UAE Nutritional Supplements & Functional Foods Market Overview

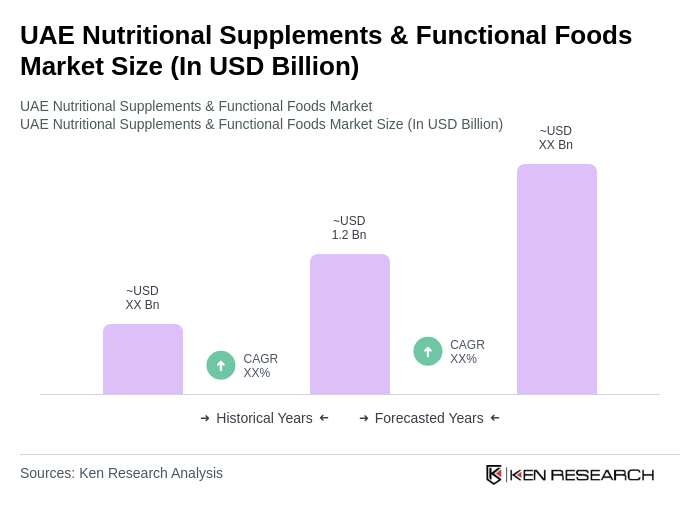

- The UAE Nutritional Supplements & Functional Foods Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rise in lifestyle-related diseases, and a growing trend towards preventive healthcare. The market has seen a significant uptick in demand for products that support overall wellness and specific health needs.

- Key cities dominating this market include Dubai and Abu Dhabi, which are known for their affluent populations and high consumer spending on health and wellness products. The presence of a diverse expatriate community also contributes to the demand for a wide range of nutritional supplements and functional foods, catering to various dietary preferences and health requirements.

- In 2023, the UAE government implemented regulations requiring all nutritional supplements to be registered with the Ministry of Health and Prevention (MoHAP) before being marketed. This regulation aims to ensure product safety, efficacy, and quality, thereby enhancing consumer trust and promoting a healthier market environment.

UAE Nutritional Supplements & Functional Foods Market Segmentation

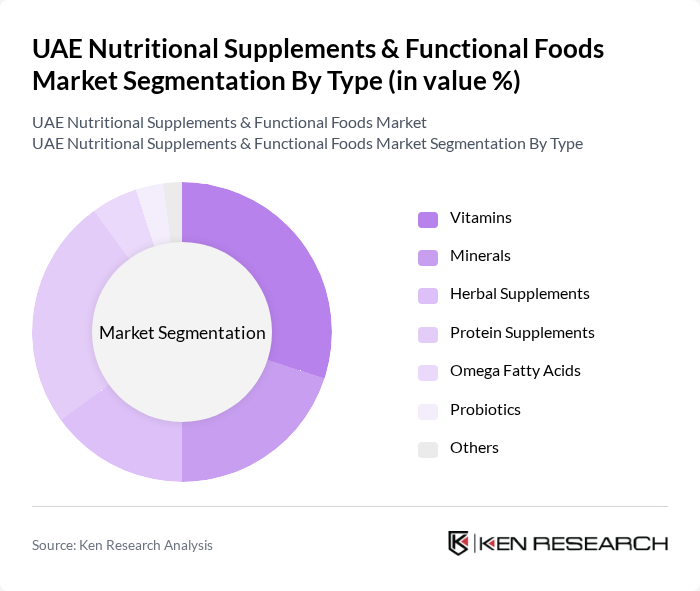

By Type:The market is segmented into various types of nutritional supplements and functional foods, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and others. Among these, vitamins and protein supplements are particularly popular due to their essential roles in health maintenance and fitness. The increasing trend of fitness and wellness among consumers has led to a surge in demand for protein supplements, especially among athletes and fitness enthusiasts.

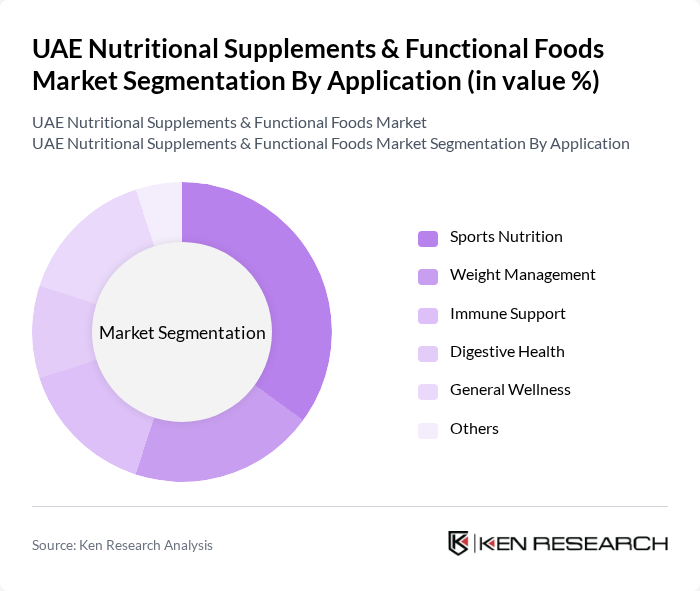

By Application:The application segment includes sports nutrition, weight management, immune support, digestive health, general wellness, and others. Sports nutrition is currently the leading application area, driven by the increasing number of fitness enthusiasts and athletes in the UAE. The growing awareness of the importance of nutrition in enhancing athletic performance has led to a significant rise in the consumption of sports nutrition products.

UAE Nutritional Supplements & Functional Foods Market Competitive Landscape

The UAE Nutritional Supplements & Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, Glanbia plc, DSM Nutritional Products, Nature's Bounty Co., Blackmores Limited, Swisse Wellness Pty Ltd., USANA Health Sciences, Inc., Herbalife Nutrition Ltd., Solgar Inc., NOW Foods, Nature's Way Products, LLC contribute to innovation, geographic expansion, and service delivery in this space.

UAE Nutritional Supplements & Functional Foods Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The UAE has witnessed a significant rise in health awareness, with 70% of the population actively seeking healthier lifestyles. This trend is supported by government initiatives promoting wellness, such as the UAE Vision 2021, which aims to enhance the health of citizens. The World Health Organization reported that the UAE's healthcare expenditure reached approximately AED 66 billion in future, reflecting a growing investment in health and wellness, driving demand for nutritional supplements and functional foods.

- Rising Demand for Preventive Healthcare:Preventive healthcare is gaining traction in the UAE, with the Ministry of Health and Prevention reporting a 30% increase in preventive health services utilization from the previous year to future. This shift is fueled by a growing awareness of chronic diseases, leading to a surge in demand for supplements that support immune health and overall well-being. The market for preventive health products is projected to reach AED 18 billion in future, indicating a robust growth trajectory.

- Growth of E-commerce Platforms:The e-commerce sector in the UAE is booming, with online retail sales projected to reach AED 25 billion in future, up from AED 18 billion in the previous year. This growth is driven by increased internet penetration, which stands at 99%, and a shift in consumer behavior towards online shopping. Nutritional supplements and functional foods are increasingly available through e-commerce platforms, making them more accessible to consumers and contributing to market expansion.

Market Challenges

- Regulatory Compliance Issues:The UAE's nutritional supplements market faces stringent regulatory compliance challenges, with over 1,200 products rejected annually due to non-compliance with local regulations. The Emirates Authority for Standardization and Metrology (ESMA) enforces strict guidelines, which can hinder market entry for new products. Companies must invest significantly in ensuring compliance, which can divert resources from innovation and marketing efforts, impacting overall market growth.

- Consumer Skepticism towards Supplements:Despite the growing market, consumer skepticism remains a significant challenge, with 45% of UAE residents expressing doubts about the efficacy of nutritional supplements. This skepticism is often fueled by misinformation and a lack of understanding of product benefits. To overcome this barrier, companies must invest in educational campaigns and transparent marketing strategies to build trust and credibility among consumers, which is essential for market growth.

UAE Nutritional Supplements & Functional Foods Market Future Outlook

The future of the UAE nutritional supplements and functional foods market appears promising, driven by increasing health consciousness and a shift towards preventive healthcare. As consumers become more informed about health benefits, the demand for innovative and personalized nutrition solutions is expected to rise. Additionally, the integration of technology in product development and marketing strategies will enhance consumer engagement, paving the way for sustainable growth in this dynamic market landscape.

Market Opportunities

- Growth in Organic and Natural Products:The demand for organic and natural nutritional supplements is on the rise, with the market for organic products projected to reach AED 6 billion in future. This trend is driven by consumer preferences for clean-label products, reflecting a shift towards healthier, environmentally friendly options. Companies that focus on organic certifications can tap into this lucrative segment, enhancing their market position.

- Development of Personalized Nutrition:Personalized nutrition is emerging as a key opportunity, with 35% of consumers expressing interest in tailored supplement solutions. The market for personalized nutrition products is expected to grow significantly, driven by advancements in technology and data analytics. Companies that leverage consumer data to offer customized products can differentiate themselves and capture a larger share of the market, meeting the evolving needs of health-conscious consumers.