Region:Asia

Author(s):Rebecca

Product Code:KRAA5735

Pages:86

Published On:January 2026

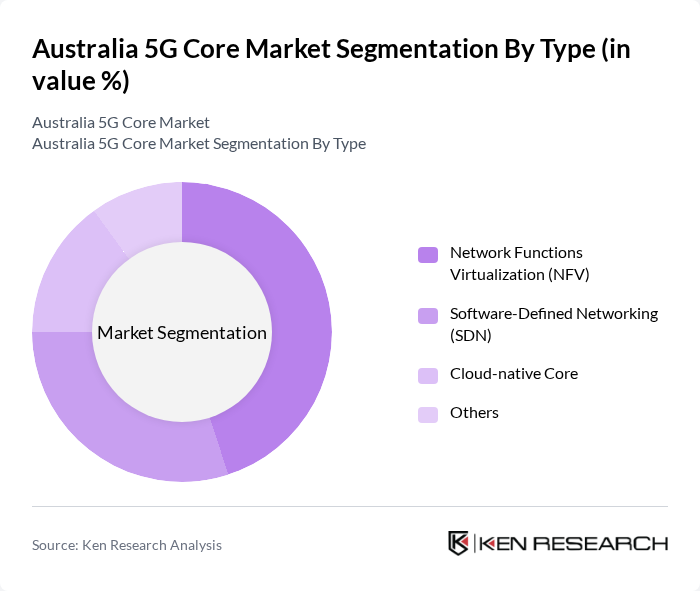

By Type:The market is segmented into Network Functions Virtualization (NFV), Software-Defined Networking (SDN), Cloud-native Core, and Others. Among these, NFV is leading due to its ability to enhance network efficiency and reduce operational costs. The shift towards virtualization in network management is driven by the need for flexibility and scalability in service delivery.

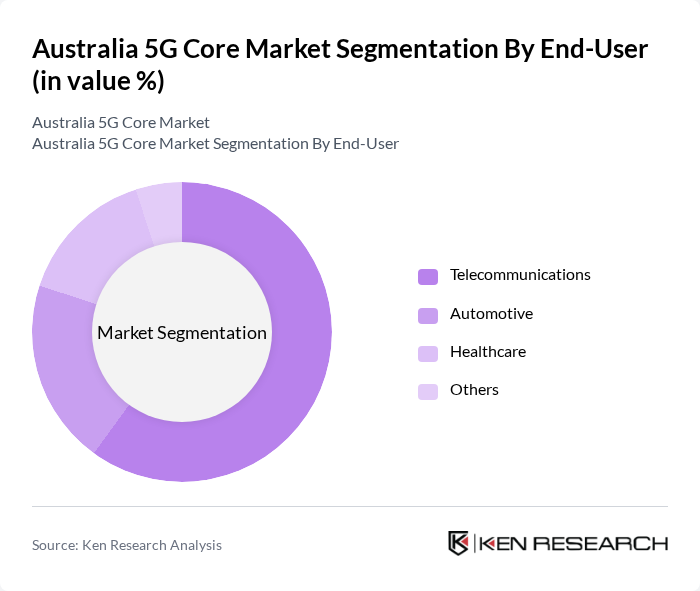

By End-User:The end-user segmentation includes Telecommunications, Automotive, Healthcare, and Others. The telecommunications sector is the dominant segment, driven by the rapid deployment of 5G networks and the increasing demand for high-speed data services. This sector's growth is fueled by consumer demand for enhanced mobile experiences and the need for robust network infrastructure.

The Australia 5G Core Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telstra Corporation Limited, Optus, Vodafone Hutchison Australia, Nokia Networks, Ericsson Australia, Huawei Technologies Australia, Cisco Systems Australia, Samsung Electronics Australia, NEC Australia, ZTE Corporation, Fujitsu Australia, Infinera Corporation, Ciena Corporation, Juniper Networks, Mavenir contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia 5G core market appears promising, driven by technological advancements and increasing consumer demand for connectivity. In the future, the integration of edge computing is expected to enhance network efficiency, while the growth of private 5G networks will cater to specific industry needs. Additionally, the focus on sustainability in network operations will likely shape investment strategies, as operators seek to reduce their carbon footprint and align with global environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Functions Virtualization (NFV) Software-Defined Networking (SDN) Cloud-native Core Others |

| By End-User | Telecommunications Automotive Healthcare Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Application | Enhanced Mobile Broadband (eMBB) Ultra-Reliable Low Latency Communications (URLLC) Massive Machine Type Communications (mMTC) Others |

| By Industry Vertical | Manufacturing Retail Energy and Utilities Others |

| By Region | New South Wales Victoria Queensland Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 100 | Network Engineers, Technical Directors |

| Infrastructure Providers | 80 | Project Managers, Operations Heads |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Enterprise Users | 70 | IT Managers, Procurement Officers |

| Industry Analysts | 60 | Market Researchers, Telecom Consultants |

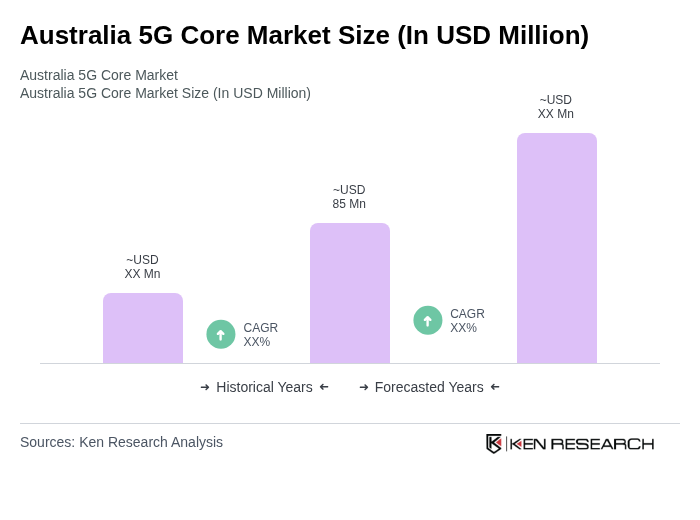

The Australia 5G Core Market is valued at approximately USD 85 million, reflecting significant growth driven by the demand for high-speed internet, IoT device proliferation, and enhanced mobile broadband services.