Region:Asia

Author(s):Rebecca

Product Code:KRAE2610

Pages:80

Published On:February 2026

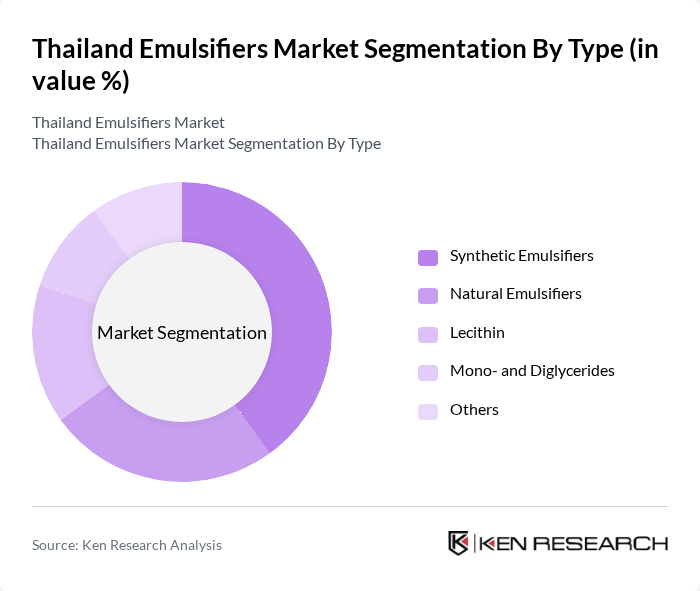

By Type:The emulsifiers market can be segmented into various types, including Synthetic Emulsifiers, Natural Emulsifiers, Lecithin, Mono- and Diglycerides, and Others. Among these, Synthetic Emulsifiers are gaining traction due to their effectiveness and cost-efficiency in food processing applications. Natural Emulsifiers are also witnessing increased demand as consumers lean towards clean-label products. Lecithin, derived from soy and egg, is widely used in the food industry for its multifunctional properties. Mono- and Diglycerides are popular for their emulsifying and stabilizing properties in baked goods and dairy products. The Others category includes various specialty emulsifiers that cater to niche applications.

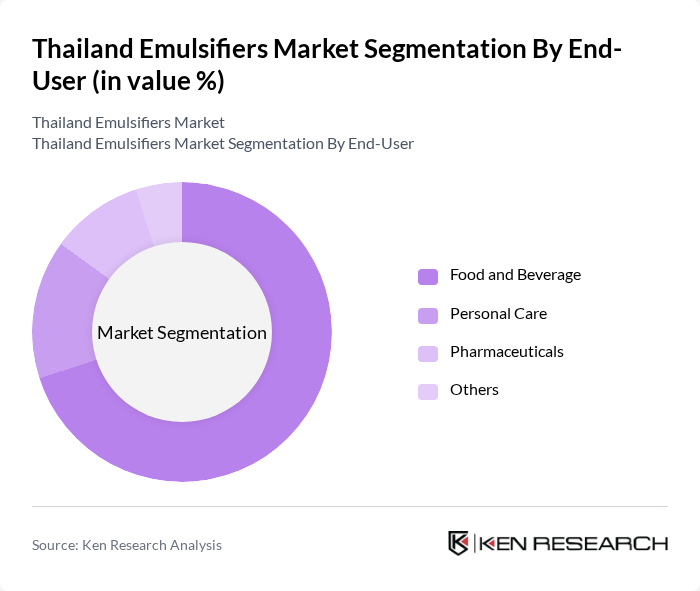

By End-User:The emulsifiers market is segmented by end-user into Food and Beverage, Personal Care, Pharmaceuticals, and Others. The Food and Beverage sector is the largest consumer of emulsifiers, driven by the increasing demand for processed foods, convenience products, and the need for improved texture and stability in food formulations. Personal Care products also utilize emulsifiers for their emulsifying and stabilizing properties in creams and lotions. The Pharmaceuticals sector employs emulsifiers in drug formulations to enhance bioavailability and stability. The Others category includes applications in various industries such as textiles and agriculture.

The Thailand Emulsifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Cargill, Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group plc, Palsgaard A/S, Wilmar International Limited, Solvay S.A., Tate & Lyle PLC, AAK AB, Evonik Industries AG, Ashland Global Holdings Inc., Fuchs Petrolub SE, Clariant AG contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand emulsifiers market is poised for significant transformation, driven by evolving consumer preferences and regulatory landscapes. The shift towards plant-based and clean label products is expected to gain momentum, with an increasing number of manufacturers exploring sustainable sourcing practices. Additionally, technological advancements in emulsification processes will likely enhance product quality and efficiency. As the market adapts to these trends, opportunities for growth and innovation will emerge, positioning Thailand as a key player in the regional emulsifiers landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Emulsifiers Natural Emulsifiers Lecithin Mono- and Diglycerides Others |

| By End-User | Food and Beverage Personal Care Pharmaceuticals Others |

| By Application | Bakery Products Dairy Products Sauces and Dressings Confectionery Others |

| By Source | Plant-based Animal-based Synthetic Others |

| By Formulation | Liquid Emulsifiers Powder Emulsifiers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Thailand Northern Thailand Southern Thailand Eastern Thailand Western Thailand |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Industry | 100 | Product Development Managers, Quality Assurance Specialists |

| Cosmetics and Personal Care | 80 | Formulators, Brand Managers |

| Pharmaceutical Applications | 60 | Regulatory Affairs Managers, R&D Scientists |

| Industrial Emulsifiers | 50 | Procurement Managers, Production Supervisors |

| Market Trends and Innovations | 70 | Market Analysts, Industry Consultants |

The Thailand Emulsifiers Market is valued at approximately USD 150 million, reflecting a steady increase driven by the growing demand for processed food products and consumer awareness regarding food quality and safety.