Indonesia Emulsifiers Market Overview

- The Indonesia Emulsifiers Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for processed food products, rising health consciousness among consumers, and the expanding personal care and cosmetics industry. The emulsifiers play a crucial role in enhancing the texture, stability, and shelf life of various products, thereby boosting their market presence.

- Key cities such as Jakarta, Surabaya, and Bandung dominate the emulsifiers market due to their significant industrial activities and consumer bases. Jakarta, being the capital, serves as a hub for food processing and personal care manufacturing, while Surabaya and Bandung contribute through their growing urban populations and increasing disposable incomes, leading to higher demand for emulsified products.

- In 2023, the Indonesian government implemented regulations aimed at ensuring the safety and quality of food emulsifiers. The regulation mandates that all emulsifiers used in food products must be approved by the National Agency of Drug and Food Control (BPOM), ensuring compliance with safety standards and promoting consumer health. This initiative is part of a broader effort to enhance food safety and quality across the country.

Indonesia Emulsifiers Market Segmentation

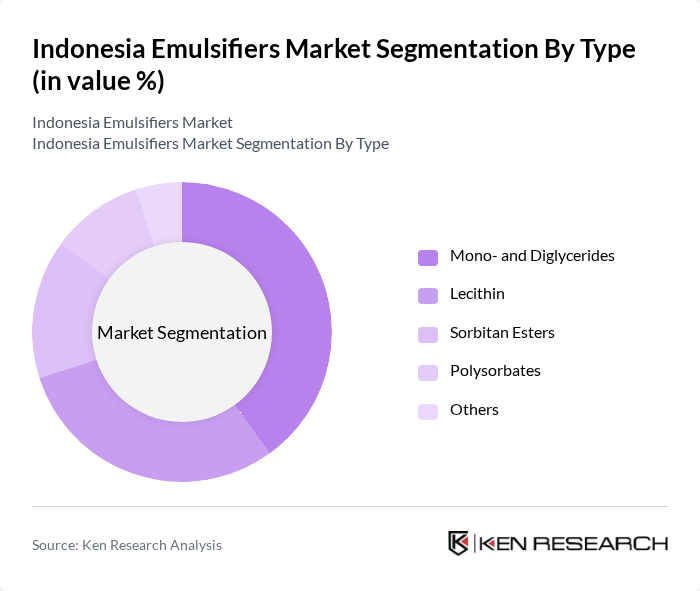

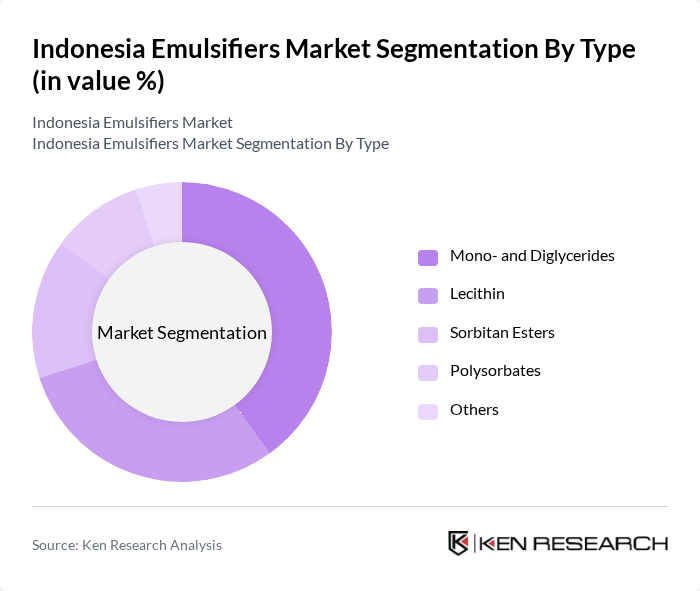

By Type:The emulsifiers market can be segmented into various types, including Mono- and Diglycerides, Lecithin, Sorbitan Esters, Polysorbates, and Others. Among these, Mono- and Diglycerides are the most dominant due to their widespread use in the food industry, particularly in baked goods and dairy products. Lecithin follows closely, favored for its natural origin and multifunctional properties in both food and personal care applications. The increasing trend towards clean label products is also driving the demand for natural emulsifiers like Lecithin.

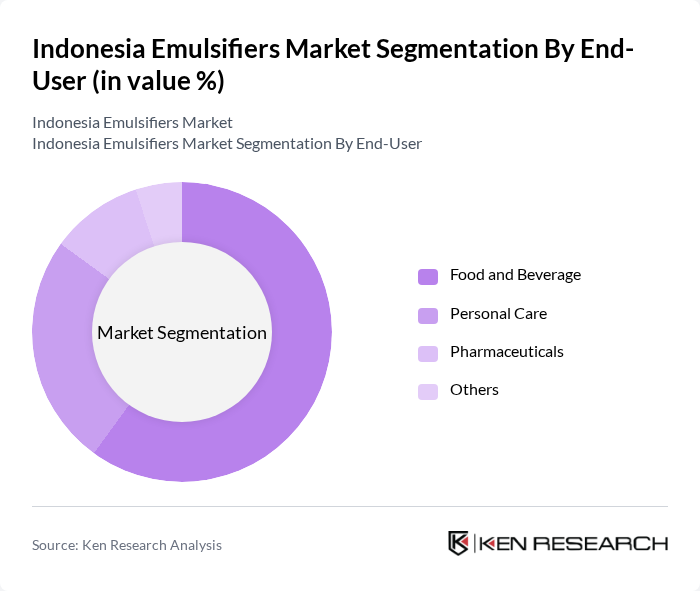

By End-User:The emulsifiers market is segmented by end-user into Food and Beverage, Personal Care, Pharmaceuticals, and Others. The Food and Beverage sector is the largest consumer of emulsifiers, driven by the growing demand for processed foods and convenience products. The Personal Care segment is also significant, as emulsifiers are essential in formulating creams, lotions, and other cosmetic products. The increasing consumer preference for high-quality and stable formulations in both sectors is propelling the growth of emulsifiers.

Indonesia Emulsifiers Market Competitive Landscape

The Indonesia Emulsifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Cargill, Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group plc, Palsgaard A/S, Wilmar International Limited, Solvay S.A., Tate & Lyle PLC, AAK AB, Evonik Industries AG, Fuchs Petrolub SE, MGP Ingredients, Inc., KMC Ingredients A/S contribute to innovation, geographic expansion, and service delivery in this space.

Indonesia Emulsifiers Market Industry Analysis

Growth Drivers

- Increasing Demand for Processed Foods:The processed food sector in Indonesia is projected to reach a value of IDR 1,200 trillion in future, driven by urbanization and changing consumer lifestyles. This surge in demand for convenience foods directly correlates with the need for emulsifiers, which enhance texture and stability. As more consumers opt for ready-to-eat meals, the emulsifiers market is expected to benefit significantly from this trend, with an estimated increase in consumption of emulsifiers by 15% annually.

- Rising Health Consciousness Among Consumers:With a growing awareness of health and nutrition, Indonesian consumers are increasingly seeking products that are low in fat and sugar. The health food market is anticipated to grow to IDR 300 trillion in future, prompting food manufacturers to incorporate emulsifiers that improve the nutritional profile of their products. This shift towards healthier options is expected to drive the demand for functional emulsifiers, which can enhance the sensory attributes of low-calorie foods.

- Expansion of the Food and Beverage Industry:The Indonesian food and beverage industry is projected to grow at a rate of 8% annually, reaching IDR 1,500 trillion in future. This expansion is fueled by increasing disposable incomes and a burgeoning middle class. As the industry grows, the demand for emulsifiers will rise, particularly in sectors such as dairy, bakery, and sauces, where emulsifiers play a crucial role in product formulation and quality enhancement.

Market Challenges

- Fluctuating Raw Material Prices:The emulsifiers market faces significant challenges due to the volatility of raw material prices, particularly for palm oil and soy derivatives, which are essential for emulsifier production. In future, palm oil prices fluctuated between IDR 10,000 and IDR 14,000 per kilogram, impacting production costs. This instability can lead to increased prices for emulsifiers, affecting profit margins and market competitiveness for manufacturers in Indonesia.

- Stringent Regulatory Compliance:The Indonesian government has implemented strict regulations regarding food safety and labeling, which pose challenges for emulsifier manufacturers. Compliance with these regulations requires significant investment in quality control and testing. In future, the cost of compliance is expected to rise by 20%, putting pressure on smaller manufacturers who may lack the resources to meet these standards, thereby limiting their market participation.

Indonesia Emulsifiers Market Future Outlook

The future of the Indonesia emulsifiers market appears promising, driven by the increasing demand for innovative food products and the shift towards healthier formulations. As consumers continue to prioritize clean label and plant-based options, manufacturers are likely to invest in research and development to create new emulsifier solutions. Additionally, the expansion into emerging markets within Southeast Asia presents significant growth potential, allowing Indonesian companies to leverage their expertise in emulsifier production to capture new customer segments.

Market Opportunities

- Growth in the Bakery and Confectionery Sector:The bakery and confectionery market in Indonesia is expected to reach IDR 200 trillion in future, creating substantial opportunities for emulsifier manufacturers. Emulsifiers are essential for improving texture and shelf life, making them critical ingredients in this sector. As consumer preferences shift towards premium baked goods, the demand for specialized emulsifiers will likely increase, enhancing market prospects.

- Development of Clean Label Products:The trend towards clean label products is gaining momentum, with consumers increasingly seeking transparency in ingredient sourcing. In future, the clean label market in Indonesia is projected to grow to IDR 100 trillion. This shift presents an opportunity for emulsifier manufacturers to innovate and develop natural emulsifiers that meet consumer demands for healthier, more transparent food options, thereby expanding their market reach.