Region:Middle East

Author(s):Rebecca

Product Code:KRAA5706

Pages:98

Published On:January 2026

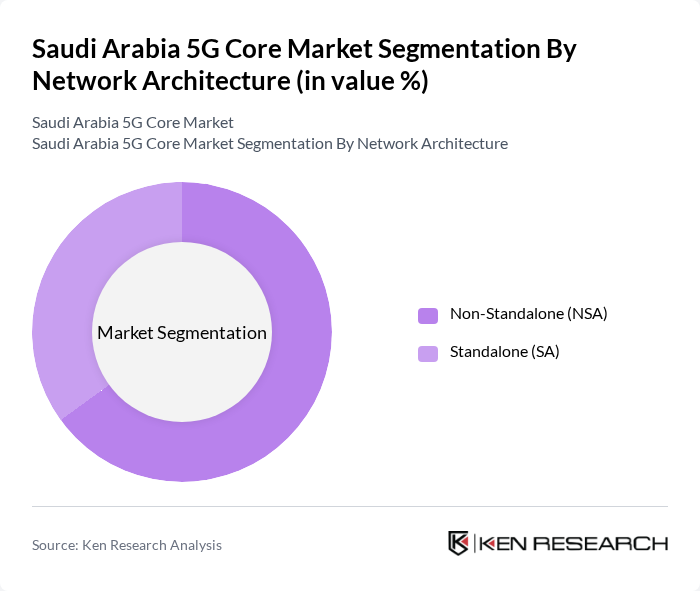

By Network Architecture:

The market is segmented into Non-Standalone (NSA) and Standalone (SA) architectures. The Non-Standalone architecture is currently dominating the market due to its ability to leverage existing 4G infrastructure, allowing for a quicker rollout of 5G services. This approach is particularly appealing to telecom operators looking to enhance their service offerings without significant upfront investments. The Standalone architecture, while offering greater efficiency and lower latency, is still in the early stages of adoption as operators gradually transition to fully independent 5G networks, with recent launches such as Zain KSA's SA network in Riyadh and Jeddah.

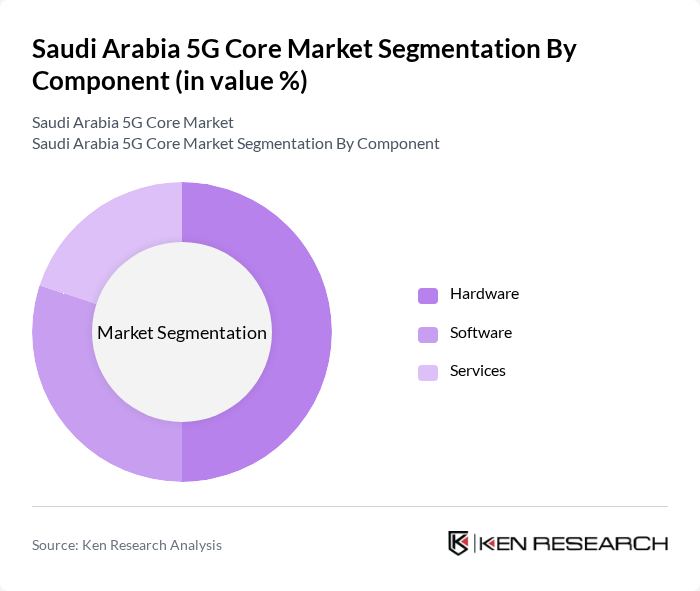

By Component:

The components of the market include Hardware, Software, and Services. Hardware is the leading segment, driven by the demand for advanced networking equipment and infrastructure necessary for 5G deployment, including base stations, antennas, and network equipment. The increasing complexity of network requirements and the need for high-performance devices are propelling hardware sales. Software solutions are also gaining traction as operators seek to optimize network management and enhance user experiences through virtualized service-based architectures supporting network slicing and cloud-native operations. Services, including installation and maintenance, are essential for supporting the growing infrastructure but currently represent a smaller share of the market.

The Saudi Arabia 5G Core Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group, Mobily, Zain KSA, Ericsson, Nokia, Huawei, Cisco Systems, Qualcomm, Samsung Electronics, NEC Corporation, Fujitsu, Intel Corporation, Oracle Corporation, Juniper Networks, Keysight Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 5G core market in Saudi Arabia appears promising, driven by ongoing government support and technological advancements. As the country continues to invest in digital infrastructure, the integration of 5G technology is expected to enhance connectivity and support various sectors, including healthcare and smart cities. Additionally, the rise of edge computing and AI in network management will further optimize 5G networks, ensuring efficient service delivery and improved user experiences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Network Architecture | Non-Standalone (NSA) Standalone (SA) |

| By Component | Hardware Software Services |

| By Communication Infrastructure | G Radio Access Networks Transport Networks G Core Network |

| By Deployment Model | On-Premises Dedicated Network Operator-Managed / Hosted Private Network Hybrid / Shared Private Network Public Cloud-Hosted Private Network |

| By Vertical | Enterprise & Corporate Residential Industrial Transportation & Logistics Smart City Energy & Utilities |

| By Spectrum | Sub-6 GHz mmWave |

| By Region | Northern and Central Region (Riyadh) Eastern Region (Dammam, Dhahran) Western Region (Jeddah, Makkah, Madinah) Southern Region (Tabuk) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 100 | Network Engineers, Product Managers |

| Enterprise Users of 5G | 80 | IT Directors, Operations Managers |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Technology Vendors | 70 | Sales Executives, Technical Support Managers |

| Research Institutions | 60 | Academic Researchers, Industry Analysts |

The Saudi Arabia 5G Core Market is valued at approximately USD 150 million, driven by the increasing demand for high-speed internet, IoT proliferation, and government initiatives under Vision 2030 aimed at enhancing digital infrastructure.