Region:Asia

Author(s):Rebecca

Product Code:KRAE2611

Pages:83

Published On:February 2026

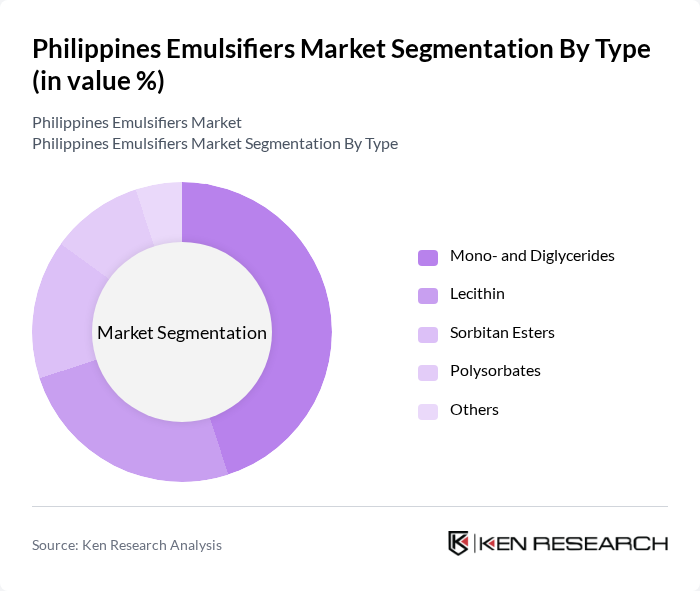

By Type:The emulsifiers market can be segmented into various types, including Mono- and Diglycerides, Lecithin, Sorbitan Esters, Polysorbates, and Others. Among these, Mono- and Diglycerides are the most widely used due to their versatility and effectiveness in various applications, particularly in the food and beverage industry. Lecithin is also gaining traction, especially in health-conscious products, as it is derived from natural sources. The demand for Sorbitan Esters and Polysorbates is growing, driven by their specific functionalities in food processing and personal care products.

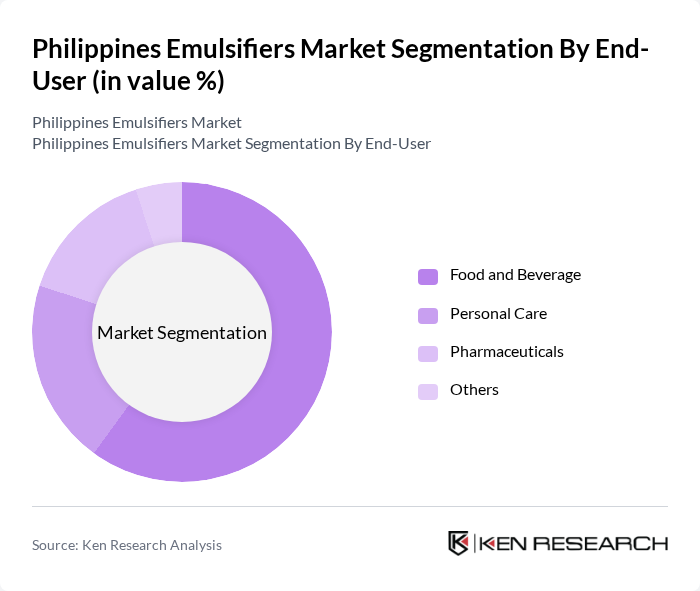

By End-User:The emulsifiers market is segmented by end-user into Food and Beverage, Personal Care, Pharmaceuticals, and Others. The Food and Beverage sector dominates the market due to the high demand for emulsifiers in various food products, including baked goods, dairy, and sauces. The Personal Care segment is also significant, as emulsifiers are essential in formulating creams, lotions, and other cosmetic products. The Pharmaceuticals sector is growing, driven by the need for emulsifiers in drug formulations.

The Philippines Emulsifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Philippines, Cargill Philippines, DuPont Nutrition & Biosciences, Kerry Group, ADM Philippines, Ingredion Philippines, Univar Solutions, Wilmar International, Palsgaard A/S, Solvay S.A., Tate & Lyle, AAK AB, Beldem S.A., Riken Vitamin Co., Ltd., KMC Ingredients contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines emulsifiers market is poised for growth, driven by increasing consumer demand for healthier and more sustainable food options. Innovations in emulsifier formulations, particularly plant-based alternatives, are expected to gain traction as consumers prioritize clean label products. Additionally, the expansion of the food and beverage industry, coupled with rising health consciousness, will likely create new opportunities for emulsifier applications across various sectors, including personal care and bakery products.

| Segment | Sub-Segments |

|---|---|

| By Type | Mono- and Diglycerides Lecithin Sorbitan Esters Polysorbates Others |

| By End-User | Food and Beverage Personal Care Pharmaceuticals Others |

| By Application | Bakery Products Dairy Products Sauces and Dressings Confectionery Others |

| By Source | Plant-Based Emulsifiers Animal-Based Emulsifiers Synthetic Emulsifiers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Formulation | Liquid Emulsifiers Powder Emulsifiers Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 150 | Product Development Managers, Quality Assurance Officers |

| Emulsifier Suppliers | 100 | Sales Managers, Technical Support Specialists |

| Food Safety Regulators | 50 | Regulatory Affairs Managers, Compliance Officers |

| Research and Development Teams | 80 | Food Scientists, Innovation Managers |

| Market Analysts and Consultants | 70 | Market Research Analysts, Industry Consultants |

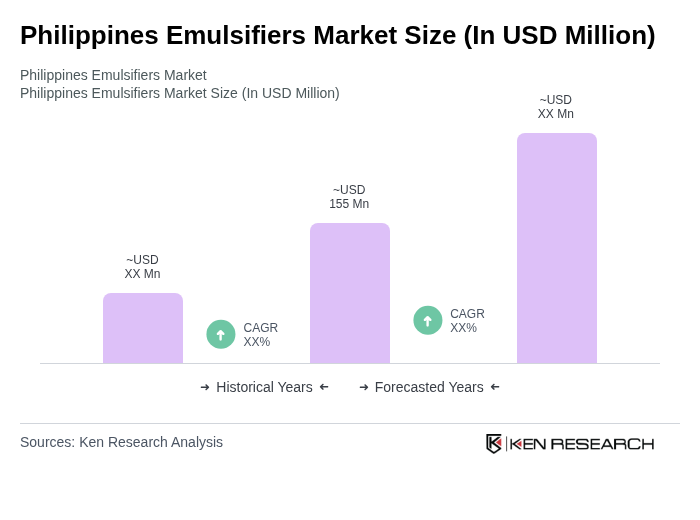

The Philippines Emulsifiers Market is valued at approximately USD 155 million, reflecting a significant growth driven by the increasing demand for processed food products and a shift towards natural emulsifiers among health-conscious consumers.