Region:Asia

Author(s):Rebecca

Product Code:KRAE2609

Pages:84

Published On:February 2026

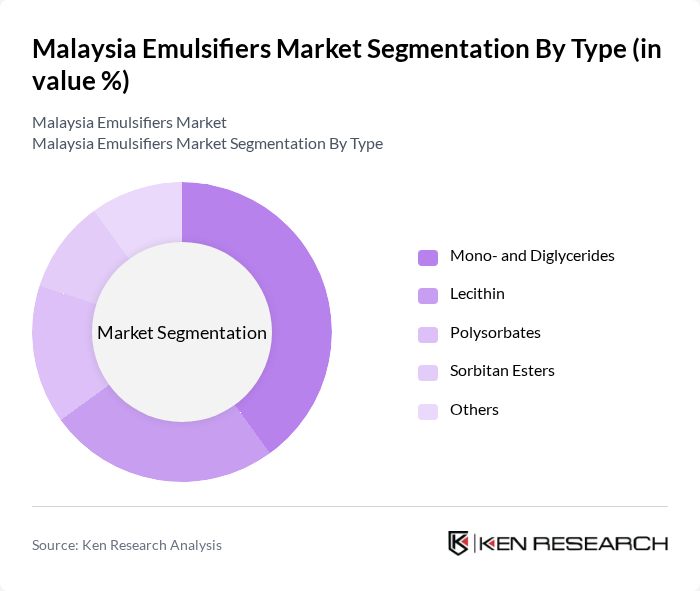

By Type:The emulsifiers market can be segmented into various types, including Mono- and Diglycerides, Lecithin, Polysorbates, Sorbitan Esters, and Others. Among these, Mono- and Diglycerides are the most widely used due to their versatility and effectiveness in food applications. They are commonly utilized in baked goods, margarine, and dairy products, making them a preferred choice for manufacturers. Lecithin, derived from soybeans and egg yolks, is also gaining traction due to its natural origin and health benefits. The increasing consumer preference for clean-label products is driving the demand for natural emulsifiers, further enhancing the market landscape.

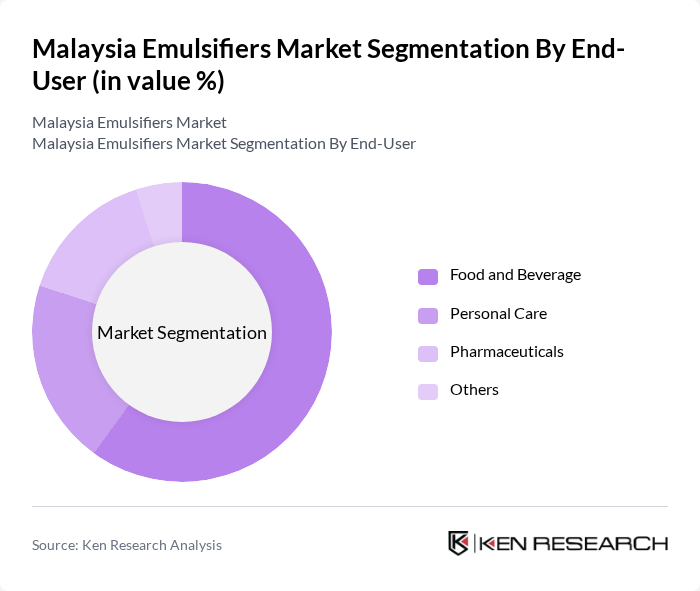

By End-User:The emulsifiers market is segmented by end-user into Food and Beverage, Personal Care, Pharmaceuticals, and Others. The Food and Beverage sector holds the largest share, driven by the increasing demand for processed and convenience foods. Emulsifiers are essential in improving the texture and stability of various food products, including sauces, dressings, and baked goods. The Personal Care segment is also witnessing growth due to the rising demand for cosmetic products that require emulsifiers for formulation stability. The trend towards natural and organic products is influencing the choice of emulsifiers, with manufacturers increasingly opting for plant-based options.

The Malaysia Emulsifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Cargill, Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group plc, Palsgaard A/S, Wilmar International Limited, Solvay S.A., AAK AB, Tate & Lyle PLC, Evonik Industries AG, Ashland Global Holdings Inc., Fuchs Petrolub SE, MÜNZING Chemie GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia emulsifiers market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for clean label and plant-based products continues to rise, manufacturers are likely to innovate their emulsifier formulations to meet these trends. Additionally, the expansion of the food and beverage sector into emerging markets presents significant growth opportunities, allowing companies to diversify their product offerings and enhance market reach while addressing sustainability concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Mono- and Diglycerides Lecithin Polysorbates Sorbitan Esters Others |

| By End-User | Food and Beverage Personal Care Pharmaceuticals Others |

| By Application | Bakery Products Dairy Products Sauces and Dressings Confectionery Others |

| By Source | Natural Emulsifiers Synthetic Emulsifiers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Northern Region Southern Region Eastern Region |

| By Product Form | Liquid Emulsifiers Powdered Emulsifiers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 150 | Product Development Managers, Quality Assurance Officers |

| Beverage Industry | 100 | Operations Managers, R&D Specialists |

| Bakery Products | 80 | Production Supervisors, Ingredient Buyers |

| Dairy Products | 70 | Technical Managers, Supply Chain Coordinators |

| Food Additives Distributors | 60 | Sales Managers, Market Analysts |

The Malaysia Emulsifiers Market is valued at approximately USD 300 million, reflecting a robust growth trajectory driven by increasing demand for processed food products and the expanding personal care and cosmetics industry.