Region:Middle East

Author(s):Rebecca

Product Code:KRAE2612

Pages:89

Published On:February 2026

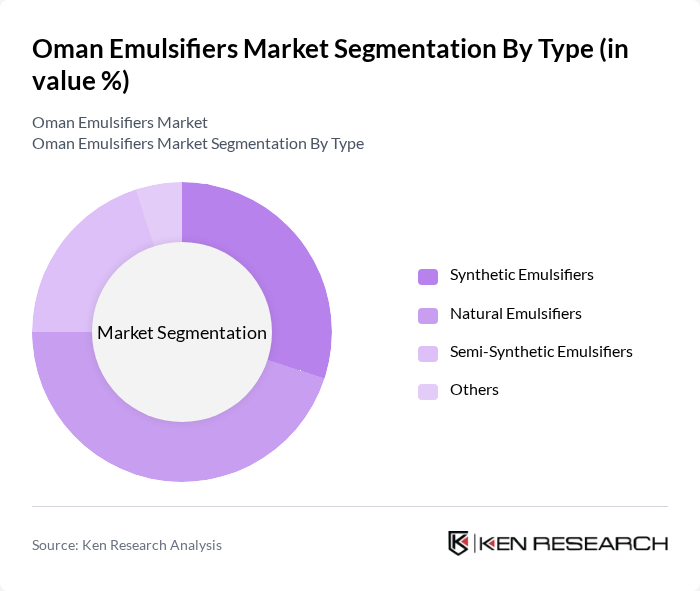

By Type:The emulsifiers market can be segmented into various types, including synthetic emulsifiers, natural emulsifiers, semi-synthetic emulsifiers, and others. Among these, natural emulsifiers are gaining significant traction due to the increasing consumer demand for clean-label products and healthier food options. Synthetic emulsifiers, while still prevalent, are facing scrutiny due to health concerns, leading to a shift towards more natural alternatives. The semi-synthetic segment is also growing as it offers a balance between performance and natural sourcing.

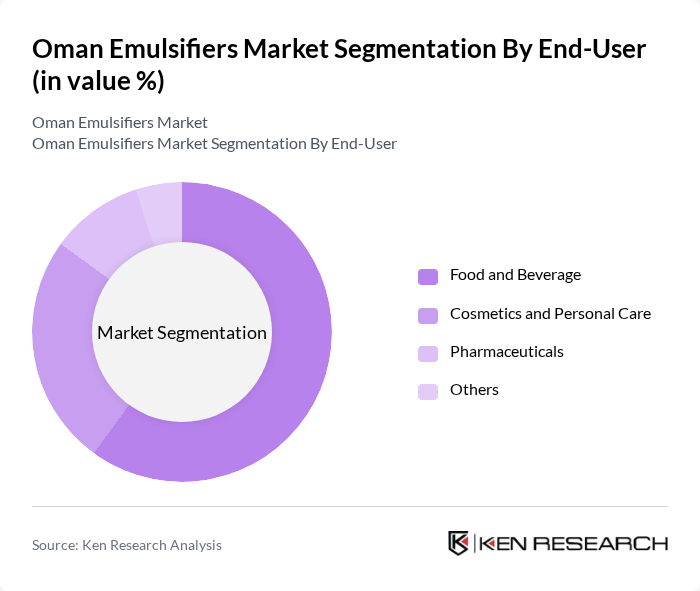

By End-User:The end-user segmentation includes food and beverage, cosmetics and personal care, pharmaceuticals, and others. The food and beverage sector is the largest consumer of emulsifiers, driven by the growing demand for processed foods and convenience products. The cosmetics and personal care segment is also expanding, as emulsifiers play a crucial role in formulating creams, lotions, and other personal care items. The pharmaceutical sector, while smaller, is witnessing increased use of emulsifiers in drug formulations.

The Oman Emulsifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Evonik Industries AG, Croda International Plc, Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group Plc, Palsgaard A/S, AAK AB, Solvay S.A., Cargill, Incorporated, Clariant AG, Mitsubishi Chemical Corporation, Stepan Company, Wilmar International Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Oman emulsifiers market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The shift towards plant-based and clean label products is expected to reshape product formulations, with manufacturers increasingly focusing on sustainable sourcing. Additionally, the integration of innovative emulsification technologies will enhance product performance and efficiency. As the market adapts to these trends, collaboration between emulsifier producers and food manufacturers will be crucial in meeting the growing demand for high-quality, safe, and effective emulsifiers.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Emulsifiers Natural Emulsifiers Semi-Synthetic Emulsifiers Others |

| By End-User | Food and Beverage Cosmetics and Personal Care Pharmaceuticals Others |

| By Application | Bakery Products Dairy Products Sauces and Dressings Others |

| By Source | Plant-Based Emulsifiers Animal-Based Emulsifiers Microbial Emulsifiers Others |

| By Formulation | Liquid Emulsifiers Powder Emulsifiers Granular Emulsifiers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Salalah Sohar Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Industry | 100 | Product Developers, Quality Assurance Managers |

| Personal Care Products | 80 | Formulation Chemists, Brand Managers |

| Pharmaceutical Applications | 70 | Regulatory Affairs Specialists, R&D Managers |

| Industrial Emulsifiers | 60 | Procurement Managers, Production Supervisors |

| Market Trends and Insights | 90 | Market Analysts, Industry Consultants |

The Oman Emulsifiers Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is largely driven by the increasing demand for emulsifiers in the food and beverage sector, particularly in bakery and dairy products.