Region:Asia

Author(s):Geetanshi

Product Code:KRAA4906

Pages:100

Published On:January 2026

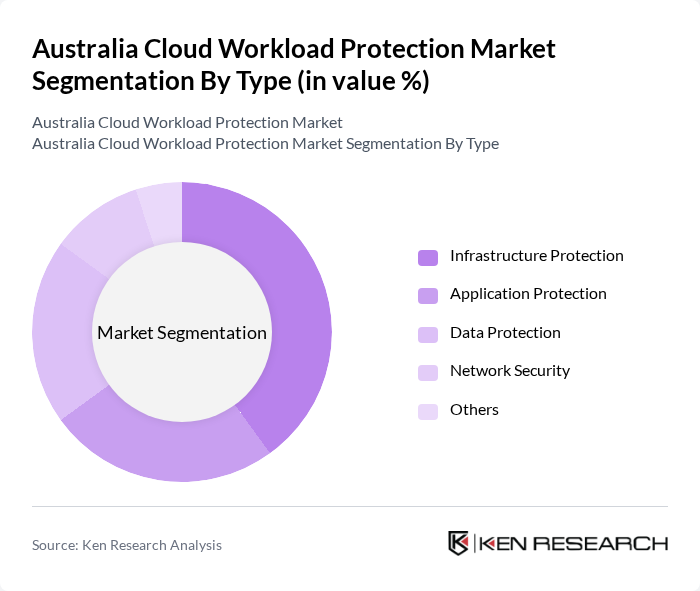

By Type:The market is segmented into various types, including Infrastructure Protection, Application Protection, Data Protection, Network Security, and Others. Among these, Infrastructure Protection is currently the leading sub-segment due to the increasing need for securing cloud infrastructure against various cyber threats. Organizations are prioritizing the protection of their foundational systems to ensure business continuity and data integrity.

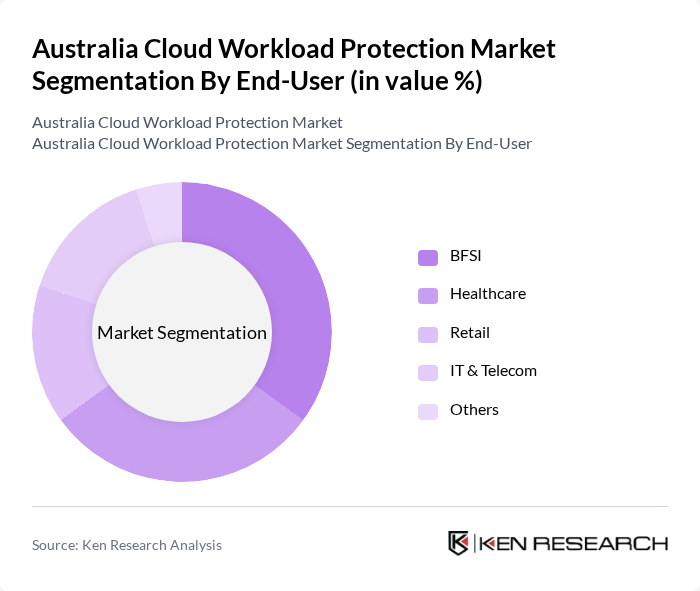

By End-User:The end-user segmentation includes BFSI, Healthcare, Retail, IT & Telecom, and Others. The BFSI sector is the dominant segment, driven by stringent regulatory requirements and the need for robust security measures to protect sensitive financial data. Financial institutions are increasingly adopting cloud workload protection solutions to mitigate risks associated with data breaches and cyberattacks.

The Australia Cloud Workload Protection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trend Micro, McAfee, Palo Alto Networks, Check Point Software Technologies, Fortinet, Sophos, Cisco Systems, IBM Security, Microsoft Azure Security, AWS Security, CrowdStrike, Zscaler, Barracuda Networks, CyberArk, RSA Security contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia Cloud Workload Protection Market is poised for significant transformation, driven by technological advancements and evolving security needs. Organizations are increasingly adopting zero trust security models, which emphasize continuous verification and access control. Additionally, the integration of artificial intelligence and machine learning into security solutions is expected to enhance threat detection and response capabilities, enabling businesses to proactively address emerging cyber threats and streamline security processes.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure Protection Application Protection Data Protection Network Security Others |

| By End-User | BFSI Healthcare Retail IT & Telecom Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Service Type | Managed Services Professional Services Consulting Services Others |

| By Industry Vertical | Government Education Manufacturing Energy & Utilities Others |

| By Region | New South Wales Victoria Queensland Western Australia Others |

| By Compliance Standards | ISO 27001 PCI DSS GDPR Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cloud Security | 100 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 80 | Healthcare IT Directors, Data Privacy Officers |

| Retail Cloud Workload Management | 70 | Operations Managers, E-commerce Directors |

| Government Cloud Security Initiatives | 60 | Public Sector IT Managers, Cybersecurity Analysts |

| Manufacturing Sector Cybersecurity | 90 | IT Infrastructure Managers, Risk Management Officers |

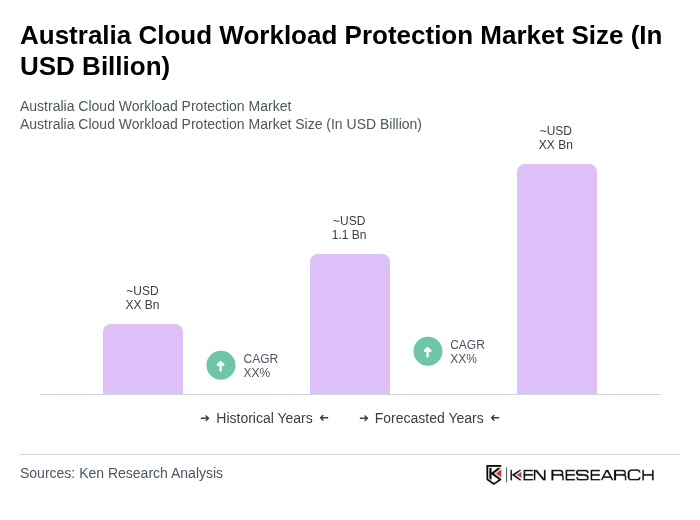

The Australia Cloud Workload Protection Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing adoption of cloud services, rising cyber threats, and the need for regulatory compliance among businesses.