Region:Asia

Author(s):Rebecca

Product Code:KRAA0380

Pages:90

Published On:August 2025

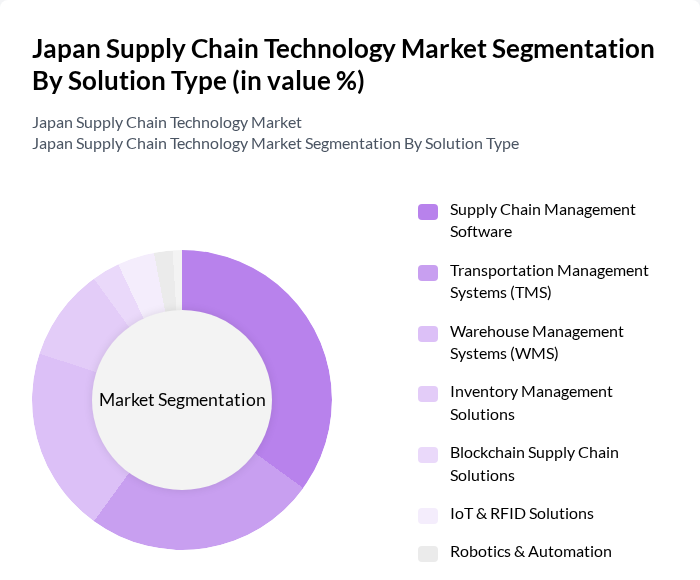

By Solution Type:The solution type segmentation includes various subsegments that address different aspects of supply chain management. The leading subsegment is Supply Chain Management Software, which is essential for businesses to streamline operations, improve end-to-end visibility, and enable data-driven decision-making. Other notable subsegments include Transportation Management Systems (TMS) and Warehouse Management Systems (WMS), which are increasingly adopted due to the expansion of e-commerce, the need for efficient logistics, and the growing importance of last-mile delivery. Inventory Management Solutions, Blockchain Supply Chain Solutions, IoT & RFID Solutions, and Robotics & Automation are also gaining traction as companies seek to optimize inventory, enhance transparency, and automate repetitive tasks .

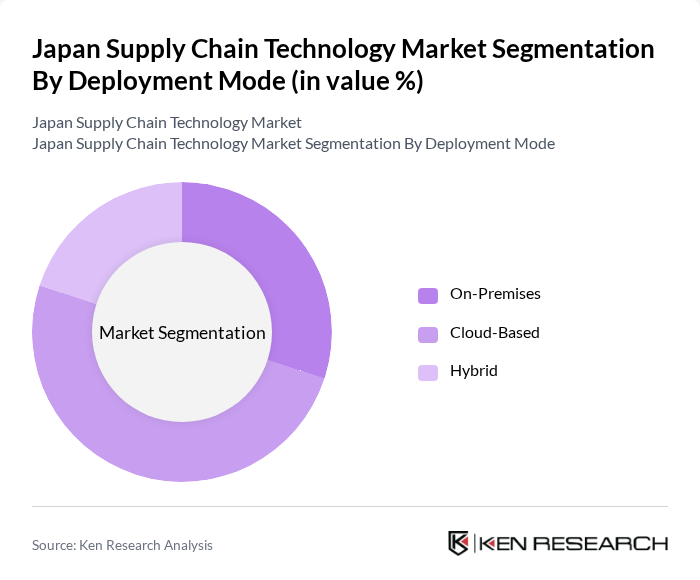

By Deployment Mode:The deployment mode segmentation includes On-Premises, Cloud-Based, and Hybrid solutions. Cloud-Based deployment is currently leading the market due to its flexibility, scalability, and cost-effectiveness, making it an attractive option for businesses of all sizes. On-Premises solutions remain significant, particularly among large enterprises that require greater control over their data and systems, while Hybrid models are adopted for balancing security and scalability .

The Japan Supply Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Tsusho Corporation, Hitachi Transport System, Ltd., Nippon Express Holdings, Inc., Yusen Logistics Co., Ltd., Kintetsu World Express, Inc., Daifuku Co., Ltd., Panasonic Connect Co., Ltd., Fujitsu Limited, NEC Corporation, SoftBank Robotics Corp., Rakuten, Inc., Yamato Holdings Co., Ltd., Seino Holdings Co., Ltd., Sagawa Express Co., Ltd., and Marubeni Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan supply chain technology market is poised for transformative growth, driven by advancements in digitalization and automation. Companies are increasingly adopting integrated solutions that leverage real-time data analytics and IoT technologies to enhance operational efficiency. Additionally, the focus on sustainability and green supply chain practices is expected to shape investment strategies, as businesses seek to align with environmental regulations and consumer preferences for eco-friendly operations. This evolving landscape presents both challenges and opportunities for stakeholders in the industry.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Supply Chain Management Software Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Inventory Management Solutions Blockchain Supply Chain Solutions IoT & RFID Solutions Robotics & Automation Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Industry Vertical | Retail & E-commerce Manufacturing Automotive Food & Beverage Healthcare & Pharmaceuticals Electronics Others |

| By Region | Kanto Kansai Chubu Kyushu Others |

| By Policy Support | Government Grants Tax Incentives Subsidies for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Technology | 70 | Supply Chain Managers, IT Directors |

| Retail Technology Adoption | 50 | Operations Managers, E-commerce Directors |

| Logistics Automation Solutions | 40 | Logistics Coordinators, Technology Officers |

| Cold Chain Management Technologies | 40 | Warehouse Managers, Quality Assurance Heads |

| Supply Chain Sustainability Initiatives | 50 | Sustainability Managers, Compliance Officers |

The Japan Supply Chain Technology Market is valued at approximately USD 1.9 billion, driven by the demand for efficient logistics solutions, e-commerce growth, and advancements in technologies like IoT and AI that enhance operational efficiency and decision-making.