Region:Middle East

Author(s):Rebecca

Product Code:KRAA5729

Pages:81

Published On:January 2026

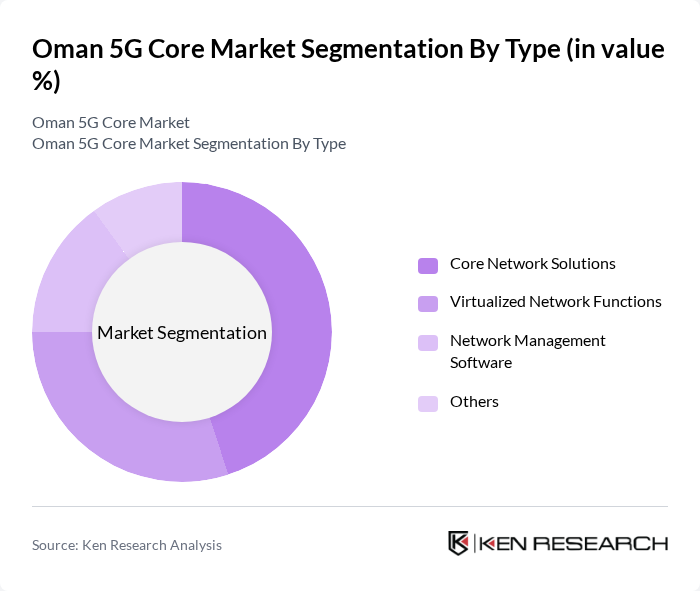

By Type:The market is segmented into Core Network Solutions, Virtualized Network Functions, Network Management Software, and Others. Core Network Solutions are leading the market due to their critical role in managing network traffic and ensuring seamless connectivity. Virtualized Network Functions are gaining traction as they offer flexibility and scalability, while Network Management Software is essential for optimizing network performance. The Others category includes various ancillary services that support the core functionalities.

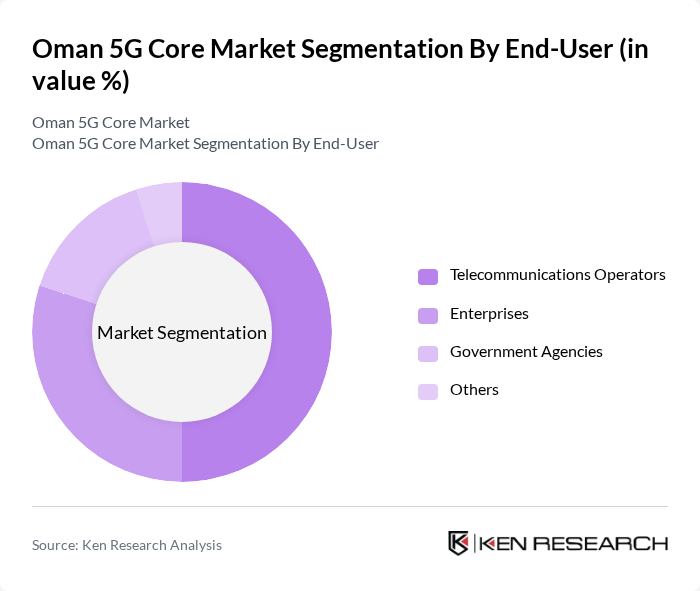

By End-User:The end-user segmentation includes Telecommunications Operators, Enterprises, Government Agencies, and Others. Telecommunications Operators dominate the market as they are the primary providers of 5G services, driving demand for core network solutions. Enterprises are increasingly adopting 5G for enhanced operational efficiency, while Government Agencies are leveraging the technology for public services. The Others category encompasses various sectors utilizing 5G for specific applications.

The Oman 5G Core Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel, Ooredoo Oman, Ericsson, Nokia, Huawei Technologies, ZTE Corporation, Cisco Systems, Samsung Electronics, NEC Corporation, Fujitsu, Intel Corporation, Qualcomm Technologies, Juniper Networks, Ciena Corporation, Keysight Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 5G core market in Oman appears promising, driven by ongoing government support and increasing consumer demand for high-speed connectivity. In future, advancements in network technologies, such as network slicing and edge computing, are expected to enhance service delivery and operational efficiency. Additionally, the integration of artificial intelligence in network management will optimize resource allocation, ensuring a seamless user experience. As the market matures, collaboration between telecom operators and technology firms will be crucial for fostering innovation and expanding service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Core Network Solutions Virtualized Network Functions Network Management Software Others |

| By End-User | Telecommunications Operators Enterprises Government Agencies Others |

| By Application | Enhanced Mobile Broadband Massive Machine Type Communications Ultra-Reliable Low Latency Communications Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Service Type | Consulting Services Integration Services Managed Services Others |

| By Technology | Software-Defined Networking Network Function Virtualization Cloud-Native Architecture Others |

| By Region | Muscat Dhofar Al Batinah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 100 | Network Engineers, Operations Managers |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Technology Consultants | 75 | Telecom Analysts, IT Consultants |

| End-Users (Businesses) | 80 | IT Managers, Business Development Executives |

| Research Institutions | 60 | Academic Researchers, Industry Experts |

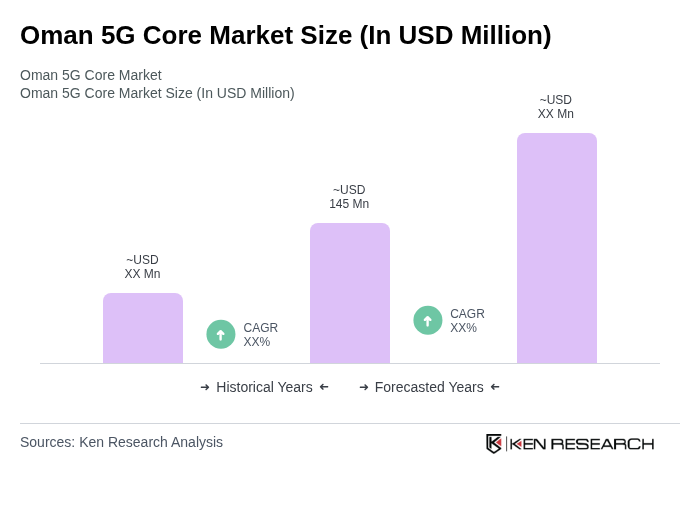

The Oman 5G Core Market is valued at approximately USD 145 million, reflecting significant growth driven by the demand for high-speed internet, low latency, and advanced network capabilities, alongside government initiatives for digital transformation.