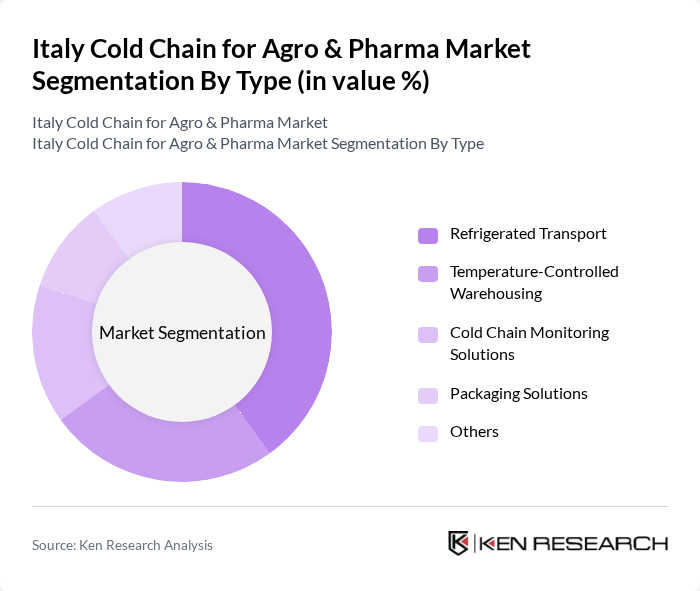

By Type:The cold chain market is segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Solutions, Packaging Solutions, and Others. Among these, Refrigerated Transport is the leading sub-segment due to the increasing demand for fresh produce and pharmaceuticals that require specific temperature conditions during transit. The rise in e-commerce and home delivery services has also contributed to the growth of this segment, as consumers expect timely and safe delivery of perishable goods.

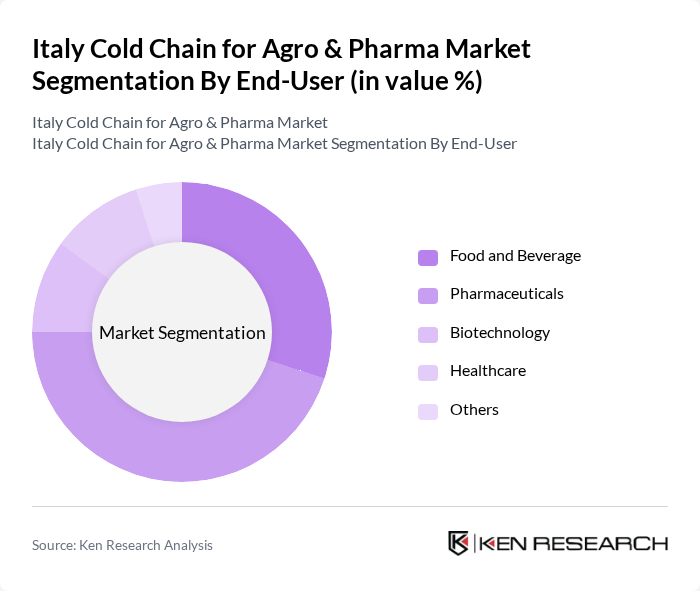

By End-User:The market is categorized by end-users, including Food and Beverage, Pharmaceuticals, Biotechnology, Healthcare, and Others. The Pharmaceuticals segment is the dominant player, driven by the increasing need for effective distribution of temperature-sensitive medications and vaccines. The COVID-19 pandemic has further highlighted the importance of a robust cold chain for pharmaceuticals, leading to increased investments in this area.

The Italy Cold Chain for Agro & Pharma Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, Lineage Logistics, Americold Logistics, Geodis, Agility Logistics, Panalpina, CEVA Logistics, UPS Supply Chain Solutions, FedEx Logistics, Maersk, DSV Panalpina, TSE Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain market in Italy appears promising, driven by technological innovations and increasing consumer demand for quality perishable goods. As the market adapts to e-commerce growth, investments in infrastructure and automation will be crucial. Additionally, sustainability practices are expected to gain traction, with companies focusing on reducing carbon footprints. The integration of advanced monitoring technologies will enhance operational efficiency, ensuring compliance with regulatory standards while meeting consumer expectations for freshness and safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Solutions Packaging Solutions Others |

| By End-User | Food and Beverage Pharmaceuticals Biotechnology Healthcare Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Packaging Type | Insulated Containers Refrigerated Trucks Temperature-Controlled Pallets Others |

| By Service Type | Transportation Services Warehousing Services Monitoring Services Others |

| By Region | Northern Italy Central Italy Southern Italy Islands |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Pharmaceutical Distribution Networks | 80 | Supply Chain Managers, Compliance Officers |

| Cold Chain Technology Providers | 60 | Product Development Managers, Sales Executives |

| Logistics Service Providers | 90 | Business Development Managers, Logistics Coordinators |

| Retail Cold Chain Operations | 70 | Store Managers, Inventory Control Specialists |

The Italy Cold Chain for Agro & Pharma Market is valued at approximately USD 8.5 billion, reflecting a significant growth driven by the increasing demand for temperature-sensitive products in both food and pharmaceutical sectors.