Region:Asia

Author(s):Geetanshi

Product Code:KRAB1661

Pages:87

Published On:October 2025

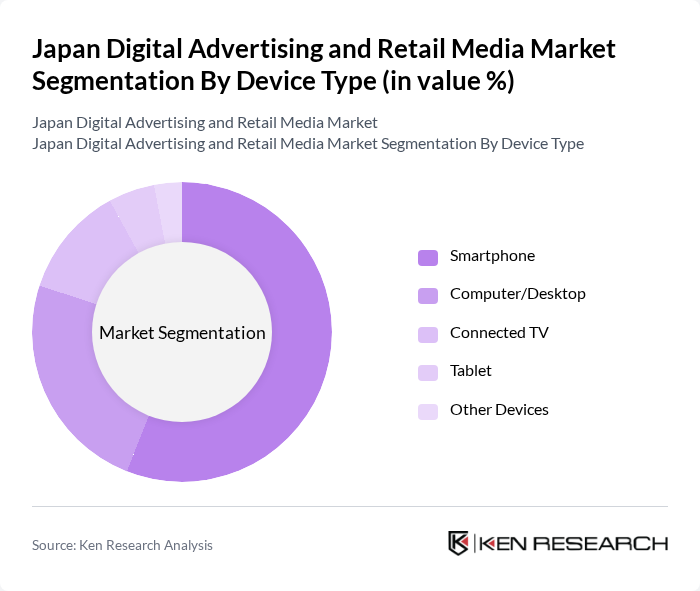

By Device Type:The market is segmented into smartphones, computers/desktops, connected TVs, tablets, and other devices. Smartphones dominate the market, accounting for the largest share due to their widespread adoption and the growing trend of mobile shopping. The convenience of accessing digital content and advertisements on-the-go has led to a significant shift in consumer behavior, making smartphones the preferred device for digital advertising. Connected TVs and tablets are also experiencing increased ad spend, driven by the popularity of streaming services and multi-device usage .

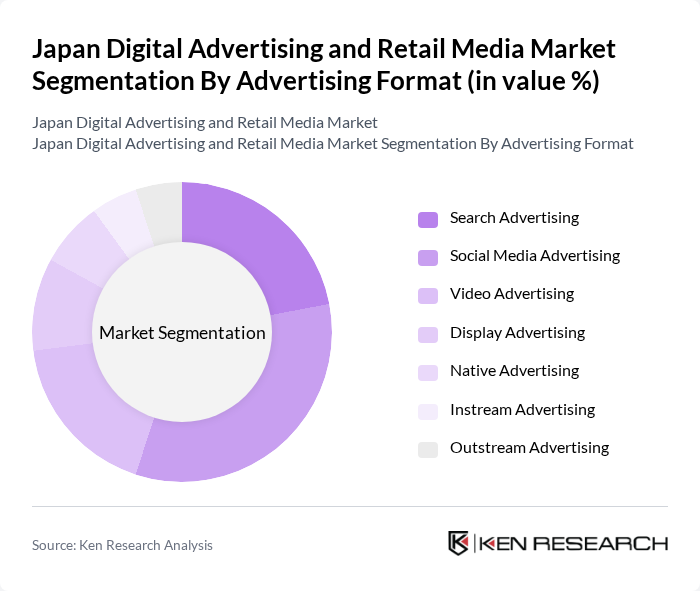

By Advertising Format:The advertising format segmentation includes search advertising, social media advertising, video advertising, display advertising, native advertising, instream advertising, and outstream advertising. Social media advertising is currently the leading format, driven by high engagement rates on platforms such as Instagram, LINE, and TikTok. Video advertising is rapidly growing, especially on YouTube and Connected TV, reflecting the shift toward immersive and interactive content. Search advertising remains a core channel, but its share is now nearly matched by social media ad spend .

The Japan Digital Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dentsu Inc., CyberAgent, Inc., Hakuhodo DY Holdings Inc., Google Japan G.K., Meta Platforms Japan, LINE Corporation, Yahoo Japan Corporation (Z Holdings), Amazon Japan G.K., Rakuten Group, Inc., ByteDance Japan, Microsoft Japan Co., Ltd., Adobe Japan, Tencent Japan, Baidu Japan, Verizon Media Japan contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's digital advertising and retail media market appears promising, driven by technological advancements and evolving consumer preferences. As mobile and e-commerce continue to grow, advertisers will increasingly leverage data analytics and AI to enhance targeting and personalization. Additionally, the integration of sustainability into marketing strategies is expected to resonate with consumers, influencing purchasing decisions. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves for sustained growth in the dynamic digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Smartphone Computer/Desktop Connected TV Tablet Other Devices |

| By Advertising Format | Search Advertising Social Media Advertising Video Advertising Display Advertising Native Advertising Instream Advertising Outstream Advertising |

| By Industry Vertical | Retail & E-commerce Automotive Consumer Electronics Food & Beverage Travel & Hospitality Healthcare & Pharmaceuticals Financial Services Telecommunications |

| By Platform Type | Social Media Platforms Search Engines Video Platforms E-commerce Platforms Mobile Apps Websites |

| By Target Demographics | Youth (18-34) Middle-aged (35-54) Silver Market (55+) Gender-based Targeting Income-based Targeting |

| By Campaign Objective | Brand Awareness Lead Generation Sales Conversion Customer Retention App Downloads |

| By Retail Media Type | Sponsored Products Sponsored Brands Display Ads on Retail Sites Video Ads on Retail Platforms Off-site Advertising |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 50 | Account Managers, Media Planners |

| Retail Chains Utilizing Digital Media | 60 | Marketing Directors, E-commerce Managers |

| Consumer Insights on Retail Media | 100 | General Consumers, Online Shoppers |

| Technology Providers in Advertising | 50 | Product Managers, Sales Executives |

| Market Analysts and Consultants | 40 | Industry Analysts, Research Directors |

The Japan Digital Advertising and Retail Media Market is valued at approximately USD 43 billion, driven by smartphone usage and the growth of e-commerce platforms, which have transformed consumer shopping behaviors significantly.