Region:Middle East

Author(s):Rebecca

Product Code:KRAA5727

Pages:100

Published On:January 2026

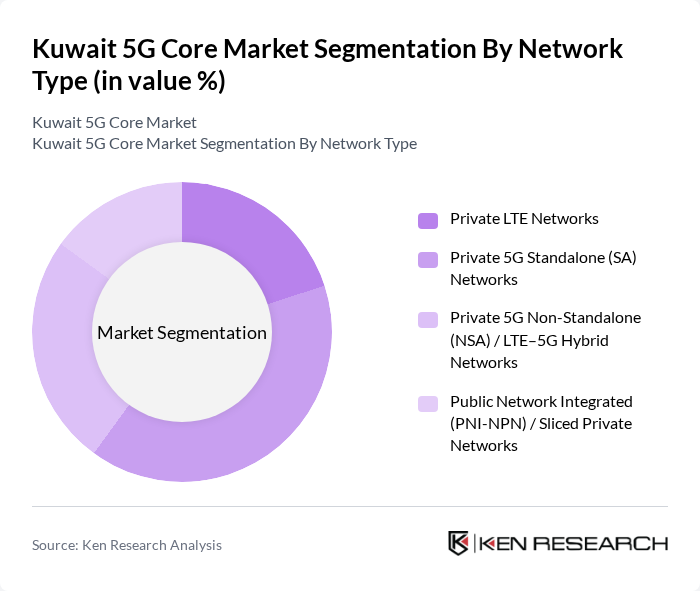

By Network Type:

The network type segmentation includes Private LTE Networks, Private 5G Standalone (SA) Networks, Private 5G Non-Standalone (NSA) / LTE–5G Hybrid Networks, and Public Network Integrated (PNI-NPN) / Sliced Private Networks. Among these, Private 5G Standalone (SA) Networks are leading the market due to their ability to provide dedicated bandwidth and low latency, which are essential for critical applications in industries such as manufacturing and healthcare. The demand for secure and reliable connectivity in private enterprises is driving the adoption of this sub-segment.

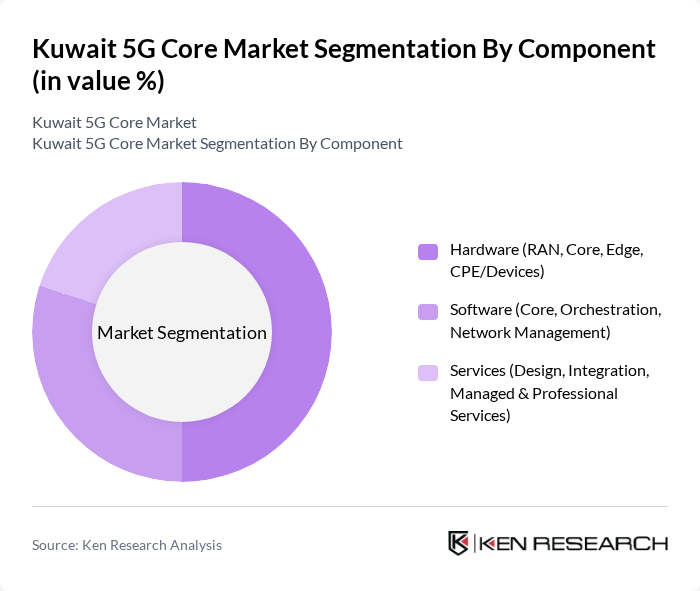

By Component:

This segmentation includes Hardware (RAN, Core, Edge, CPE/Devices), Software (Core, Orchestration, Network Management), and Services (Design, Integration, Managed & Professional Services). The Hardware segment is currently dominating the market, driven by the need for robust radio access, core network, edge computing, and customer-premises equipment to support high-speed, low-latency private LTE and 5G deployments across industrial sites and campuses. The increasing investments in RAN and core network components are essential for enhancing network performance and capacity, making this sub-segment critical for telecom operators.

The Kuwait 5G Core Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zain Kuwait, Ooredoo Kuwait, stc Kuwait, Nokia, Ericsson, Huawei Technologies, Cisco Systems, Qualcomm Technologies, Samsung Electronics, NEC Corporation, Fujitsu, Juniper Networks, Ciena Corporation, and Keysight Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait 5G core market appears promising, driven by ongoing investments in telecommunications infrastructure and the government's commitment to digital transformation. As consumer awareness increases and IoT applications expand, the demand for high-speed connectivity will likely rise. Additionally, the integration of advanced technologies such as AI and edge computing will enhance network efficiency, paving the way for innovative services and applications that cater to the evolving needs of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Network Type | Private LTE Networks Private 5G Standalone (SA) Networks Private 5G Non-Standalone (NSA) / LTE–5G Hybrid Networks Public Network Integrated (PNI-NPN) / Sliced Private Networks |

| By Component | Hardware (RAN, Core, Edge, CPE/Devices) Software (Core, Orchestration, Network Management) Services (Design, Integration, Managed & Professional Services) |

| By Spectrum & Frequency Band | Licensed Spectrum Shared / Local Licensed Spectrum Unlicensed Spectrum Sub-6 GHz Bands mmWave Bands |

| By Deployment Model | On-Premises Private Network Cloud-Managed Private Network Hybrid Deployment |

| By Use Case / Application | Industrial Automation & Robotics Mission-Critical Communications & Public Safety Smart Ports, Airports & Logistics Hubs Video Surveillance & Remote Operations Fixed Wireless Access (Enterprise & Campus) Others |

| By End-User Vertical | Oil & Gas and Petrochemicals Utilities & Energy Manufacturing & Industrial Transportation & Logistics Government, Public Safety & Defense Smart Cities & Infrastructure Healthcare Education & Campuses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Service Providers | 45 | Network Engineers, Product Managers |

| Enterprise Users of 5G | 40 | IT Managers, Operations Directors |

| Government Regulatory Bodies | 25 | Policy Makers, Regulatory Analysts |

| Consumer Insights | 60 | General Public, Tech Enthusiasts |

| Industry Experts and Analysts | 30 | Market Analysts, Telecom Consultants |

The Kuwait 5G Core Market is valued at approximately USD 35 million, reflecting significant investments in private LTE and 5G deployments driven by the demand for high-speed data services and enhanced mobile broadband.