Region:Europe

Author(s):Rebecca

Product Code:KRAB2859

Pages:95

Published On:October 2025

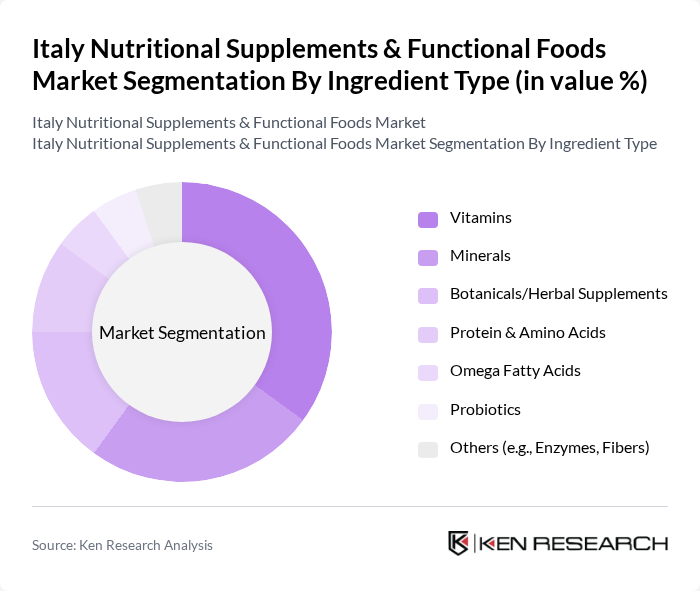

By Ingredient Type:The ingredient type segmentation includes various subsegments such as Vitamins, Minerals, Botanicals/Herbal Supplements, Protein & Amino Acids, Omega Fatty Acids, Probiotics, and Others (e.g., Enzymes, Fibers). Among these, Vitamins and Minerals are the leading subsegments, driven by their essential roles in maintaining health and preventing deficiencies. The increasing awareness of the importance of micronutrients in daily diets, especially among the aging population and those following plant-based diets, has led to a surge in demand for these products .

By Dosage Form:The dosage form segmentation includes Tablets, Capsules, Powder, Liquid, Gummies & Chewables, and Others. Tablets and Capsules dominate this segment due to their convenience and ease of consumption. The trend towards more palatable forms, such as Gummies & Chewables, is also gaining traction, particularly among younger consumers and those who may have difficulty swallowing pills. This shift reflects changing consumer preferences towards more enjoyable and accessible supplement formats .

The Italy Nutritional Supplements & Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, Nestlé S.A., Amway Corporation, Herbalife Nutrition Ltd., Glanbia plc, DSM-Firmenich, GNC Holdings, Inc., Nature's Bounty Co., Solgar Inc., Swisse Wellness Pty Ltd., Alfasigma S.p.A., ESI S.p.A., PharmaNutra S.p.A., Abbott Laboratories, USANA Health Sciences, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian nutritional supplements and functional foods market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As consumers continue to prioritize wellness, the demand for personalized and plant-based supplements is expected to rise. Additionally, advancements in technology will likely enhance product development, leading to innovative solutions that cater to diverse consumer needs. The market is poised for growth, with opportunities for brands to expand their offerings and reach new customer segments.

| Segment | Sub-Segments |

|---|---|

| By Ingredient Type | Vitamins Minerals Botanicals/Herbal Supplements Protein & Amino Acids Omega Fatty Acids Probiotics Others (e.g., Enzymes, Fibers) |

| By Dosage Form | Tablets Capsules Powder Liquid Gummies & Chewables Others |

| By Application | Sports Nutrition Weight Management Immune Support Digestive Health Bone & Joint Health Cardiovascular Health Cognitive/Mental Health General Wellness Others |

| By Distribution Channel | Pharmacies/Drugstores Health Food Stores Supermarkets/Hypermarkets Online Retail Direct Sales Others |

| By Consumer Demographics | Age Group (Infants, Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) |

| By Packaging Type | Bottles Sachets Blister Packs Bulk Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers First-Time Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Nutritional Supplements | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Insights on Functional Foods | 60 | Store Managers, Product Buyers |

| Healthcare Professionals' Perspectives | 50 | Nutritionists, Dietitians, General Practitioners |

| Market Trends in E-commerce for Health Products | 70 | E-commerce Managers, Digital Marketing Specialists |

| Regulatory Impact on Nutritional Products | 40 | Regulatory Affairs Specialists, Compliance Officers |

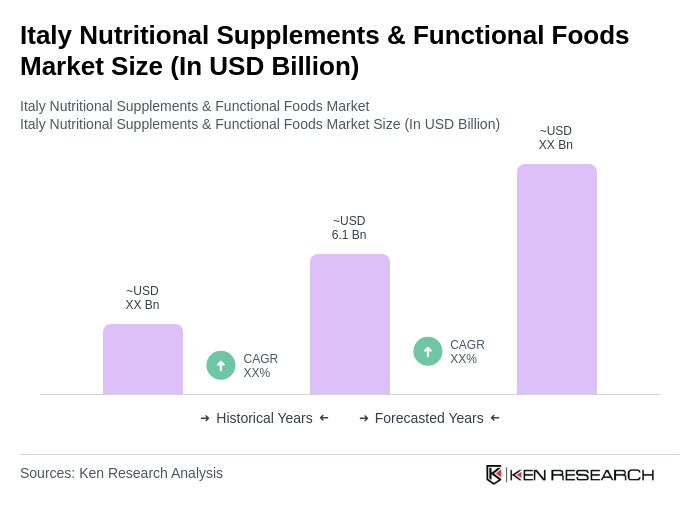

The Italy Nutritional Supplements & Functional Foods Market is valued at approximately USD 6.1 billion, reflecting a significant growth trend driven by increasing health consciousness and demand for preventive healthcare among consumers.