Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4845

Pages:89

Published On:January 2026

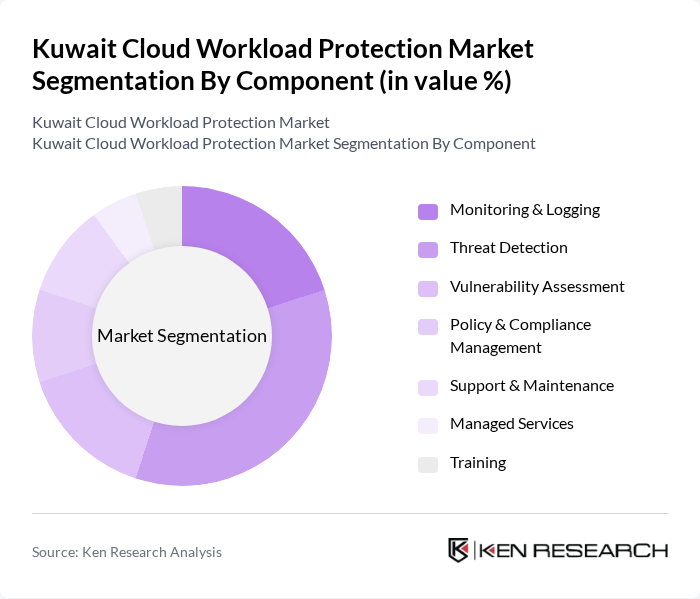

By Component:

The component segmentation of the Kuwait Cloud Workload Protection Market includes solutions and services. Within solutions, the subsegments are Monitoring & Logging, Threat Detection, Vulnerability Assessment, and Policy & Compliance Management. The services segment comprises Support & Maintenance, Managed Services, and Training. The solutions segment is currently dominating the market, particularly Threat Detection, as organizations increasingly prioritize proactive measures to identify and mitigate potential threats before they can cause significant damage. The growing complexity of cyber threats and the need for real-time monitoring are driving this trend.

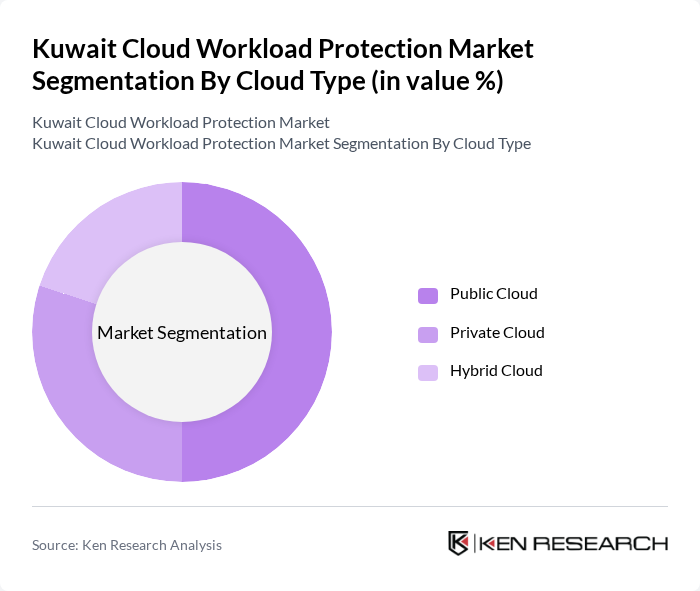

By Cloud Type:

The cloud type segmentation includes Public Cloud, Private Cloud, and Hybrid Cloud. The Public Cloud segment is leading the market due to its cost-effectiveness and scalability, making it an attractive option for businesses of all sizes. Organizations are increasingly migrating to public cloud environments to leverage the benefits of flexibility and reduced infrastructure costs. The growing acceptance of cloud services among enterprises is further propelling the demand for public cloud solutions.

The Kuwait Cloud Workload Protection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Palo Alto Networks, CrowdStrike, Trend Micro, Fortinet, Check Point Software Technologies, IBM Security, Cisco Systems, Microsoft Azure Security, Broadcom Symantec, Sophos, Zscaler, Aqua Security, Sysdig, Lacework, Wiz contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Cloud Workload Protection Market appears promising, driven by increasing awareness of cybersecurity threats and the necessity for compliance with evolving regulations. As organizations continue to embrace digital transformation, the demand for innovative security solutions will likely rise. Additionally, the integration of artificial intelligence and machine learning technologies is expected to enhance threat detection and response capabilities, making cloud workload protection more effective and efficient in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions Monitoring & Logging Threat Detection Vulnerability Assessment Policy & Compliance Management Services Support & Maintenance Managed Services Training |

| By Cloud Type | Public Cloud Private Cloud Hybrid Cloud |

| By Workload Type | Virtual Machines Containers Serverless Functions |

| By Security Architecture | Agent-Based Agentless |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Industry Vertical | BFSI (Banking, Financial Services, Insurance) Healthcare & Life Sciences IT & Telecom Retail Government & Defense Manufacturing Education Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cloud Security | 100 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 80 | Healthcare IT Directors, Data Protection Officers |

| Government Cloud Workload Security | 70 | Government IT Administrators, Cybersecurity Analysts |

| Retail Sector Cloud Solutions | 60 | IT Managers, E-commerce Directors |

| Telecommunications Security Measures | 90 | Network Security Engineers, Operations Managers |

The Kuwait Cloud Workload Protection Market is valued at approximately USD 145 million, reflecting a significant growth trend driven by increased cloud service adoption and rising cybersecurity concerns among organizations in the region.