Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3765

Pages:81

Published On:November 2025

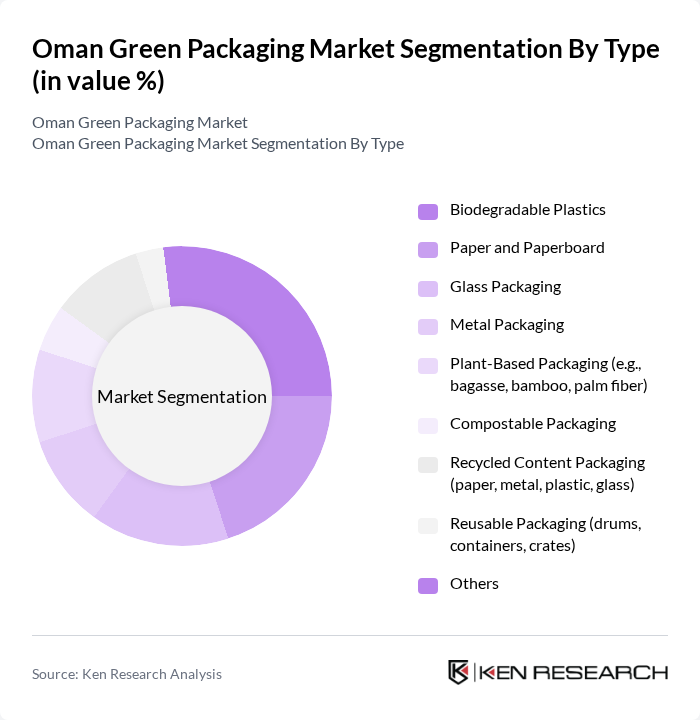

By Type:The market is segmented into various types of green packaging materials, including biodegradable plastics, paper and paperboard, glass packaging, metal packaging, plant-based packaging, compostable packaging, recycled content packaging, reusable packaging, and others. Each of these subsegments plays a crucial role in addressing environmental concerns and catering to consumer preferences for sustainable options.

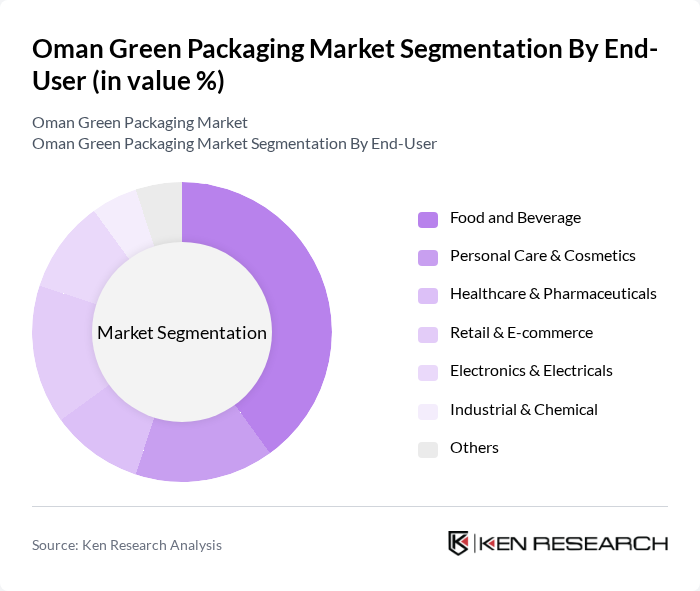

By End-User:The end-user segmentation includes various industries such as food and beverage, personal care and cosmetics, healthcare and pharmaceuticals, retail and e-commerce, electronics and electricals, industrial and chemical sectors, and others. Each of these sectors has unique packaging requirements, driving the demand for green packaging solutions tailored to their specific needs.

The Oman Green Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Packaging Company SAOG, Al Kamil Plastic Packaging LLC, Gulf Packaging Industries LLC, Oman Green Packaging LLC, Al Jazeera Plastic Products Co. LLC, National Plastic Factory LLC, Majan Glass Company SAOG, Al Batinah Packaging & Packing Materials LLC, Muscat Packaging Solutions LLC, EcoPack Oman LLC, Green Pack Solutions LLC, Sustainable Packaging Oman LLC, Al Harthy Packaging LLC, Oman Bioplastics LLC, Eco-Friendly Packaging Company LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman green packaging market is poised for significant growth as environmental concerns continue to shape consumer behavior and government policies. With increasing investments in sustainable technologies and a shift towards a circular economy, businesses are likely to innovate in packaging solutions. The anticipated rise in e-commerce will further drive demand for eco-friendly packaging, as companies seek to meet consumer expectations for sustainability while adhering to regulatory standards. This evolving landscape presents a promising future for green packaging in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | Biodegradable Plastics Paper and Paperboard Glass Packaging Metal Packaging Plant-Based Packaging (e.g., bagasse, bamboo, palm fiber) Compostable Packaging Recycled Content Packaging (paper, metal, plastic, glass) Reusable Packaging (drums, containers, crates) Others |

| By End-User | Food and Beverage Personal Care & Cosmetics Healthcare & Pharmaceuticals Retail & E-commerce Electronics & Electricals Industrial & Chemical Others |

| By Material | Bioplastics (PLA, PHA, starch blends) Recycled Materials (paper, plastics, metals, glass) Natural Fibers (jute, hemp, palm, bagasse) Others |

| By Application | Food Packaging (trays, containers, wraps) Non-Food Packaging (personal care, electronics, retail) Industrial Packaging Gift & Specialty Packaging Others |

| By Distribution Channel | Online Retail Offline Retail (supermarkets, specialty stores) Direct Sales (B2B) Distributors/Wholesalers Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Al Sharqiyah Others |

| By Consumer Demographics | Age Group Income Level Urban vs Rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Green Packaging Adoption | 60 | Retail Managers, Sustainability Managers |

| Food & Beverage Industry Packaging Preferences | 50 | Product Managers, Supply Chain Managers |

| Consumer Insights on Eco-friendly Packaging | 100 | General Consumers, Eco-conscious Shoppers |

| Manufacturers of Green Packaging Solutions | 40 | Operations Managers, R&D Managers |

| Government and Regulatory Bodies' Perspectives | 40 | Policy Makers, Environmental Officers |

The Oman Green Packaging Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing environmental awareness and consumer demand for sustainable packaging solutions.