GCC Digital Insurance Platforms Market Overview

- The GCC Digital Insurance Platforms Market is valued at USD 90 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital technologies, rising consumer demand for personalized insurance products, and the need for enhanced operational efficiency among insurance providers. The shift towards digital platforms has enabled insurers to streamline processes, reduce costs, and improve customer engagement. Recent trends include the integration of artificial intelligence, cloud computing, and data analytics, which are accelerating the modernization of insurance operations and enabling more tailored customer experiences.

- The United Arab Emirates and Saudi Arabia dominate the GCC Digital Insurance Platforms Market due to their advanced technological infrastructure, high internet penetration rates, and a growing population that is increasingly tech-savvy. These countries have also seen significant investments in fintech and insurtech, fostering innovation and competition in the digital insurance space. The broader GCC region is experiencing a surge in digital adoption, supported by regulatory initiatives and rising demand for seamless, mobile-first insurance solutions.

- In 2023, the Saudi Arabian Monetary Authority (SAMA) issued the Insurance Companies Digital Transformation Framework, mandating that all licensed insurance companies in Saudi Arabia must implement digital platforms for policy management and claims processing. The framework requires insurers to provide customers with online access to policy information, digital claims submission, and real-time tracking, aiming to enhance transparency, improve customer experience, and promote technology adoption across the sector. Compliance is mandatory for all insurers operating in the Kingdom, with phased implementation timelines and regular reporting to SAMA.

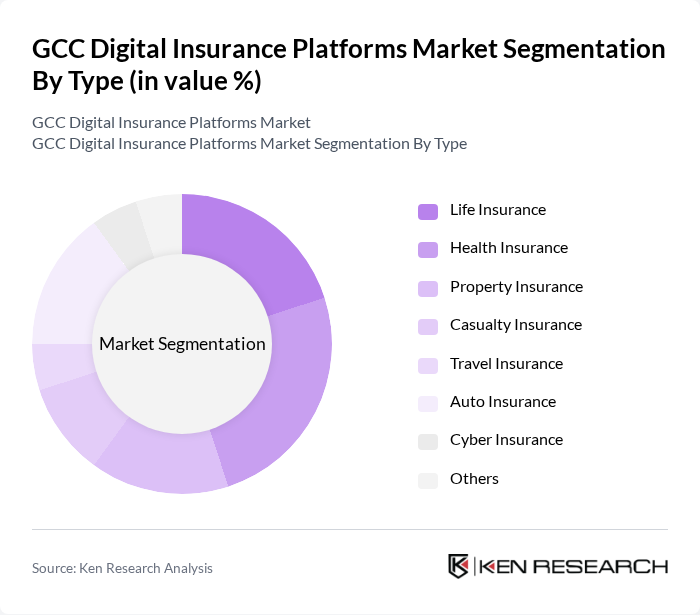

GCC Digital Insurance Platforms Market Segmentation

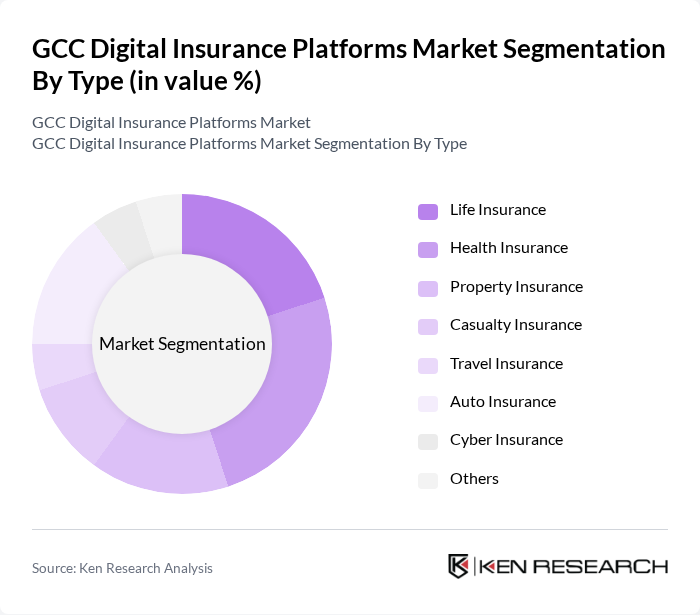

By Type:The market is segmented into various types of insurance products, including Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Travel Insurance, Auto Insurance, Cyber Insurance, and Others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth. Globally, property and casualty insurance dominates digital platform adoption due to the need for efficient claims processing and risk management, while health insurance is the fastest-growing segment as digital solutions help manage complex health data and streamline claims.

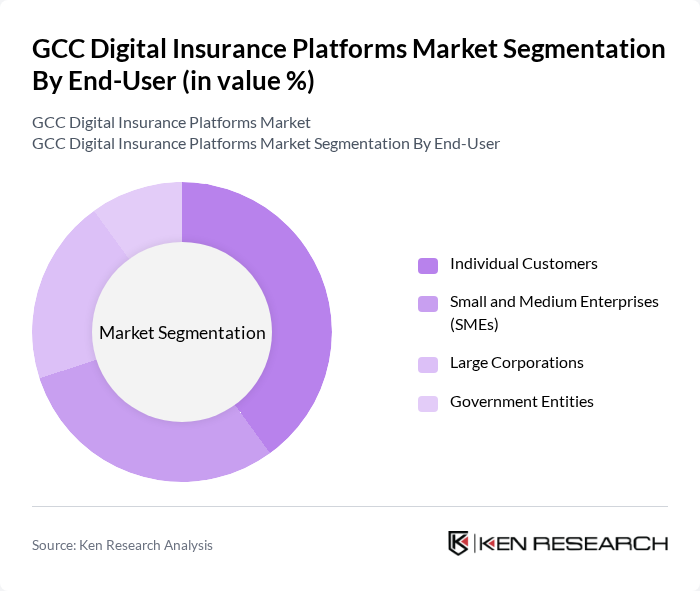

By End-User:The market is segmented by end-users, including Individual Customers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has unique requirements and purchasing behaviors that influence the types of digital insurance products they seek. SMEs are increasingly adopting embedded, subscription-based digital solutions that lower cost and complexity, broadening the user base beyond traditional large enterprises.

GCC Digital Insurance Platforms Market Competitive Landscape

The GCC Digital Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz SE, AXA Group, Zurich Insurance Group, AIG (American International Group), MetLife, Inc., Prudential Financial, Inc., Munich Re, Chubb Limited, Aviva plc, Generali Group, Berkshire Hathaway Inc., Cigna Corporation, Tokio Marine Holdings, Inc., Liberty Mutual Insurance, Aon plc, Oman Insurance Company, Emirates Insurance Company, Qatar Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

GCC Digital Insurance Platforms Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:The GCC region has witnessed a significant rise in internet penetration, reaching approximately 99% in future. This widespread access facilitates the adoption of digital insurance platforms, allowing consumers to engage with services online. The growing number of internet users, estimated at 50 million, enhances the potential customer base for digital insurers, driving innovation and competition in the market.

- Rising Demand for Personalized Insurance Products:In future, the demand for personalized insurance products in the GCC is projected to increase, with 60% of consumers expressing a preference for tailored solutions. This shift is driven by changing consumer expectations and the desire for customized coverage options. Insurers are leveraging data analytics to create personalized offerings, enhancing customer satisfaction and retention, which is crucial for growth in the digital insurance sector.

- Adoption of Mobile Technology:The mobile penetration rate in the GCC is expected to reach 90% in future. This high adoption of mobile technology enables consumers to access insurance services conveniently through mobile applications. Insurers are increasingly investing in mobile platforms to enhance user experience, streamline claims processing, and improve customer engagement, thereby driving the growth of digital insurance solutions in the region.

Market Challenges

- Data Privacy Concerns:Data privacy remains a significant challenge for digital insurance platforms in the GCC, with 70% of consumers expressing concerns about data security in future. The implementation of stringent data protection regulations, such as the GDPR-inspired laws, necessitates that insurers invest heavily in compliance measures. This can lead to increased operational costs and may hinder the rapid deployment of innovative digital solutions.

- High Competition Among Insurers:The GCC digital insurance market is characterized by intense competition, with over 100 insurers vying for market share in future. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Established players are compelled to innovate continuously and enhance their service offerings to maintain a competitive edge, which can strain resources and impact profitability.

GCC Digital Insurance Platforms Market Future Outlook

The GCC digital insurance landscape is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As insurers increasingly adopt AI and machine learning, operational efficiencies will improve, enabling faster claims processing and personalized services. Additionally, the rise of insurtech startups is expected to foster innovation, creating a dynamic ecosystem. Regulatory support for digital transformation will further enhance market stability, paving the way for sustainable growth in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Insurers have a significant opportunity to expand into emerging markets within the GCC, where insurance penetration is currently low, estimated at 2%. By tailoring products to meet local needs, insurers can tap into a vast customer base, driving growth and increasing market share in these underserved regions.

- Development of AI-Driven Solutions:The integration of AI-driven solutions presents a lucrative opportunity for insurers, with the global AI in insurance market projected to grow substantially in future. By leveraging AI for risk assessment and customer service, GCC insurers can enhance operational efficiency, reduce costs, and improve customer satisfaction, positioning themselves competitively in the digital landscape.