Region:Africa

Author(s):Rebecca

Product Code:KRAB2936

Pages:95

Published On:October 2025

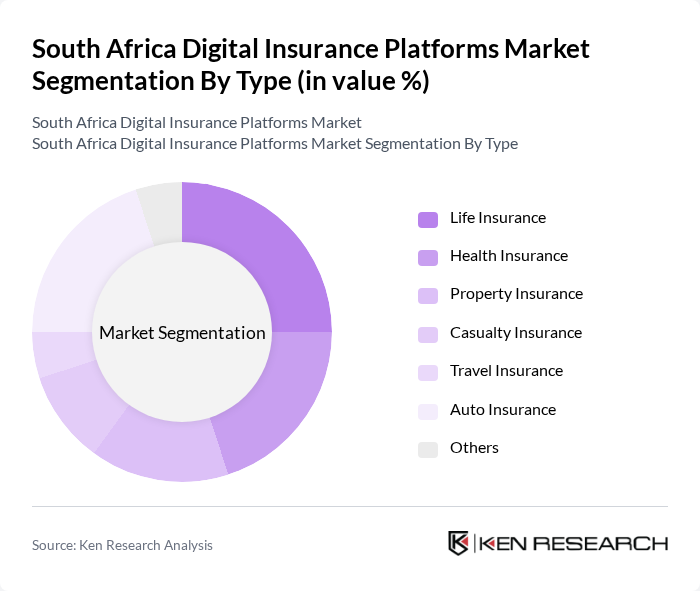

By Type:The market can be segmented into various types of insurance products, including Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Travel Insurance, Auto Insurance, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of insurance offerings available in the digital realm.

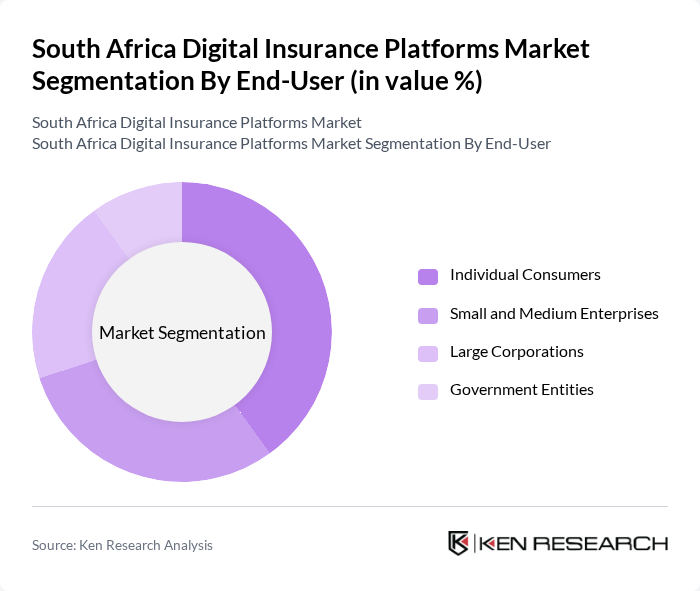

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has unique requirements and purchasing behaviors, influencing how digital insurance platforms tailor their offerings to meet diverse needs.

The South Africa Digital Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Discovery Limited, Old Mutual Limited, Santam Limited, Hollard Insurance, Momentum Metropolitan Holdings, Liberty Holdings Limited, Guardrisk Insurance Company, AIG South Africa, Zurich Insurance Company South Africa, Allianz Global Corporate & Specialty, Mutual & Federal, Telesure Investment Holdings, Cigna Global Re, AXA South Africa, Standard Bank Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of South Africa's digital insurance platforms is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As insurers increasingly adopt artificial intelligence and machine learning, they will enhance risk assessment and customer engagement. Furthermore, the integration of blockchain technology is expected to improve transparency and security in transactions. These trends will likely lead to a more efficient and customer-centric insurance landscape, fostering greater trust and participation in digital insurance offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Casualty Insurance Travel Insurance Auto Insurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Customer Segment | Millennials Gen X Baby Boomers |

| By Coverage Type | Comprehensive Coverage Basic Coverage |

| By Payment Model | Subscription-Based Pay-Per-Use |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Digital Platforms | 100 | Product Managers, Digital Strategy Leads |

| Health Insurance Digital Solutions | 80 | Operations Managers, IT Directors |

| Property Insurance Online Services | 70 | Sales Executives, Customer Experience Managers |

| Insurance Technology Startups | 60 | Founders, Business Development Managers |

| Consumer Insights on Digital Insurance | 90 | End-users, Policyholders, Insurance Advisors |

The South Africa Digital Insurance Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the adoption of digital technologies and increasing consumer demand for convenient insurance solutions.