Region:Asia

Author(s):Rebecca

Product Code:KRAB1821

Pages:81

Published On:October 2025

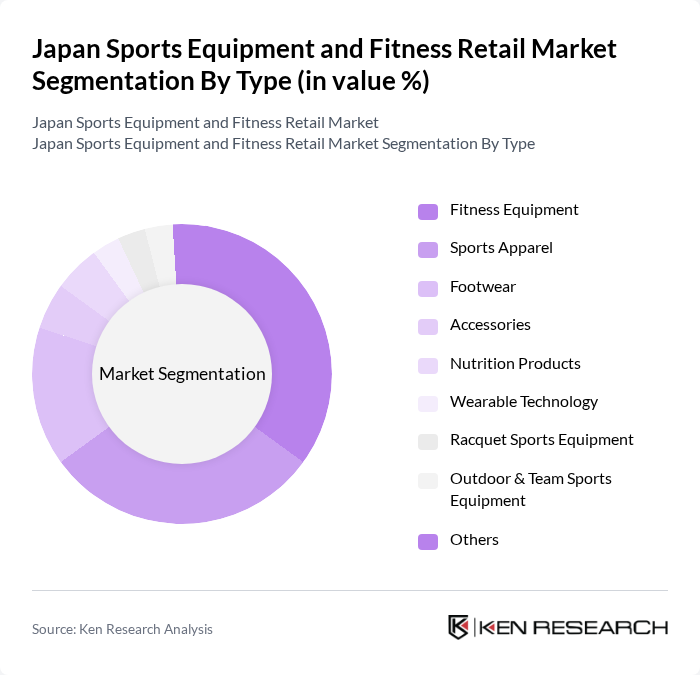

By Type:The market is segmented into fitness equipment, sports apparel, footwear, accessories, nutrition products, wearable technology, racquet sports equipment, outdoor & team sports equipment, and others. Fitness equipment and sports apparel are the leading segments, propelled by the growing number of fitness enthusiasts, the rise of athleisure wear, and the integration of smart technology in product offerings. Demand for innovative, high-quality, and performance-oriented products continues to rise, reflecting evolving consumer preferences for both home and commercial fitness solutions .

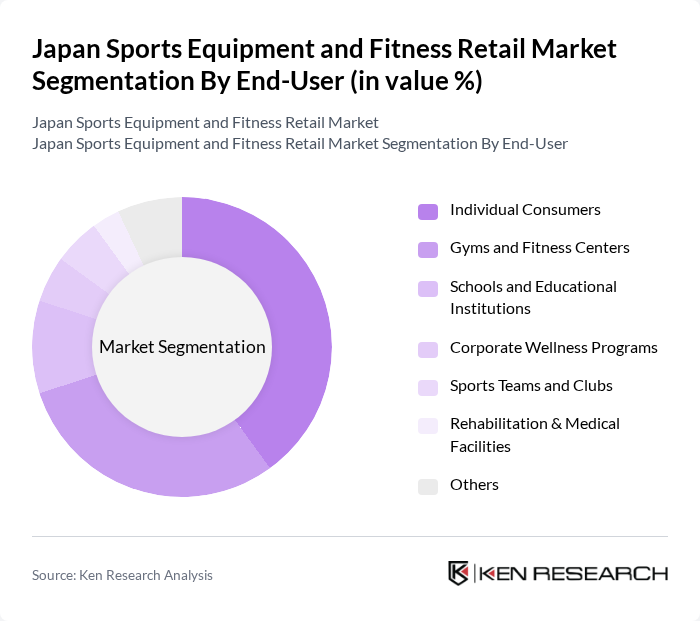

By End-User:The end-user segmentation includes individual consumers, gyms and fitness centers, schools and educational institutions, corporate wellness programs, sports teams and clubs, rehabilitation & medical facilities, and others. Individual consumers and gyms and fitness centers dominate this segment, driven by the growing trend of personal fitness, the proliferation of fitness facilities, and the adoption of digital fitness platforms. Schools and educational institutions also contribute significantly, reflecting government initiatives to promote youth sports participation .

The Japan Sports Equipment and Fitness Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as ASICS Corporation, Mizuno Corporation, Yonex Co., Ltd., Descente Ltd., Nike, Inc., Adidas AG, Under Armour, Inc., PUMA SE, New Balance Athletics, Inc., Columbia Sportswear Company, The North Face (VF Corporation), Reebok International Ltd., Oakley, Inc., Salomon S.A., Wilson Sporting Goods Co., NISHOHI, Bridgestone Corporation, Dunlop Sports Co., Ltd., Tachikara, Head N.V., Tecnifibre, Oliver Sports & Squash GmbH, Babolat, Solinco, Volkl International GmbH, XIOM Co., Ltd., Seino Logix Co., Ltd., Molax Line Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan sports equipment and fitness retail market appears promising, driven by ongoing trends in health and wellness. As the population continues to embrace fitness, innovations in technology and personalized products are expected to gain traction. Additionally, the integration of digital platforms will enhance consumer engagement, while the focus on sustainability will shape product offerings. Companies that adapt to these trends will likely thrive in this evolving landscape, ensuring long-term growth and market relevance.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Footwear Accessories Nutrition Products Wearable Technology Racquet Sports Equipment Outdoor & Team Sports Equipment Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Educational Institutions Corporate Wellness Programs Sports Teams and Clubs Rehabilitation & Medical Facilities Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Direct Sales Distributors Specialty Sports Stores Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Brand Type | Domestic Brands International Brands Private Labels Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Others |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports Equipment Retailers | 120 | Store Managers, Sales Representatives |

| Fitness Center Operators | 85 | Gym Owners, Fitness Program Directors |

| Consumer Insights on Sports Apparel | 95 | Active Lifestyle Consumers, Sports Enthusiasts |

| Market Trends in Home Fitness Equipment | 70 | Home Gym Users, Fitness Equipment Purchasers |

| Trends in E-commerce for Sports Products | 75 | E-commerce Managers, Digital Marketing Specialists |

The Japan Sports Equipment and Fitness Retail Market is valued at approximately USD 16 billion, reflecting a significant share of about 17% of the Asia Pacific sports equipment market, driven by increasing health consciousness and fitness trends among consumers.