Region:Middle East

Author(s):Rebecca

Product Code:KRAC1181

Pages:92

Published On:October 2025

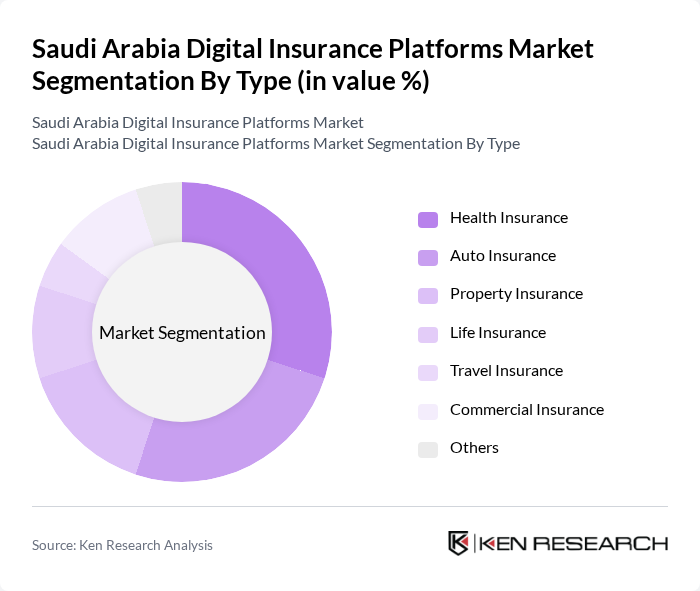

By Type:The market is segmented into Health Insurance, Auto Insurance, Property Insurance, Life Insurance, Travel Insurance, Commercial Insurance, and Others. Among these, Health Insurance and Auto Insurance are the most prominent segments. Health Insurance leads due to compulsory and employer-mandated coverage, regulatory pressure, and the expansion of digital health platforms. Auto Insurance is driven by the growing number of vehicles, adoption of telematics, and regulatory requirements for motor coverage. Property and Commercial Insurance segments are expanding as businesses seek comprehensive risk management solutions, while Life and Travel Insurance segments benefit from rising consumer awareness and increased travel activity .

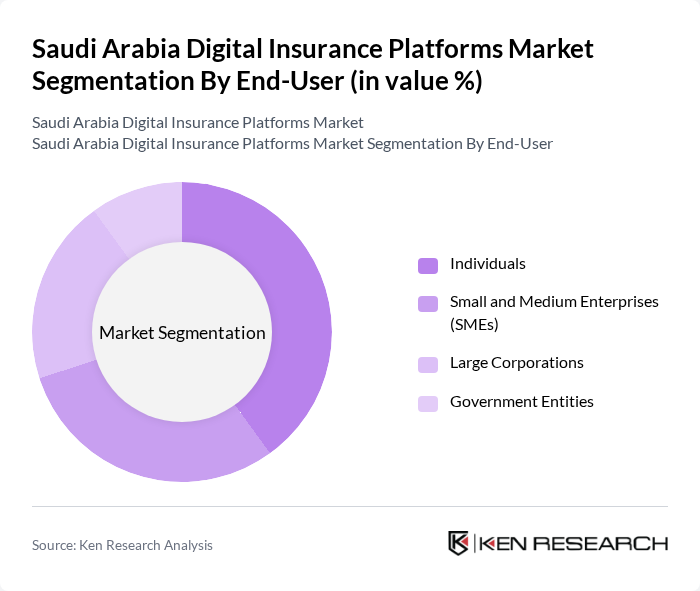

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individuals represent the largest segment, driven by increasing awareness of personal insurance needs, regulatory mandates for health and auto insurance, and the convenience of digital platforms. SMEs are a significant segment, seeking affordable and customizable insurance solutions to protect their businesses and comply with regulatory requirements. Large Corporations and Government Entities continue to drive demand for comprehensive risk management and group insurance products .

The Saudi Arabia Digital Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Al Rajhi Takaful, Gulf Insurance Group (GIG Saudi), Allianz Saudi Fransi, Medgulf, Alinma Tokio Marine, United Cooperative Assurance (UCA), Walaa Cooperative Insurance Co., Al-Etihad Cooperative Insurance Co., Aljazira Takaful Taawuni Co., Al Sagr Cooperative Insurance Co., Malath Cooperative Insurance Co., Arabian Shield Cooperative Insurance Co., Solidarity Saudi Takaful Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital insurance market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As insurers increasingly adopt artificial intelligence and big data analytics, personalized insurance offerings are expected to become more prevalent. Additionally, the integration of blockchain technology is anticipated to enhance transparency and security in transactions, further boosting consumer confidence. These trends indicate a robust growth trajectory for digital insurance platforms in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Auto Insurance Property Insurance Life Insurance Travel Insurance Commercial Insurance Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Product Offering | Standard Insurance Products Customized Insurance Solutions Bundled Insurance Packages |

| By Customer Segment | Retail Customers Corporate Clients High Net-Worth Individuals |

| By Technology Utilization | AI-Driven Solutions Blockchain Applications Big Data Analytics |

| By Policy Type | Annual Policies Monthly Policies Pay-Per-Use Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Digital Platforms | 100 | Product Managers, Marketing Directors |

| Auto Insurance Digital Solutions | 80 | Operations Managers, Customer Experience Leads |

| Property Insurance Digital Offerings | 60 | Underwriters, Sales Executives |

| Consumer Adoption of Digital Insurance | 100 | End-users, Insurance Policyholders |

| Regulatory Impact on Digital Insurance | 40 | Compliance Officers, Legal Advisors |

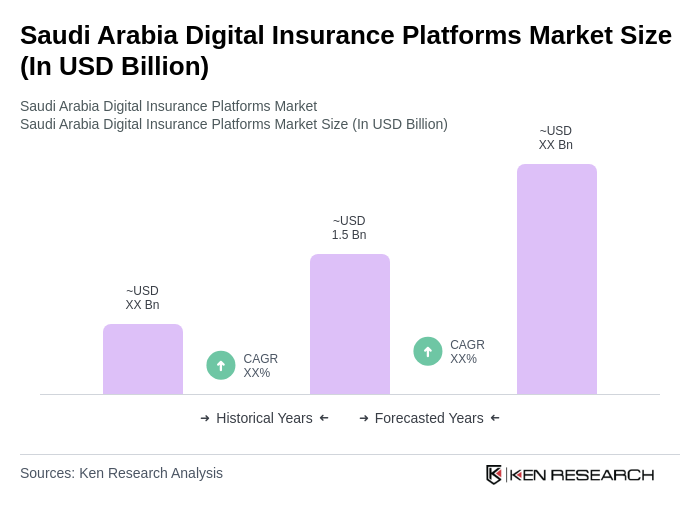

The Saudi Arabia Digital Insurance Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by digital technology adoption, consumer demand for personalized solutions, and government initiatives for digital transformation in the financial sector.