Region:Middle East

Author(s):Rebecca

Product Code:KRAC1201

Pages:82

Published On:October 2025

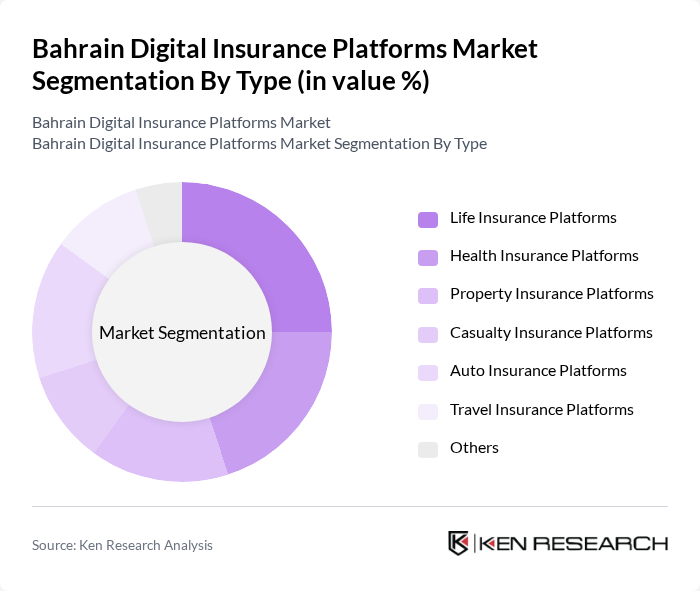

By Type:The market is segmented into various types of digital insurance platforms, including Life Insurance Platforms, Health Insurance Platforms, Property Insurance Platforms, Casualty Insurance Platforms, Auto Insurance Platforms, Travel Insurance Platforms, and Others. Each of these segments caters to specific consumer needs and preferences, with varying levels of adoption and market penetration. Health Insurance Platforms currently lead in adoption, driven by rising healthcare costs and increased consumer awareness, while Auto and Property Insurance Platforms are also experiencing robust growth due to regulatory requirements and asset protection needs .

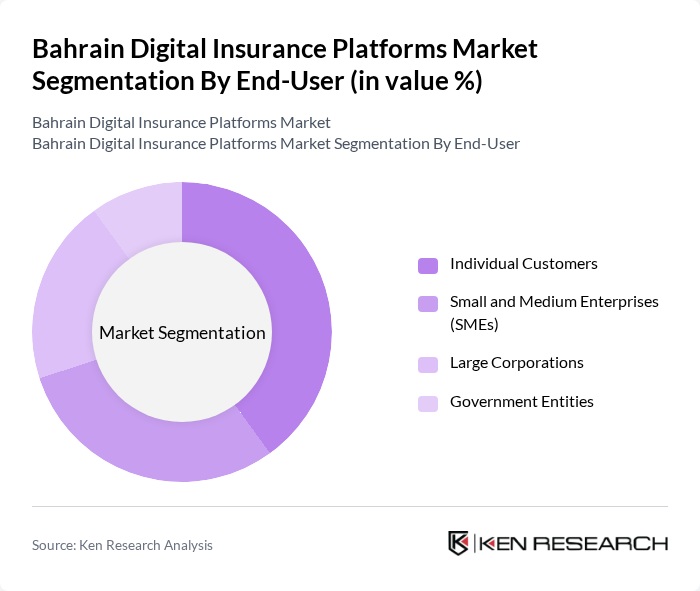

By End-User:The end-user segmentation includes Individual Customers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has distinct requirements and preferences, influencing the types of digital insurance platforms that are most popular among them. Individual Customers dominate the market, driven by growing population, increased insurance awareness, and the ease of accessing digital insurance solutions. SMEs and Large Corporations are adopting digital platforms for streamlined policy management and cost efficiency, while Government Entities leverage these platforms for public sector risk management .

The Bahrain Digital Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain National Insurance Company B.S.C., Gulf Insurance Group, Takaful International Company B.S.C., Al Ahlia Insurance Company B.S.C., Bahrain Kuwait Insurance Company B.S.C., Arab Insurance Group (ARIG), Allianz Bahrain, MetLife Bahrain, AXA Gulf, Qatar Insurance Company, Zurich Insurance Group, AIG Bahrain, Oman Insurance Company, Bupa Arabia, National Life & General Insurance Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Bahrain digital insurance market appears promising, driven by technological advancements and evolving consumer preferences. As artificial intelligence and machine learning become integral to service delivery, insurers will enhance risk assessment and customer engagement. Additionally, the increasing focus on personalized insurance products will cater to diverse consumer needs, fostering loyalty and retention. The market is expected to witness further innovations, particularly in mobile solutions, as providers adapt to the digital-first landscape and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Platforms Health Insurance Platforms Property Insurance Platforms Casualty Insurance Platforms Auto Insurance Platforms Travel Insurance Platforms Others |

| By End-User | Individual Customers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Customer Segment | Retail Customers Corporate Clients High Net-Worth Individuals |

| By Service Model | Subscription-Based Models Pay-Per-Use Models Freemium Models |

| By Technology Integration | Mobile Applications Web Portals API Integrations |

| By Policy Type | Annual Policies Monthly Policies Pay-Per-Use Policies Others |

| By Claims Processing Method | Automated Claims Processing Manual Claims Processing Hybrid Claims Processing |

| By Policy Duration | Short-Term Policies Long-Term Policies Flexible Duration Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Insurance User Experience | 100 | Current Users, Prospective Customers |

| Insurance Brokers' Perspectives | 70 | Insurance Brokers, Agents |

| Regulatory Impact Assessment | 50 | Regulatory Officials, Compliance Officers |

| Technology Providers in Insurance | 40 | IT Managers, Product Development Leads |

| Consumer Attitudes towards Digital Insurance | 80 | General Consumers, Tech-Savvy Individuals |

The Bahrain Digital Insurance Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies and a shift towards online insurance services.