Region:Middle East

Author(s):Harsh Saxena

Product Code:KR1555

Pages:90

Published On:April 2023

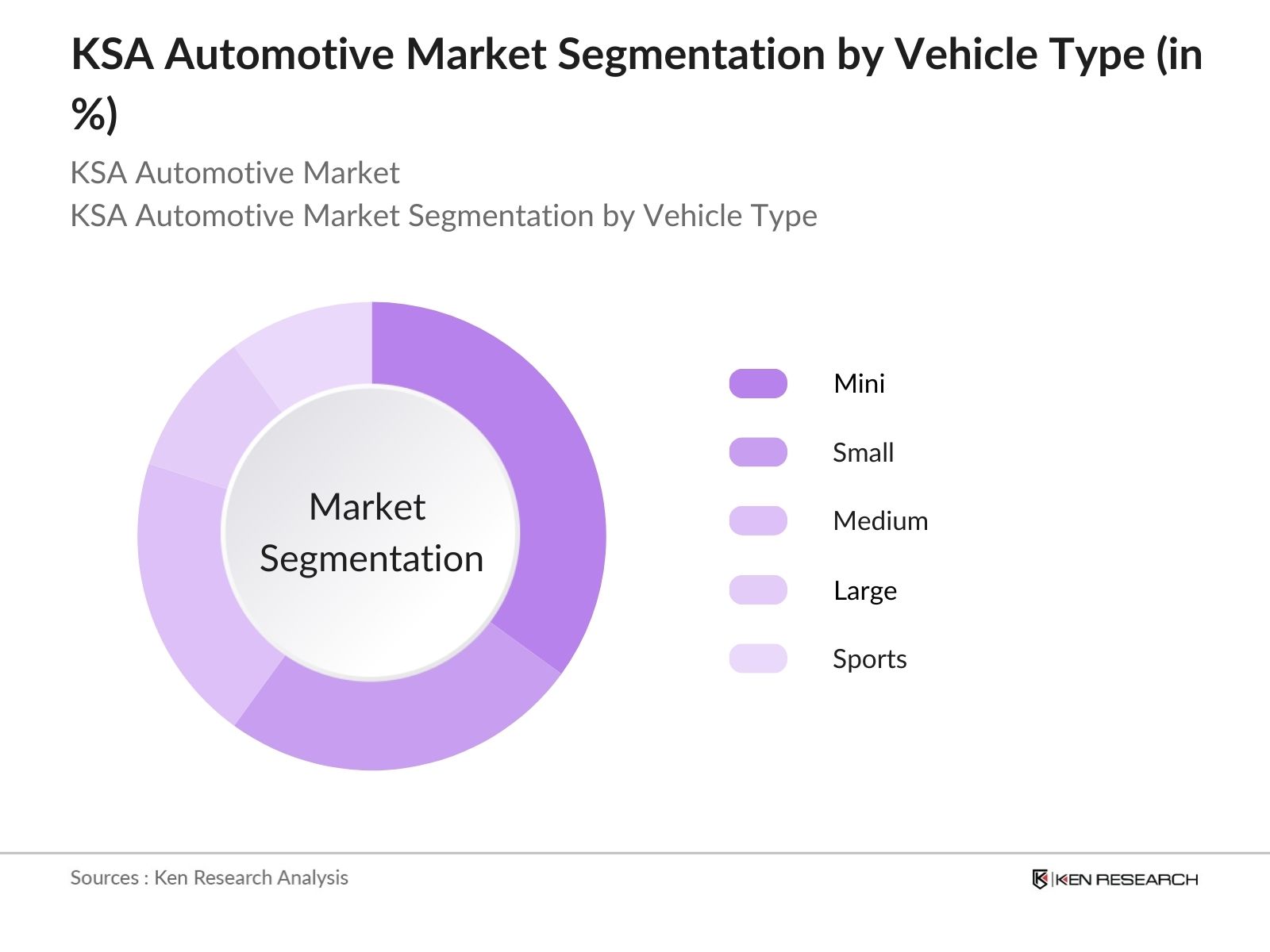

By Vehicle Type:The KSA automotive market is segmented into Mini, Small, Medium, Large, and Sports vehicles. Large SUVs and crossovers dominate the market due to rising demand for family-friendly, spacious vehicles suitable for long-distance and intercity travel. Small vehicles are the fastest-growing segment, driven by affordability and urban mobility preferences. Medium-sized cars maintain steady growth, while Mini and Sports segments are declining as consumers gravitate towards more feature-rich mainstream models offering better value, especially from Chinese manufacturers.

By Sales Channel:The sales channel segmentation includes Brick-and-Mortar and Online platforms. Brick-and-mortar remains the dominant sales channel, supported by physical inspections, trust in offline dealerships, and after-sales service. However, online sales are expanding rapidly, fueled by Vision 2030’s digital ambitions, increasing internet penetration, and growing consumer preference for convenient and seamless e-commerce journeys. The online segment is expected to grow at a faster pace, gradually reshaping the automotive retail landscape in KSA toward a more omni-channel experience????.

The KSA Automotive Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Hyundai Motor Company, Kia Corporation, Isuzu, and Changan contribute to innovation, geographic expansion, and service delivery in this space.

The KSA automotive market is poised for transformative growth, driven by increasing consumer demand and government support for local manufacturing. As infrastructure projects progress, vehicle ownership is expected to rise, while the shift towards electric vehicles will reshape the market landscape. In future, the integration of advanced technologies in vehicles will enhance user experience, and the expansion of e-commerce logistics will create new demand for commercial vehicles, further stimulating market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Mini Small Medium Large Sports |

| By Sales Channel | Brick-and-Mortar Online |

| By Retailer | Franchised Independent |

| By Brand Type | Legacy Emerging Premium |

| By Technology | Manual Automatic |

| By Propulsion Type | Petrol Diesel PHV EV |

| By Customer Segment | Retail Corporate |

| By Region | Central Western Eastern Northern Southern |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Market | 100 | Car Owners, Automotive Enthusiasts |

| Commercial Vehicle Sector | 60 | Fleet Managers, Logistics Coordinators |

| Electric Vehicle Adoption | 40 | Environmental Advocates, Early Adopters |

| Automotive Aftermarket Services | 50 | Service Center Managers, Parts Distributors |

| Consumer Preferences in Automotive Purchases | 80 | General Consumers, First-time Buyers |

The KSA automotive market is valued at approximately USD 20 billion, driven by increasing consumer demand, urbanization, and government initiatives aimed at enhancing the automotive sector.