Japan Hospitality Industry Market Overview

- The Japan Hospitality Industry Market is valued at USD 24 billion, based on a five-year historical analysis. This growth is primarily driven by a resurgence in both domestic and international tourism, increased consumer spending on travel and accommodation, and the popularity of weekend cultures and staycations. The market has seen a significant recovery post-pandemic, with a notable rise in hotel occupancy rates and average daily rates, reflecting robust demand for hospitality services. Upscale and luxury hotels in Tokyo and other major cities have experienced especially strong growth in revenue per available room, driven by higher average daily rates and increased visitor numbers .

- Tokyo, Osaka, and Kyoto are the dominant cities in the Japan Hospitality Industry Market due to their rich cultural heritage, vibrant urban life, and status as major tourist destinations. These cities attract millions of visitors annually, both domestic and international, contributing to their strong market presence. The concentration of business activities, international events, and large-scale exhibitions in these urban centers further enhances their appeal to travelers .

- In response to the COVID-19 pandemic, the Japanese government has implemented regulations and guidelines to enhance the quality of hospitality services. These measures require all hotels and accommodation providers to adhere to strict hygiene and safety standards, aiming to boost consumer confidence and ensure a safe environment for both guests and staff. This regulatory initiative continues to support the recovery and resilience of the hospitality sector .

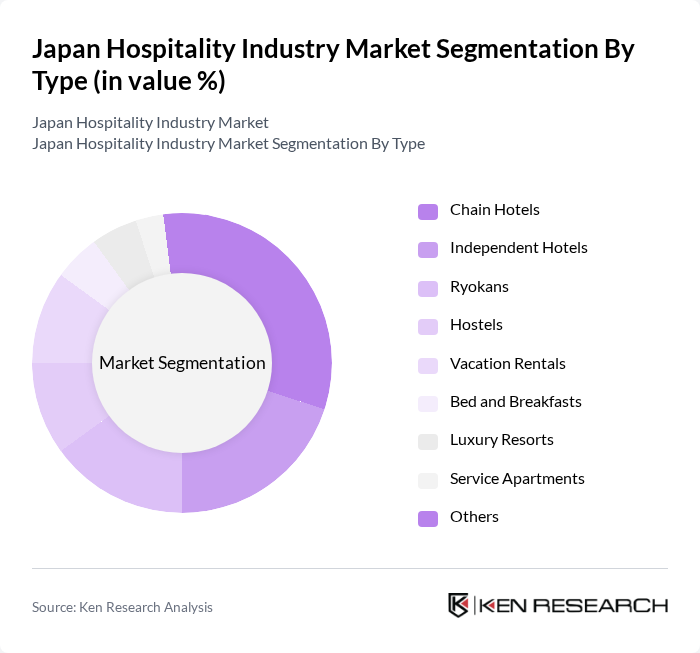

Japan Hospitality Industry Market Segmentation

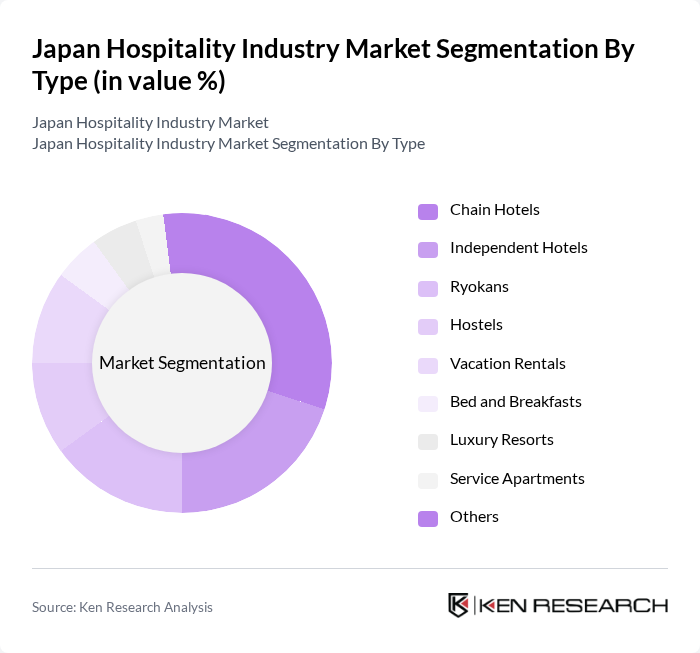

By Type:This segmentation includes a diverse range of accommodations available in the market, such as chain hotels, independent hotels, ryokans (traditional Japanese inns), hostels, vacation rentals, bed and breakfasts, luxury resorts, serviced apartments, and others. Each type addresses specific consumer preferences, including demand for cultural experiences, affordability, convenience, and luxury. The rise of unique and personalized accommodation experiences, such as boutique hotels and traditional ryokans, reflects evolving traveler expectations and contributes to the overall diversity of the hospitality landscape .

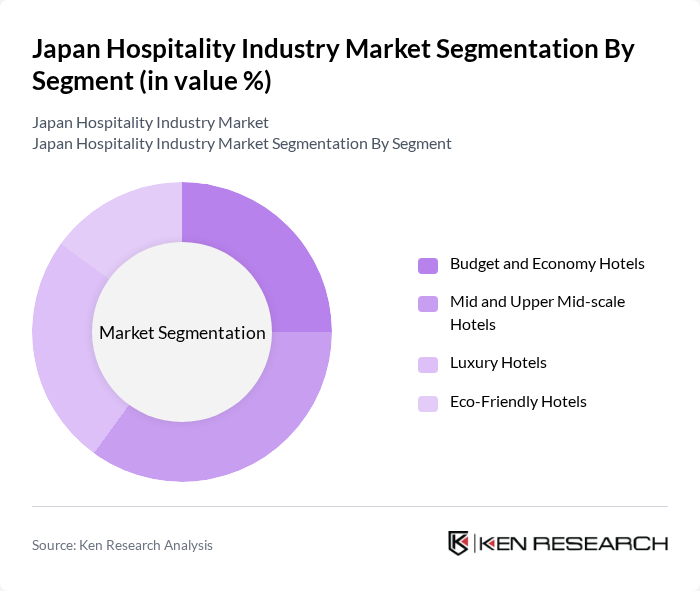

By Segment:This segmentation categorizes accommodations based on their market positioning, including budget and economy hotels, mid and upper mid-scale hotels, luxury hotels, and eco-friendly hotels. Each segment targets specific customer demographics and preferences, such as affordability, comfort, premium experiences, and sustainability. The increasing demand for eco-friendly and sustainable accommodation options reflects a broader industry shift towards responsible tourism and green practices .

Japan Hospitality Industry Market Competitive Landscape

The Japan Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as APA Group, Hoshino Resorts Inc., Prince Hotels, Inc., Hotel Okura Co., Ltd., Fujita Kanko Inc., Mitsui Fudosan Hotel Management Co., Ltd., Tokyu Hotels Co., Ltd., JR-East Hotels (East Japan Railway Company), Hilton Japan, Marriott International Japan, Hyatt Hotels Corporation Japan, InterContinental Hotels Group Japan, AccorHotels Japan, The Peninsula Tokyo, and The Tokyo Station Hotel contribute to innovation, geographic expansion, and service delivery in this space.

Japan Hospitality Industry Market Industry Analysis

Growth Drivers

- Increase in Domestic Tourism:In future, Japan's domestic tourism is projected to reach approximately 500 million trips, driven by a growing interest in local travel experiences. The government has invested around ¥1 trillion (approximately $9 billion) to promote regional tourism, enhancing infrastructure and accessibility. This surge in domestic travel is expected to significantly boost hotel occupancy rates, with an average increase of 10% in bookings across various accommodation types, benefiting the hospitality sector immensely.

- Rise in International Visitors:Japan anticipates welcoming over 30 million international tourists in future, a substantial increase from previous years. This growth is fueled by the easing of travel restrictions and the country's appeal as a cultural and culinary destination. The tourism sector is projected to generate ¥4 trillion (approximately $36 billion) in revenue, leading to increased demand for hotels and services, particularly in urban areas like Tokyo and Osaka, where international visitors predominantly stay.

- Growth of Online Booking Platforms:The online travel booking market in Japan is expected to exceed ¥2 trillion (approximately $18 billion) in future, reflecting a shift in consumer behavior towards digital solutions. With over 70% of travelers preferring online platforms for reservations, hotels are increasingly adopting these technologies to enhance customer experience. This trend is expected to streamline operations and improve occupancy rates, as hotels can reach a broader audience through digital marketing strategies.

Market Challenges

- Labor Shortages:The hospitality industry in Japan faces a significant labor shortage, with an estimated deficit of 300,000 workers in future. This shortage is exacerbated by an aging population and declining birth rates, leading to increased competition for skilled labor. As a result, many hotels are struggling to maintain service quality, which could negatively impact customer satisfaction and overall industry growth if not addressed through effective recruitment strategies and training programs.

- High Operational Costs:Operational costs for hotels in Japan are projected to rise by 15% in future, driven by increased utility prices and labor expenses. The average cost per room is expected to reach ¥15,000 (approximately $135), putting pressure on profit margins. Hotels must find innovative ways to manage these costs while maintaining service quality, which may involve investing in energy-efficient technologies and optimizing staffing levels to remain competitive in the market.

Japan Hospitality Industry Market Future Outlook

The Japan hospitality industry is poised for a transformative phase, driven by evolving consumer preferences and technological advancements. As the market adapts to the increasing demand for personalized experiences and sustainable practices, hotels will likely invest in innovative solutions to enhance guest satisfaction. Additionally, the integration of smart technologies will streamline operations, making the industry more resilient to challenges. Overall, the focus on quality service and sustainability will shape the future landscape of hospitality in Japan.

Market Opportunities

- Development of Eco-Friendly Hotels:The demand for eco-friendly accommodations is rising, with an estimated 25% of travelers prioritizing sustainability in their choices. Hotels that adopt green practices can attract this demographic, potentially increasing their market share. By investing in renewable energy and sustainable materials, properties can enhance their appeal and contribute positively to environmental conservation efforts.

- Integration of Technology in Services:The integration of technology, such as AI and IoT, presents a significant opportunity for hotels to enhance guest experiences. In future, hotels that implement smart room technologies can expect a 20% increase in customer satisfaction ratings. This technological advancement not only streamlines operations but also provides personalized services, making it a crucial area for investment in the hospitality sector.