Region:Africa

Author(s):Dev

Product Code:KRAB4333

Pages:93

Published On:October 2025

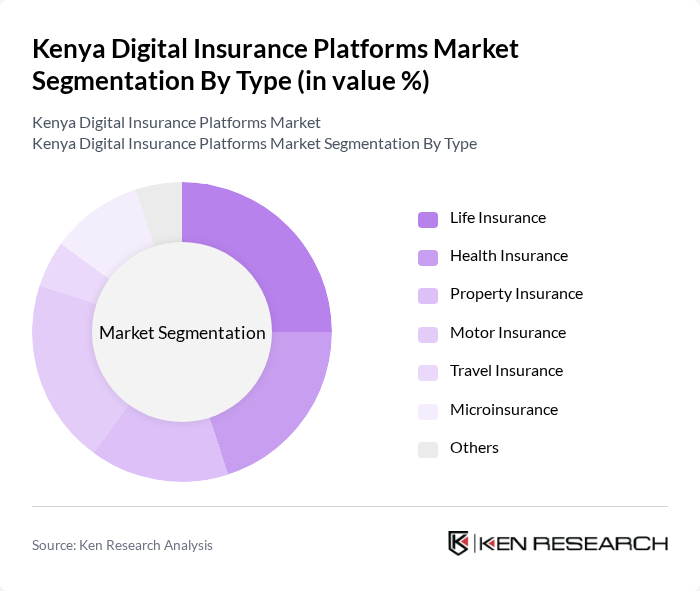

By Type:The market is segmented into various types of insurance products, including Life Insurance, Health Insurance, Property Insurance, Motor Insurance, Travel Insurance, Microinsurance, and Others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth.

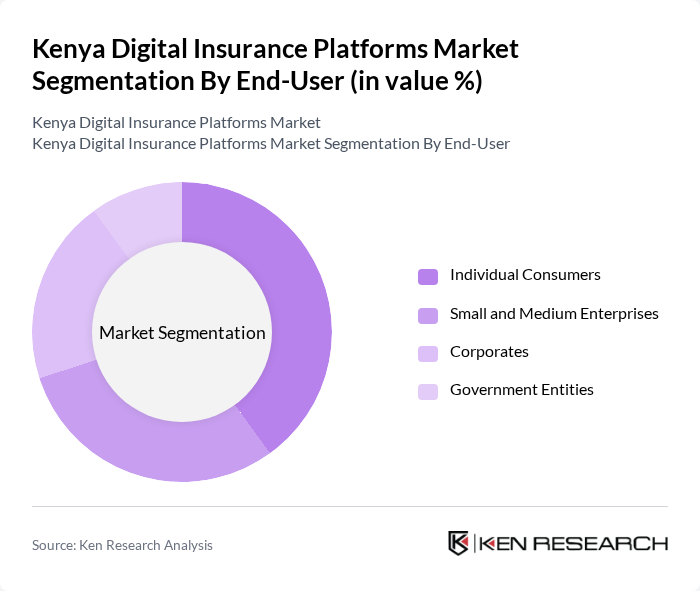

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Each segment has distinct requirements and purchasing behaviors, influencing the types of digital insurance products they prefer.

The Kenya Digital Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jubilee Insurance, Britam Insurance, Sanlam Kenya, CIC Insurance Group, Old Mutual Kenya, AAR Insurance, UAP Old Mutual, MicroEnsure, Takaful Insurance of Africa, Madison Insurance, Heritage Insurance, First Assurance, Amaco Insurance, Phoenix Assurance, Kenindia Assurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of Kenya's digital insurance platforms is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As mobile-first solutions gain traction, insurers will increasingly leverage artificial intelligence and machine learning to enhance customer experiences. Additionally, the rise of peer-to-peer insurance models is expected to reshape traditional insurance paradigms, fostering greater collaboration among users. These trends will likely lead to more personalized and accessible insurance offerings, catering to the diverse needs of the Kenyan population.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Motor Insurance Travel Insurance Microinsurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises Corporates Government Entities |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Payment Method | One-Time Payment Installment Payments |

| By Customer Segment | Urban Customers Rural Customers |

| By Policy Type | Comprehensive Policies Basic Policies Customizable Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Adoption | 150 | Health Insurance Managers, Digital Product Developers |

| Microinsurance Product Awareness | 100 | Community Leaders, Microfinance Institution Representatives |

| Consumer Preferences in Digital Insurance | 120 | Policyholders, Potential Customers |

| Regulatory Impact on Digital Insurance | 80 | Insurance Regulators, Compliance Officers |

| Technological Innovations in Insurance | 90 | IT Managers, Digital Transformation Officers |

The Kenya Digital Insurance Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digital technology adoption, smartphone penetration, and heightened awareness of insurance among the population.