Region:Asia

Author(s):Rebecca

Product Code:KRAA5849

Pages:82

Published On:September 2025

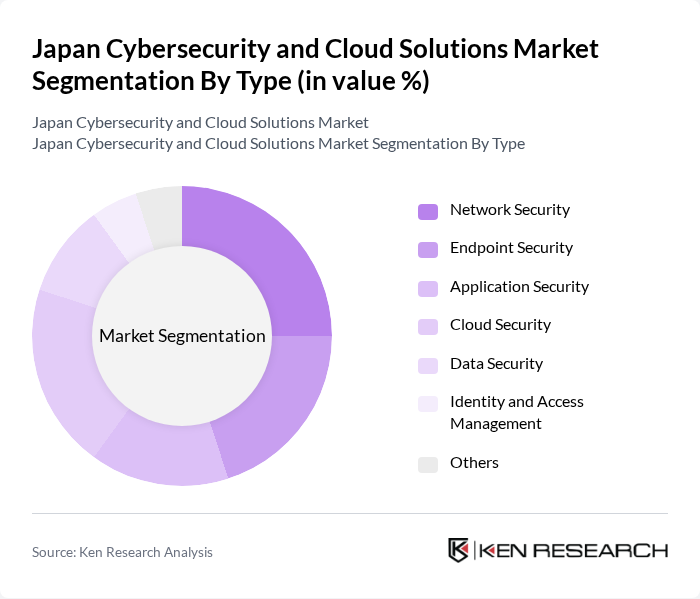

By Type:The market is segmented into various types, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these sub-segments plays a crucial role in addressing specific security needs and challenges faced by organizations.

The Network Security sub-segment is currently dominating the market due to the increasing number of cyber threats and the need for organizations to protect their networks from unauthorized access and attacks. As businesses continue to digitize their operations, the demand for robust network security solutions has surged. Endpoint Security is also gaining traction as more employees work remotely, necessitating the protection of devices accessing corporate networks. Overall, the focus on comprehensive security strategies is driving growth across all sub-segments.

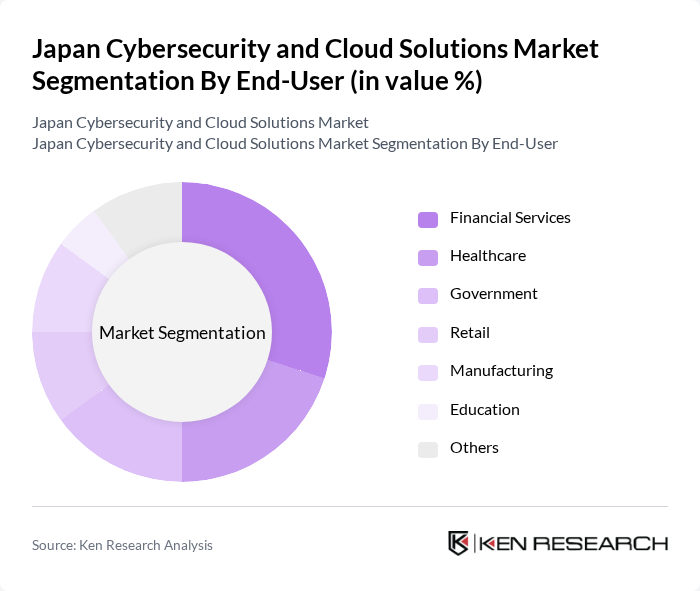

By End-User:The market is segmented by end-users, including Financial Services, Healthcare, Government, Retail, Manufacturing, Education, and Others. Each sector has unique security requirements and regulatory obligations that influence their cybersecurity and cloud solutions adoption.

The Financial Services sector is the leading end-user in the market, driven by stringent regulatory requirements and the need to protect sensitive customer data. The Healthcare sector follows closely, as it faces increasing cyber threats targeting patient information and critical systems. Government agencies are also significant users, focusing on national security and public safety. Each sector's unique challenges and compliance needs drive the demand for tailored cybersecurity and cloud solutions.

The Japan Cybersecurity and Cloud Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as NEC Corporation, Fujitsu Limited, NTT Security Corporation, Trend Micro Incorporated, Hitachi, Ltd., SoftBank Group Corp., CyberAgent, Inc., A10 Networks, Inc., Cybertrust Japan Co., Ltd., SCSK Corporation, SECOM Co., Ltd., Rakuten, Inc., IIJ (Internet Initiative Japan Inc.), Zscaler, Inc., Palo Alto Networks, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

As Japan continues to navigate the complexities of digital transformation, the cybersecurity and cloud solutions market is poised for significant evolution. The increasing integration of artificial intelligence and machine learning in security protocols will enhance threat detection and response capabilities. Additionally, the shift towards hybrid and multi-cloud environments will necessitate more sophisticated security frameworks, driving innovation and investment in the sector. Organizations will prioritize resilience and adaptability to stay ahead of emerging threats, ensuring a robust cybersecurity landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Financial Services Healthcare Government Retail Manufacturing Education Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By Service Type | Managed Services Professional Services Consulting Services Support and Maintenance Others |

| By Industry Vertical | Telecommunications Energy and Utilities Transportation and Logistics Media and Entertainment Others |

| By Security Type | Threat Intelligence Incident Response Vulnerability Management Security Information and Event Management (SIEM) Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cybersecurity Solutions | 150 | Chief Information Security Officers, IT Managers |

| Cloud Service Adoption Trends | 120 | Cloud Architects, IT Directors |

| Regulatory Compliance in Cybersecurity | 100 | Compliance Officers, Risk Management Executives |

| SME Cybersecurity Needs | 80 | Small Business Owners, IT Consultants |

| Cybersecurity Training and Awareness Programs | 70 | HR Managers, Training Coordinators |

The Japan Cybersecurity and Cloud Solutions Market is valued at approximately USD 15 billion, driven by increasing cyber threats, cloud service adoption, and regulatory compliance needs across various sectors.