Region:Middle East

Author(s):Dev

Product Code:KRAC4181

Pages:92

Published On:October 2025

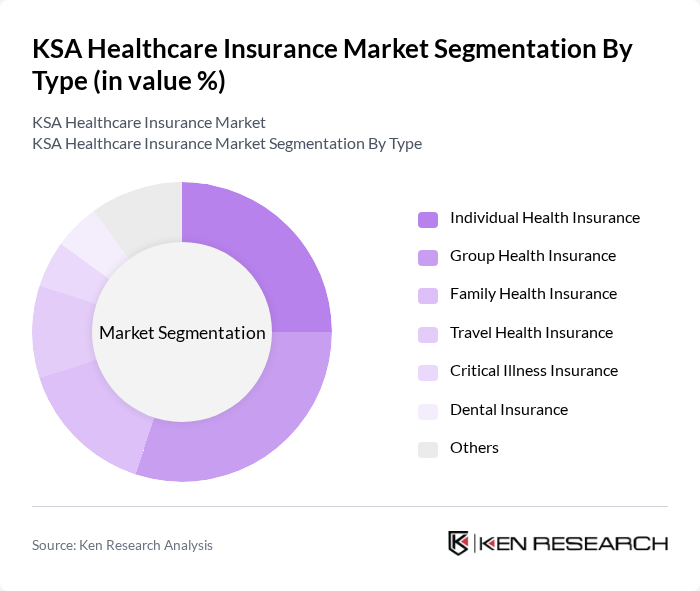

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Group Health Insurance, Family Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. These sub-segments reflect the diverse landscape of health insurance in the Kingdom, with Group and Individual Health Insurance dominating due to employer mandates and rising individual awareness. Travel and Critical Illness Insurance are increasingly sought after by expatriates and high-risk populations, while Dental Insurance is gaining traction among urban professionals.

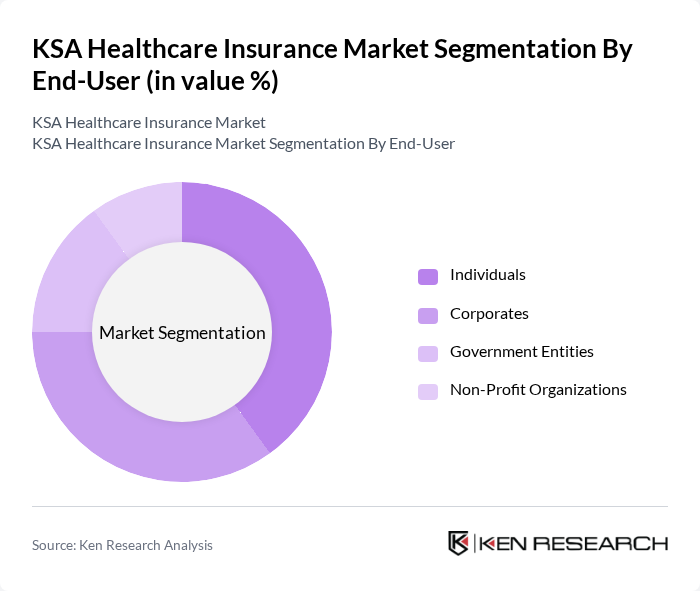

By End-User:The end-user segmentation includes Individuals, Corporates, Government Entities, and Non-Profit Organizations. Individuals and Corporates represent the largest segments, driven by mandatory employer coverage and growing personal health awareness. Government Entities and Non-Profit Organizations are increasingly adopting tailored insurance solutions to meet the needs of their workforce and beneficiaries, reflecting evolving purchasing behaviors and requirements.

The KSA Healthcare Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya, Bupa Arabia, Medgulf, Al Rajhi Takaful, Gulf Insurance Group, AXA Cooperative Insurance, Allianz Saudi Fransi, United Cooperative Assurance, Alinma Tokio Marine, Al-Ahlia Insurance Company, Al-Etihad Cooperative Insurance, Al-Jazira Takaful Taawuni, Al-Mawared Insurance, Al-Sagr Cooperative Insurance, and Al-Bilad Insurance contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The KSA healthcare insurance market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. The integration of digital platforms for policy management and claims processing is expected to enhance customer experience and operational efficiency. Additionally, the shift towards value-based care will encourage insurers to develop innovative products that focus on preventive care, ultimately improving health outcomes and reducing costs for both insurers and consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Group Health Insurance Family Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Profit Organizations |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Policy Type | Comprehensive Coverage Basic Coverage Supplemental Coverage |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Claim Settlement Ratio | High Settlement Ratio Medium Settlement Ratio Low Settlement Ratio |

| By Policy Duration | Short-Term Policies Long-Term Policies Annual Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policies | 80 | Policyholders, Insurance Agents |

| Group Health Insurance Plans | 60 | HR Managers, Corporate Executives |

| Government-Sponsored Health Programs | 40 | Policy Makers, Healthcare Administrators |

| Private Health Insurance Providers | 70 | Insurance Executives, Financial Analysts |

| Healthcare Consumer Insights | 50 | Patients, Healthcare Advocates |

The KSA Healthcare Insurance Market is valued at approximately USD 8 billion, reflecting significant growth driven by increasing demand for healthcare services, rising awareness of health insurance benefits, and government initiatives aimed at enhancing healthcare accessibility and quality.