Region:Middle East

Author(s):Rebecca

Product Code:KRAC1129

Pages:86

Published On:October 2025

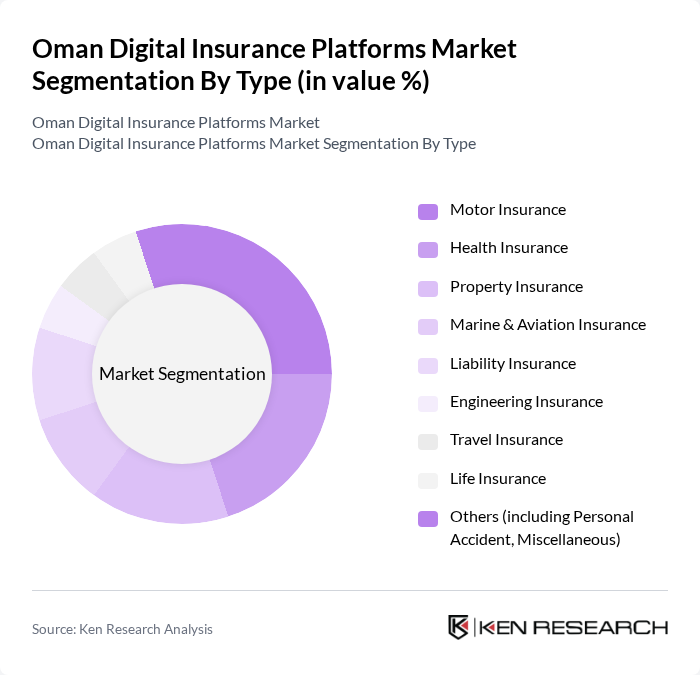

By Type:The market is segmented into various types of insurance products, including Motor Insurance, Health Insurance, Property Insurance, Marine & Aviation Insurance, Liability Insurance, Engineering Insurance, Travel Insurance, Life Insurance, and Others (including Personal Accident, Miscellaneous). Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth.

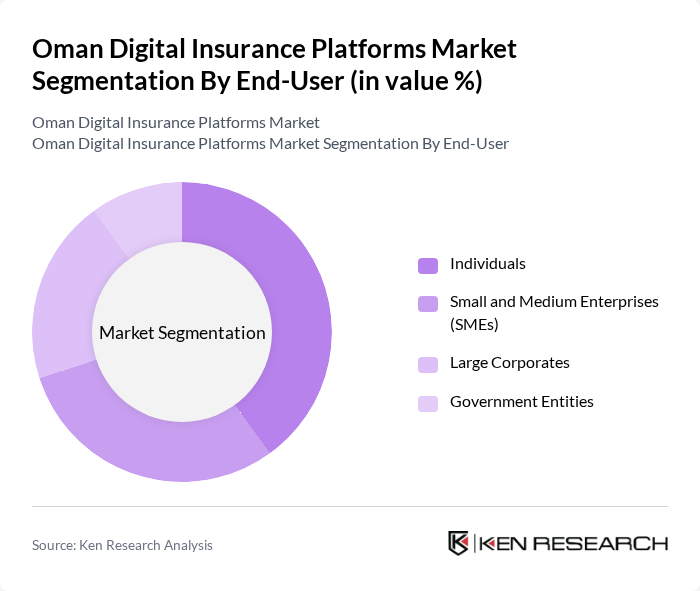

By End-User:The market is segmented by end-users, which include Individuals, Small and Medium Enterprises (SMEs), Large Corporates, and Government Entities. Each segment has distinct requirements and purchasing behaviors, influencing the types of digital insurance products offered.

The Oman Digital Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Insurance Company S.A.O.G., Dhofar Insurance Company S.A.O.G., Muscat Insurance Company S.A.O.G., Al Madina Insurance Company S.A.O.G., Oman United Insurance Company S.A.O.G., National Life & General Insurance Company S.A.O.G., Takaful Oman Insurance S.A.O.G., Al Ahlia Insurance Company S.A.O.G., Oman Reinsurance Company S.A.O.G., Al Izz Islamic Bank (Digital Bancassurance), Muscat Capital LLC, Oman National Insurance Company S.A.O.G., Al Batinah Insurance Company S.A.O.G., Vision Insurance S.A.O.G., Oman Insurance Brokers LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman digital insurance platforms market appears promising, driven by technological advancements and evolving consumer preferences. As insurers increasingly adopt artificial intelligence and machine learning, operational efficiencies will improve, enhancing customer experiences. Additionally, the shift towards on-demand insurance products is expected to gain traction, catering to the needs of a more dynamic consumer base. Overall, the market is poised for significant transformation, with innovation at its core, fostering a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Motor Insurance Health Insurance Property Insurance Marine & Aviation Insurance Liability Insurance Engineering Insurance Travel Insurance Life Insurance Others (including Personal Accident, Miscellaneous) |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporates Government Entities |

| By Distribution Channel | Direct Sales Brokers Agents Bancassurance Online Platforms |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Payment Model | Subscription-Based Pay-Per-Use One-Time Payment |

| By Policy Duration | Annual Policies Multi-Year Policies |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Coverage |

| By Claims Process | Manual Claims Automated Claims Hybrid Claims |

| By Premium Range | Low Premium Medium Premium High Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Insurance Adoption Rates | 120 | Insurance Policyholders, Digital Platform Users |

| Consumer Preferences in Insurance Products | 100 | Potential Customers, Existing Policyholders |

| Impact of Regulatory Changes on Digital Insurance | 60 | Regulatory Officials, Compliance Officers |

| Technological Innovations in Insurance | 70 | IT Managers, Digital Transformation Leads |

| Market Trends and Future Outlook | 90 | Industry Analysts, Market Researchers |

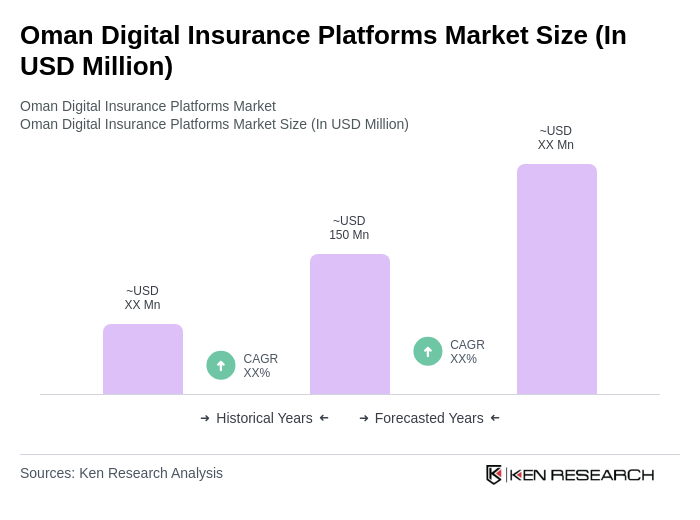

The Oman Digital Insurance Platforms Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by the increasing adoption of digital technologies and enhanced customer experiences in the insurance sector.